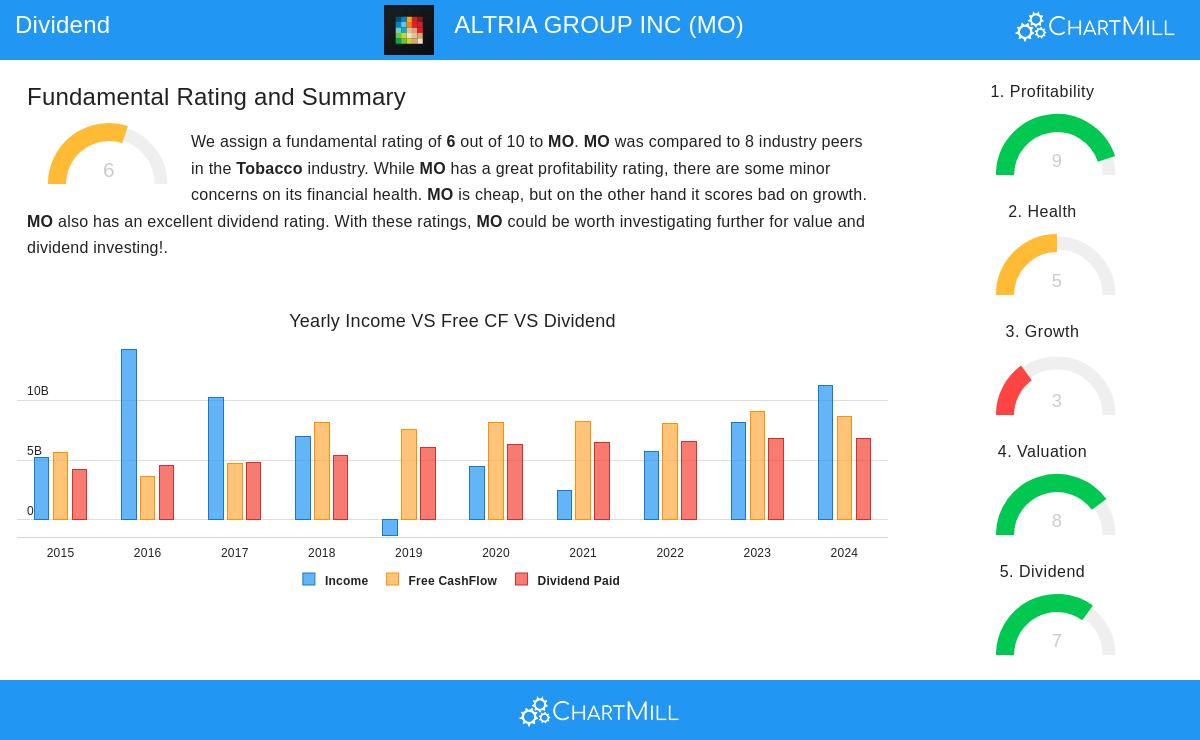

ALTRIA GROUP INC (NYSE:MO) was identified by our Best Dividend Stocks screen as a strong candidate for income-focused investors. The company offers an attractive dividend yield while maintaining solid profitability and reasonable financial health. Below, we examine why MO stands out for dividend investors.

Key Strengths for Dividend Investors

High Dividend Yield

- MO currently offers a 6.75% dividend yield, significantly above the S&P 500 average of 2.40% and the industry average of 3.95%.

- The company has paid dividends for at least 10 consecutive years without reductions, demonstrating reliability.

Dividend Growth & Sustainability

- While dividend growth has been modest at 4.03% annually, the consistency of payouts adds stability.

- The payout ratio sits at 60.92%, which is higher than ideal but still manageable given the company’s strong cash flows.

Profitability Supports Dividend Payments

- MO scores a 9 out of 10 on the ChartMill Profitability Rating, reflecting strong margins and returns.

- Return on Invested Capital (ROIC) of 34.88% is well above the industry average, indicating efficient capital use.

- Operating margins of 48.87% and profit margins of 46.78% are among the best in the tobacco sector.

Financial Health Considerations

- MO has a ChartMill Health Rating of 5, indicating moderate financial stability.

- The company’s Altman-Z score of 4.62 suggests low bankruptcy risk, but liquidity ratios (Current Ratio: 0.51, Quick Ratio: 0.39) are weak, requiring monitoring.

Attractive Valuation

- With a P/E ratio of 11.14, MO trades at a discount compared to the S&P 500 (P/E: 25.05) and is cheaper than 75% of its industry peers.

- The Price/Free Cash Flow ratio also suggests undervaluation relative to competitors.

For a deeper look, review the full fundamental analysis of MO.

Our Best Dividend Stocks screener provides more high-quality dividend stock ideas, updated daily.

Disclaimer

This is not investing advice! The article highlights observations at the time of writing, but investors should conduct their own research before making decisions.