Mastercraft Boat Holdings Inc (NASDAQ:MCFT) has become an interesting option for investors using systematic growth strategies, meeting strict technical and fundamental standards through a combined screening method. The selection process finds companies displaying both solid technical momentum and strong growth traits, focusing on stocks that show clear upward trends while keeping up accelerating business fundamentals.

Technical Strength and Trend Compliance

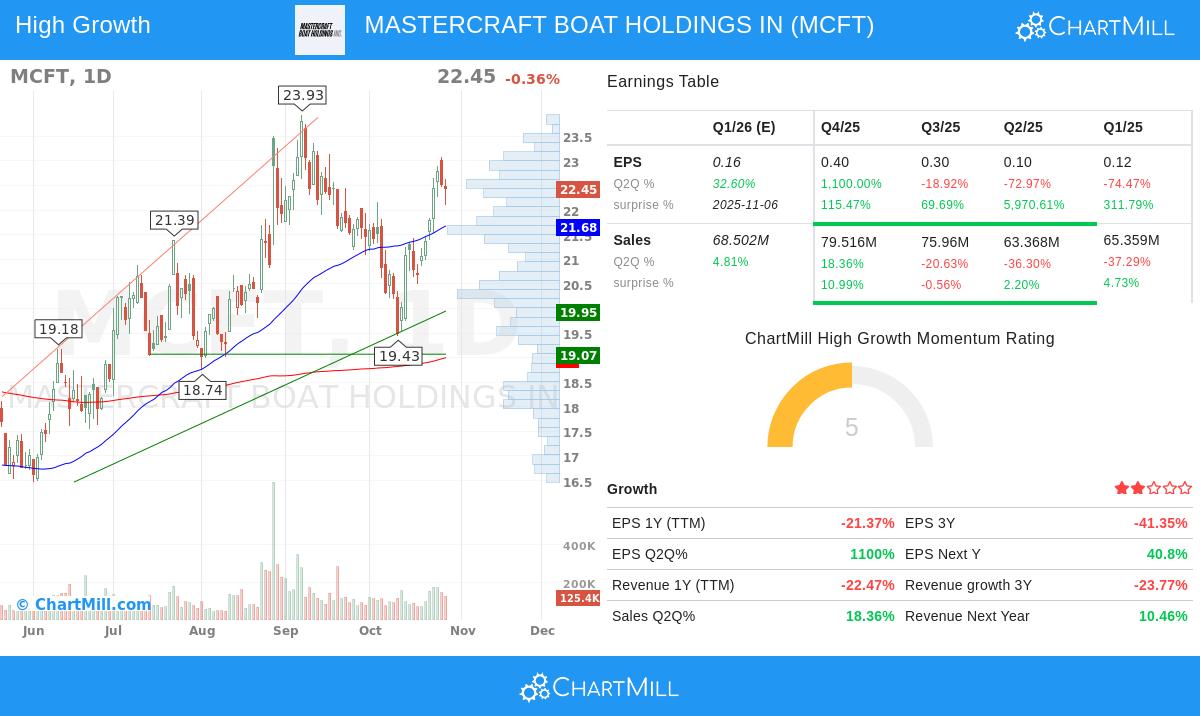

Mastercraft's present technical setup matches the Minervini Trend Template needs, which focuses on finding stocks in clear upward trends with good relative strength traits. The template's methodical process makes sure chosen securities show momentum across various timeframes while trading close to their highs, limiting contact with weakening trends.

The stock meets all important technical points:

- Current price ($22.45) trades above all main moving averages (50-day: $21.68, 150-day: $19.27, 200-day: $19.00)

- All moving averages show upward slopes, confirming continued momentum

- The 50-day SMA sits above both the 150-day and 200-day SMAs, showing correct alignment

- Price sits 78% above its 52-week low ($14.385) while staying within 6% of its 52-week high ($23.935)

- Relative strength ranking of 80.45 shows better performance than 80% of the market

This technical base is especially notable within the present market situation, where both short-term and long-term S&P 500 trends stay positive, creating a good environment for momentum strategies.

Growth Momentum Fundamentals

Beyond technical strength, Mastercraft shows interesting growth traits that meet high-growth investment standards. The company's recent performance shows notable operational gains and possible turning points.

Recent quarterly results show speeding momentum:

- Most recent quarterly EPS growth jumped 1100% year-over-year

- Revenue growth became positive at 18.36% after several quarters of decreases

- Profit margins grew to 7.16% in the latest quarter, up from 4.93% in the previous quarter

- The company exceeded EPS estimates in all four recent quarters by an average of 1,617%

- Analysts have increased next-year EPS estimates by 7.17% over the past three months

These fundamental gains happen within the setting of a wider industry recovery, with Mastercraft situated as a frontrunner in the premium recreational boating market. The company's varied portfolio across MasterCraft performance boats, Crest pontoon boats, and Aviara luxury day boats offers several growth paths as consumer discretionary spending becomes steady.

ChartMill Technical Assessment

According to ChartMill's detailed technical analysis, Mastercraft gets a perfect 10 out of 10 on technical rating, reflecting very good technical health across multiple timeframes. The assessment notes solid positive trends in both short-term and long-term views, with the stock trading in the higher part of its 52-week range.

Important technical observations include:

- Support levels found between $19.07-$19.95 giving clear risk management points

- Resistance areas between $23.03-$23.80 setting possible near-term goals

- Steady relative strength within the Leisure Products industry, performing better than 87% of similar companies

- Recent trading range between $19.43-$23.07 showing healthy price stabilization

While the setup quality gets a moderate 6 because of recent price swings, the basic technical strength indicates a chance for continued momentum once stabilization finishes.

View the complete technical analysis report for MCFT

Investment Considerations

For investors following systematic growth strategies, Mastercraft offers a noteworthy chance joining technical momentum with fundamental speeding up. The stock's fit with the Trend Template points gives a structured technical frame, while the getting better growth numbers indicate a chance for continued performance.

The company's situation within the recreational boating industry gives contact to cyclical recovery trends, with recent margin growth showing gained operational efficiency. The notable earnings beat history and upward analyst changes further back the growth story.

Discover more high-growth momentum opportunities meeting the Trend Template criteria

Disclaimer: This analysis is for informational purposes only and does not constitute investment advice. The information presented should not be interpreted as a recommendation to buy or sell any security. Investors should conduct their own research and consult with a financial advisor before making investment decisions. Past performance does not guarantee future results.