For investors looking for chances in the market, a disciplined method often involves checking for companies that seem to be trading for less than their actual value. One such process is the "Decent Value" filter, which finds stocks with good basic valuations while keeping suitable levels of earnings, financial strength, and expansion. This plan tries to find possible deals, companies that the market may not be seeing even with good core business results. Today, we look at MAXIMUS INC (NYSE:MMS), a government services provider, to see how it measures up to these points.

A Detailed View of Valuation

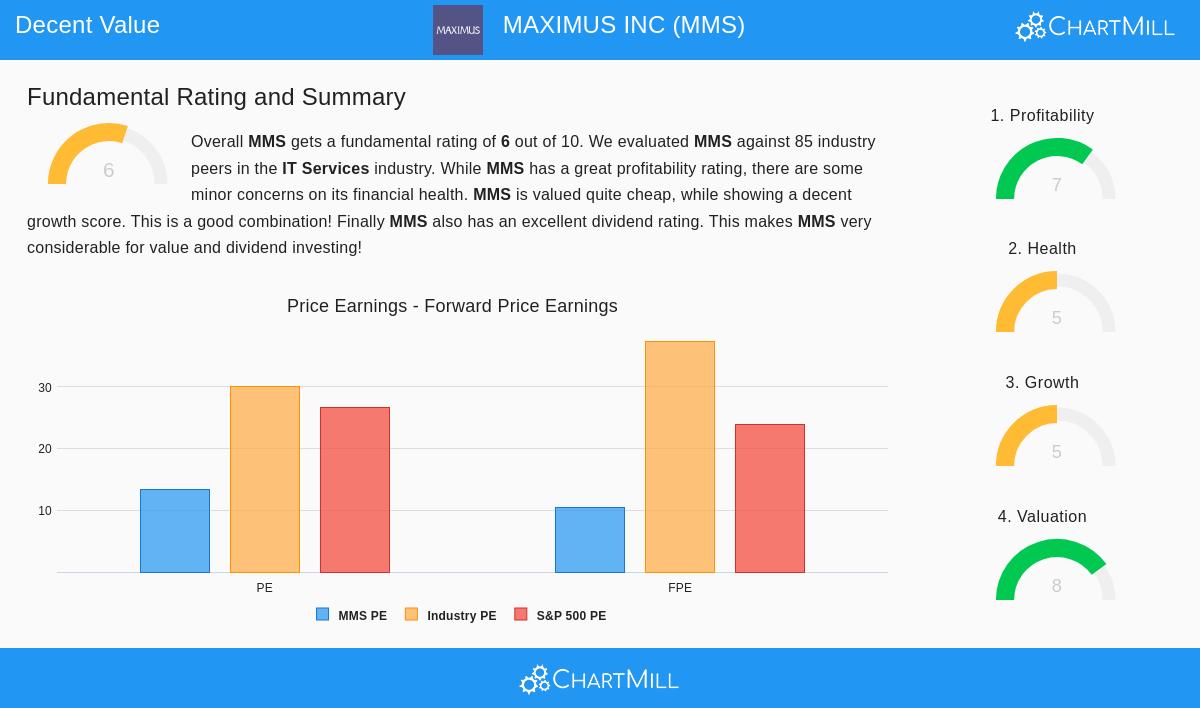

The central idea of value investing is buying a dollar's worth of assets for fifty cents. For MMS, the valuation numbers imply the market may be giving such a lower price. According to its fundamental analysis report, the company gets an 8 out of 10 on the ChartMill Valuation Rating, showing a clearly inexpensive profile compared to similar companies and the wider market.

- Price-to-Earnings (P/E) Ratio: At 13.35, MMS's P/E ratio is much lower than both the S&P 500 average (26.55) and its industry average in IT Services (29.97). It is less expensive than over 81% of its industry rivals.

- Forward P/E Ratio: The view stays positive looking forward, with a forward P/E of 10.48. This is far below the S&P 500 average (23.78) and less expensive than 87% of industry peers.

