For investors looking for dependable income, dividend investing is a fundamental method for creating lasting wealth. The process requires finding companies with durable distribution policies, good financial condition, and steady earnings, qualities that help dividends continue during different economic periods. Using organized filtering techniques helps investors sort through many stocks to find those that meet strict dividend standards. One method uses the ChartMill Dividend Rating system, which assesses stocks on several elements such as dividend durability, growth record, and financial strength. This system favors companies with Dividend Ratings of 7 or more, along with minimum Health and Profitability Ratings of 5, making sure the choices are financially healthy and able to continue distributions.

Dividend Reliability and Sustainability

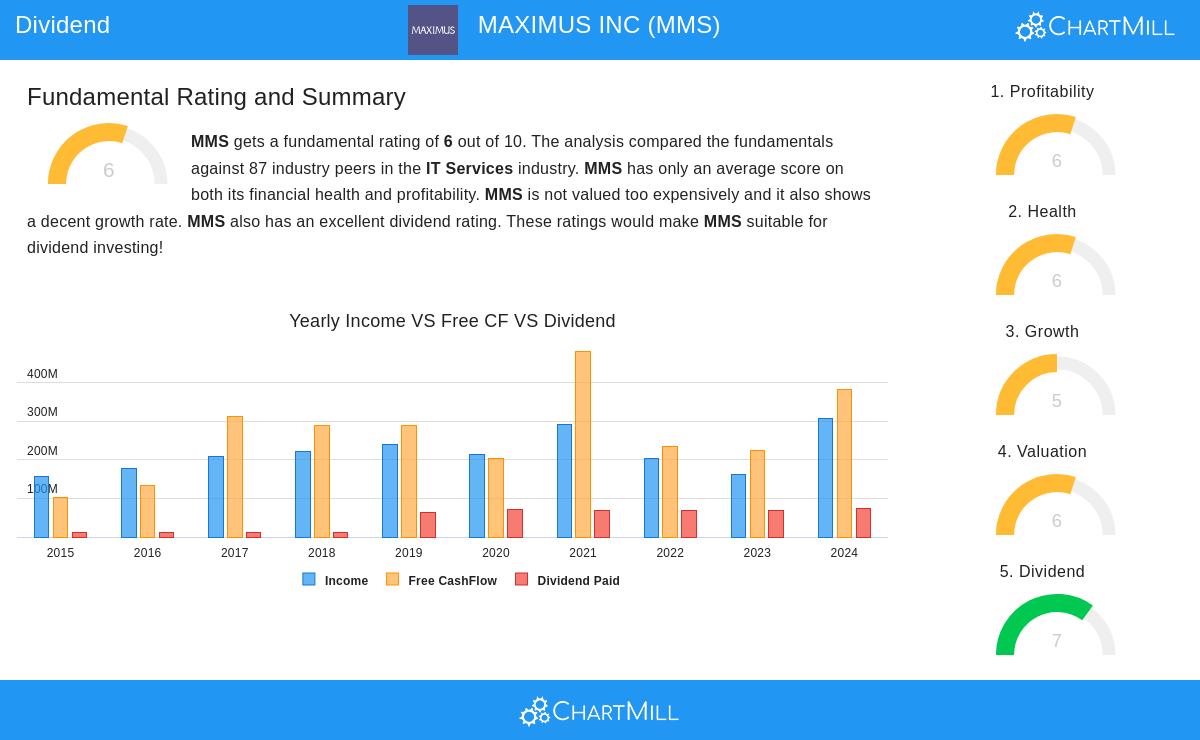

MAXIMUS INC (NYSE:MMS) offers a strong example for dividend-oriented investors, reaching a Dividend Rating of 7. The company shows careful distribution management with a durable method that fits long-term income plans. Important dividend measures include:

- Dividend Yield: 1.37%, which is higher than 83.91% of similar companies in IT Services

- Payout Ratio: 22.11% of earnings, showing significant capacity to maintain and possibly raise dividends

- Dividend Growth: 3.84% yearly growth rate over recent years

- Payment History: Steady dividend payments for more than 10 years with no decreases

The low payout ratio is especially important for dividend durability, as it shows the company keeps enough earnings to put back into business activities while paying shareholders. This careful method lowers the chance of dividend reductions in poor economic times and allows for possible future raises.

Financial Health and Stability

The company's Health Rating of 6 shows a good financial base, important for keeping dividend payments going in different market environments. MAXIMUS displays good cash positions that help continuous operations and shareholder returns:

- Current Ratio: 2.27, higher than 67.82% of industry rivals

- Quick Ratio: 2.27, showing good immediate financial flexibility

- Debt Management: Careful debt-to-equity ratio of 0.91

- Altman-Z Score: 3.33, pointing to low bankruptcy risk

These health measures are vital for dividend investors since companies with good financial statements can maintain payments during economic difficulties. The solid liquidity ratios make sure the company can handle immediate responsibilities without affecting dividend payments.

Profitability and Business Strength

With a Profitability Rating of 6, MAXIMUS shows sufficient earnings capacity to back its dividend program. The company's profitability measures display steady operational results:

- Return on Equity: 17.84%, better than 80.46% of similar companies

- Return on Invested Capital: 10.49%, above the 3-year average of 8.80%

- Profit Margin: 5.83%, in line with others in the IT Services sector

- Operating Margin: 9.53%, showing effective cost control

Profitability is basic to dividend durability because it shows the company's capacity to produce earnings that pay for shareholder distributions. The increasing return on invested capital suggests management is using resources well to build value.

Valuation and Growth Prospects

MAXIMUS trades at fair price levels while keeping growth capacity:

- P/E Ratio: 14.76, showing a lower price than both industry and S&P 500 averages

- Forward P/E: 11.59, indicating anticipated earnings growth

- Revenue Growth: 12.95% average yearly growth over recent years

- EPS Growth: 26.83% over the last year with 15.44% expected yearly in the future

The fair price multiples offer a safety buffer for income investors, while the growth path supports possible dividend raises over time. The quickening EPS growth together with stable revenue growth makes a good setting for continued dividend growth.

For investors looking for more dividend options, the Best Dividend Stocks screen gives frequently refreshed selections based on the same strict standards that found MAXIMUS. The detailed fundamental analysis report provides more information about the company's financial situation and dividend durability measures.

Disclaimer: This analysis is based on fundamental data and screening methods for information only. It does not form investment advice, suggestion, or support of any security. Investors should perform their own research and talk with financial advisors before making investment choices. Past results do not assure future outcomes, and dividend payments depend on company decisions and market situations.