LOWE'S COS INC (NYSE:LOW) was identified as a strong dividend candidate by our screening process. The company combines a reliable dividend history with solid profitability and reasonable financial health, making it an interesting option for income-focused investors.

Key Dividend Strengths

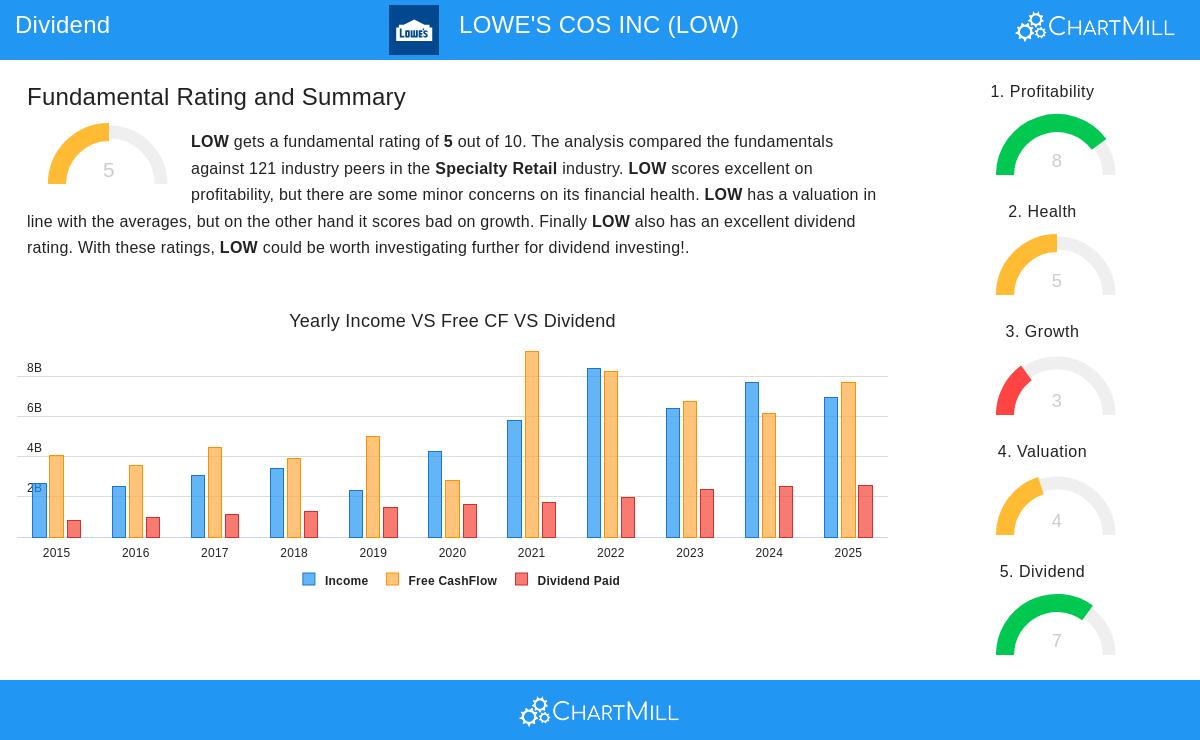

- Dividend Yield: LOW offers a yield of 1.98%, which is reasonable compared to the industry average of 5.10%. While not the highest, it remains competitive within its sector.

- Dividend Growth: The company has increased its dividend at an impressive annual rate of 16.94% over the past five years, signaling a commitment to rewarding shareholders.

- Payout Ratio: At 36.97%, LOW’s payout ratio is sustainable, leaving ample room for reinvestment and future dividend increases.

- Track Record: LOW has maintained dividend payments for at least 10 years without reductions, reinforcing its reliability.

Profitability & Financial Health

- Strong Profit Margins: LOW boasts an 8.30% profit margin and a 12.51% operating margin, outperforming most peers in the specialty retail industry.

- Return on Capital: The company generates a high Return on Invested Capital (ROIC) of 32.66%, well above its cost of capital.

- Financial Stability: While liquidity metrics like the Quick Ratio (0.16) are weak, LOW maintains a solid Altman-Z score (3.68), indicating low bankruptcy risk.

Valuation & Growth Outlook

- Fair Valuation: LOW trades at a P/E of 19.57, slightly below the S&P 500 average (26.70) and cheaper than many industry peers.

- Moderate Growth: Revenue growth has been modest (3.01% annually), but earnings are expected to grow at 9.60% yearly in the coming years.

For a deeper dive, review the full fundamental report on LOW.

Our Best Dividend Stocks screener provides more high-quality dividend ideas, updated daily.

Disclaimer

This is not investment advice. Always conduct your own research before making investment decisions.