- Other Multiples: The company's Enterprise Value to EBITDA and Price to Free Cash Flow ratios also point to a "rather inexpensive valuation" compared to most of its industry.

For a value investor, these numbers are the beginning. A low valuation gives the needed "margin of safety", a cushion against mistakes in study or unexpected market declines. It implies that even if the company's expansion is moderate, the downside may be contained by its already low price.

Checking Financial Strength and Earnings

An inexpensive stock is only a good find if the company is financially stable and able to produce earnings. A low valuation joined with poor basics is often a "value trap," a problem the Decent Value filter tries to bypass. MMS shows a varied but generally steady view here.

The company gets a ChartMill Health Rating of 5/10. Important details include:

- Solvency: The Altman-Z score of 3.45 shows a low short-term chance of failure and matches the industry. The Debt to Free Cash Flow ratio of 3.64 is seen as good, meaning it would take fewer than four years of cash flow to repay all debt.

- Points to Note: The report mentions the debt-to-equity ratio (0.77) is not as good as many peers, and liquidity ratios like the Current and Quick Ratios (both 1.64) are normal for the field.

More notable is the Profitability Rating of 7/10. MMS shows a skill to turn revenue into income well.

- Return Measures: The Return on Equity (19.06%) and Return on Invested Capital (11.77%) do better than over 80% of industry peers.

- Margins: The Operating Margin of 9.73% is good, doing better than 68% of competitors, and has been getting better. While the Gross Margin is fairly low for the industry, it also has shown good movement.

This mix is key for the value argument. Good earnings suggest the business model is effective and the company has pricing control or operational skill. Acceptable financial strength means it is not carrying too much debt and can handle economic changes, guarding the investor's money.

Looking at Expansion Potential

Pure value stocks can sometimes be flat businesses. The Decent Value filter needs "decent" expansion to make sure the company is not in lasting drop and that income has the chance to increase, thus raising the stock price over time. MMS gets a Growth Rating of 5/10, showing an even path.

- Past Results: The company has provided good income expansion, with EPS growing by nearly 30% over the last year and at a typical yearly rate of 13.77% over recent years. Revenue expansion has been more moderate but positive.

- Future Outlook: Experts forecast EPS to keep growing at a strong typical 16.31% yearly, though revenue expansion is thought to ease to a more moderate speed.

For the value investor, this expansion picture supports the case. The company is not a high-speed growth stock, but it is showing a skill to grow its net income steadily. This expected income expansion, when joined with a low P/E ratio, leads to a good PEG ratio, further hinting the stock may be priced low relative to its expansion chance.

Dividend Attraction

An extra point for many value investors is income. MMS strengthens its case with a Dividend Rating of 7/10. The yield of 1.41% may not be eye-catching, but it is more than the industry average and comes with a steady history: the company has paid and not cut its dividend for over ten years, with a maintainable payout ratio. This gives a real return while investors wait for the valuation difference to shrink.

Final Thoughts

MAXIMUS INC shows a strong profile for investors using a disciplined value plan. It trades at a large discount to the market and its own field across several valuation numbers, giving that key margin of safety. This low price is not joined with basic softness; instead, it comes with better-than-average earnings, a steady dividend, and a sensible hope for continued income expansion. While its financial strength numbers show some points to watch, they are not concerning and point to a generally stable business. In summary, MMS seems to be a financially steady, earning company with expansion outlook that is being valued by the market as if it were a normal or lesser performer.

Want to find more stocks that match this disciplined value method? You can use the same "Decent Value" filter used to find MMS to locate other possible chances. Click here to view and change the filter.

Note: This article is for information only and does not make up financial guidance, a suggestion, or a deal or request to buy or sell any securities. The study is based on data and ratings from ChartMill, and investors should do their own study and talk with a qualified financial advisor before making any investment choices. Past results do not show future outcomes.