MASCO CORP (NYSE:MAS) stands out as a strong candidate for dividend investors, according to our Best Dividend Stocks screen. The company combines a healthy dividend profile with solid profitability and reasonable financial health, making it an appealing choice for income-focused portfolios.

Dividend Strength

MASCO CORP offers several attractive qualities for dividend investors:

- Dividend Yield of 1.97% – While not the highest, it outperforms 92.86% of its industry peers and is in line with the broader market.

- Consistent Dividend Growth – The company has increased its dividend at an annualized rate of 18.34% over the past five years.

- Reliable Track Record – MAS has paid dividends for at least 10 years without reductions, signaling stability.

- Sustainable Payout Ratio – At 30.9% of earnings, the dividend is well-covered and leaves room for reinvestment.

Profitability Supports Dividend Payments

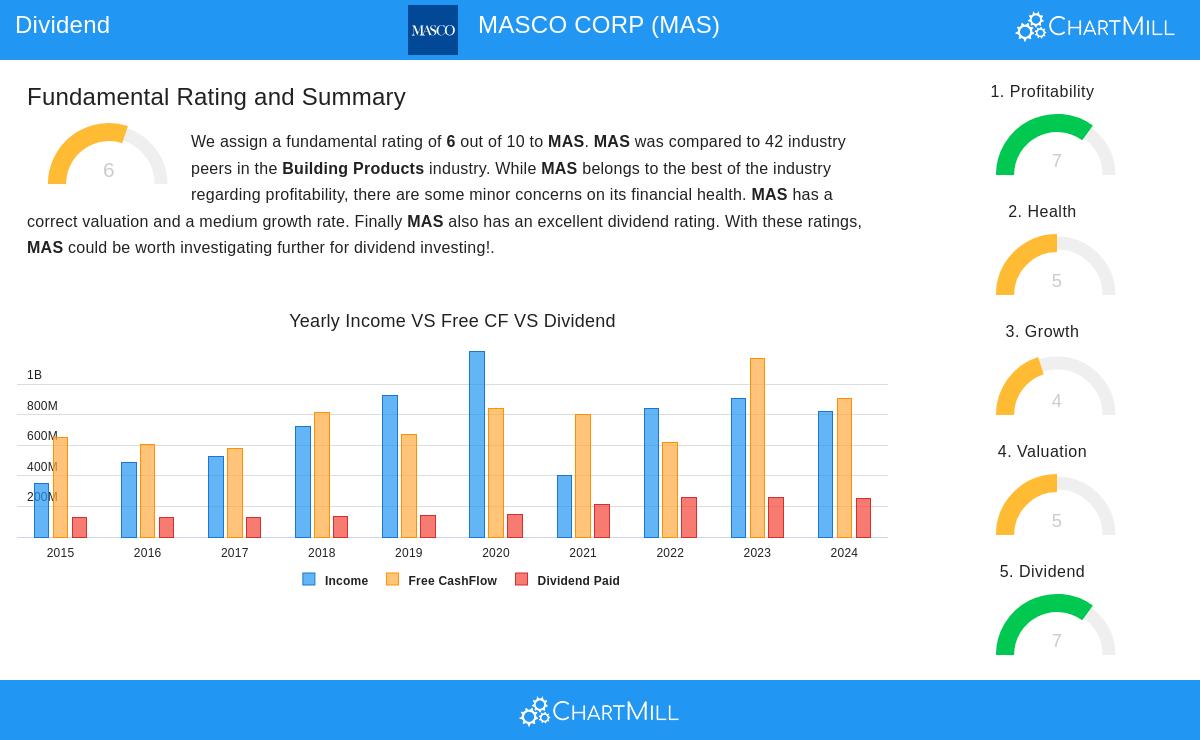

MASCO CORP earns a Profitability Rating of 7/10, reflecting strong operational performance:

- High Return on Invested Capital (30.11%) – Well above the industry average, indicating efficient capital use.

- Healthy Margins – Operating margin of 17.4% and profit margin of 10.5% demonstrate solid earnings power.

Financial Health Considerations

With a Health Rating of 5/10, MASCO CORP has manageable risks:

- Low Bankruptcy Risk – An Altman-Z score of 4.02 suggests financial stability.

- Moderate Debt Levels – A Debt-to-Free Cash Flow ratio of 3.25 is reasonable for the industry.

Valuation and Growth Prospects

- Fairly Priced – A P/E ratio of 15.29 is below the industry average, suggesting reasonable valuation.

- Steady Earnings Growth – Expected EPS growth of 10.44% annually supports future dividend increases.

For a deeper look, review the full fundamental report on MASCO CORP.

Our Best Dividend Stocks screener provides more high-quality dividend stock ideas.

Disclaimer

This is not investment advice. Always conduct your own research before making investment decisions.