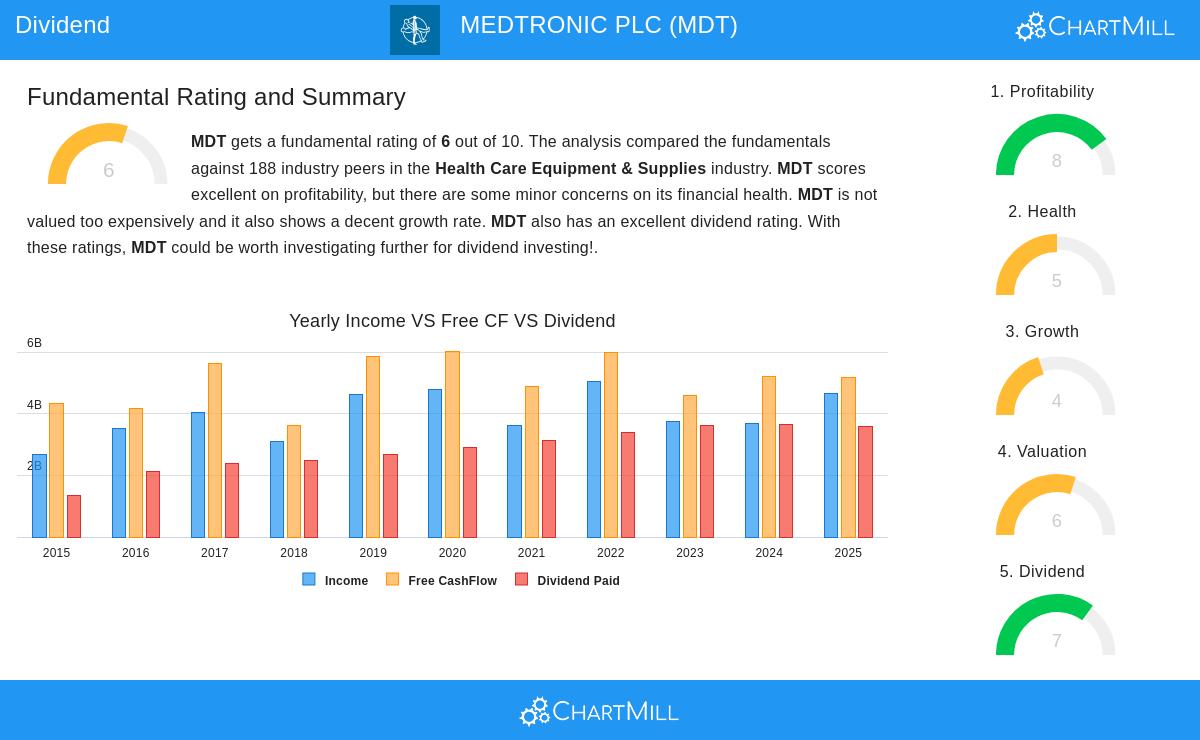

MEDTRONIC PLC (NYSE:MDT) stands out as a strong candidate for dividend investors, according to our Best Dividend Stocks screener. The company combines a solid dividend profile with decent profitability and financial health, making it an appealing option for income-focused portfolios.

Dividend Strength

- Attractive Yield: MDT offers a dividend yield of 3.45%, which is above both the industry average (1.89%) and the S&P500 average (2.38%).

- Reliable Track Record: The company has paid dividends for at least 10 years without reductions, demonstrating consistency.

- Sustainable Growth: While the annual dividend growth rate of 5.10% is modest, it remains supported by earnings growth.

Profitability & Valuation

- Strong Margins: MDT boasts an operating margin of 19.80%, outperforming 93% of its peers in the healthcare equipment sector.

- Reasonable Valuation: With a P/E ratio of 15.09, MDT trades at a discount compared to both its industry and the broader market.

Financial Health

- Manageable Debt: The company’s debt-to-equity ratio of 0.53 is acceptable, though slightly higher than some peers.

- Positive Cash Flow: MDT generates sufficient cash flow to cover its dividend, though the payout ratio of 76.97% warrants monitoring.

For a deeper dive into MDT’s fundamentals, review the full analysis report.

Our Best Dividend Stocks screener provides more high-quality dividend stock ideas.

Disclaimer

This is not investing advice. Always conduct your own research before making investment decisions.