MEDPATE HOLDINGS INC (NASDAQ:MEDP) has appeared as an interesting option for investors using systematic growth and momentum strategies. The stock recently appeared through a screening method that joins Mark Minervini's strict Trend Template with high growth momentum filters, forming a dual-focus system that finds companies showing both solid technical momentum and good fundamental growth. This method methodically filters out lesser performers by needing stocks to keep exact technical positions while also showing improving business numbers.

Technical Strength and Trend Position

MEDP shows very good technical traits that fit Minervini's Trend Template needs exactly. The template stresses trading in the direction of set trends instead of trying to guess reversals, concentrating only on stocks showing clear upward momentum over several time periods.

Important technical standards met by MEDP include:

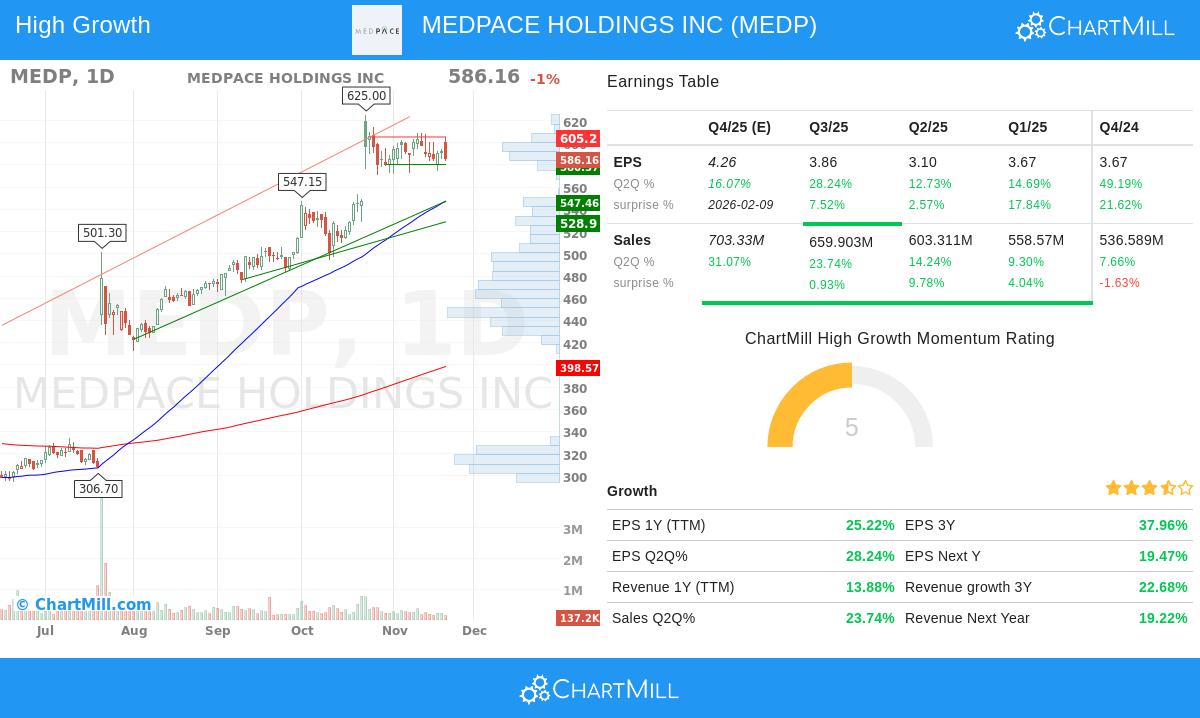

- Price position relative to moving averages: Current price of $586.16 trades well above the 50-day ($547.43), 150-day ($424.05), and 200-day ($398.57) simple moving averages

- Moving average position: The 50-day SMA sits above both the 150-day and 200-day SMAs, while the 150-day SMA trades above the 200-day SMA

- Trend direction: All major moving averages show upward slopes, confirming continued positive momentum

- 52-week performance: Current price sits 134% above the 52-week low of $250.05 while trading within 6.2% of the 52-week high of $625

- Relative strength: With a ChartMill Relative Strength score of 94.32, MEDP does better than 94% of all stocks in the market

These technical traits form what Minervini calls a "Stage 2" advance, the period where stocks usually give their biggest gains. The position over several time periods points to institutional buying and lowers the chance of false breakouts.

Fundamental Growth Measurements

Besides technical strength, MEDP shows the fundamental improvement that high growth investors look for. The company's financial performance shows the kind of earnings and revenue momentum that often comes before major price gains.

Recent fundamental points include:

- Earnings growth improvement: Quarterly EPS growth of 28.2% in the most recent quarter, following 12.7% growth in the prior quarter

- Consistent earnings surprises: Four straight quarters of positive earnings surprises with an average beat of 12.4%

- Revenue momentum: Quarterly revenue growth improving to 23.7% from 14.2% in the previous quarter

- Analyst optimism: Next-year EPS estimates have been moved upward by 16.1% over the past three months

- Profitability growth: Good profit margins of 16.8% in the latest quarter, keeping solid levels through recent reporting periods

This fundamental profile fits with Minervini's focus on companies showing "big earnings improvements" that "attract big attention" from institutional investors. The mix of improving growth, positive surprises, and upward changes forms a strong fundamental catalyst that can support continued price increases.

Industry Leadership and Market Standing

MEDP works in the Life Sciences Tools & Services industry, where it shows clear leadership traits. The company's 94.32 relative strength score shows it is doing better than 92% of its industry competitors, suggesting it is taking market share and gaining from sector trends.

The company's business model, providing clinical development services to pharmaceutical, biotechnology, and medical device companies, puts it well within the increasing clinical research organization sector. As drug development becomes more complicated and outsourced, MEDP's full-service method from Phase I-IV clinical trials provides a competitive advantage that backs its growth path.

Technical Analysis Summary

According to ChartMill's full technical report, MEDP gets a very good technical rating of 9 out of 10, supported by a solid setup rating of 8. The analysis finds several key support levels between $528.89 and $586.15, with resistance seen around $605.20. The stock currently shows a bull flag pattern, which often comes before continuation of the existing uptrend. Volume patterns show positive behavior with lower activity during recent consolidation, suggesting a lack of selling.

View the complete technical analysis report for MEDP for full support/resistance levels and trading setup ideas.

Investment Points

For investors using the Minervini method, MEDP represents the kind of "leader stock" that often does well during market gains. The mix of solid technicals, improving fundamentals, and industry leadership forms an interesting profile. However, as with any momentum strategy, correct position sizing and risk management stay important, especially given the stock's long run and nearness to all-time highs.

The current technical setup indicates possible entry points above the $605.20 resistance level with reasonable stop-loss positions below found support areas. The relatively narrow trading range in recent sessions shows lower volatility, which often comes before major price moves.

Finding Similar Options

Find more high-growth momentum stocks meeting the Trend Template criteria through our systematic screening system. This method constantly checks the market for companies showing both technical strength and fundamental improvement.

Disclaimer: This analysis is for informational and educational purposes only and should not be taken as investment advice. The information given does not form a recommendation to buy, sell, or hold any security. Investors should do their own research and talk with a qualified financial advisor before making investment decisions. Past performance is not a guide to future results.