When looking for dividend-paying stocks, investors often face the challenge of balancing yield with reliability. A high dividend yield can be tempting, but it may signal underlying problems if the company's financial condition is poor or if the payout is not maintainable. A more complete approach involves using a multi-factor screening method that prioritizes quality alongside income. This process typically filters for companies displaying strong dividend traits, good profitability to fund those payments, and a sound financial position to handle economic slowdowns. By focusing on stocks that perform well across these areas, investors can build a portfolio intended for both steady income and long-term steadiness.

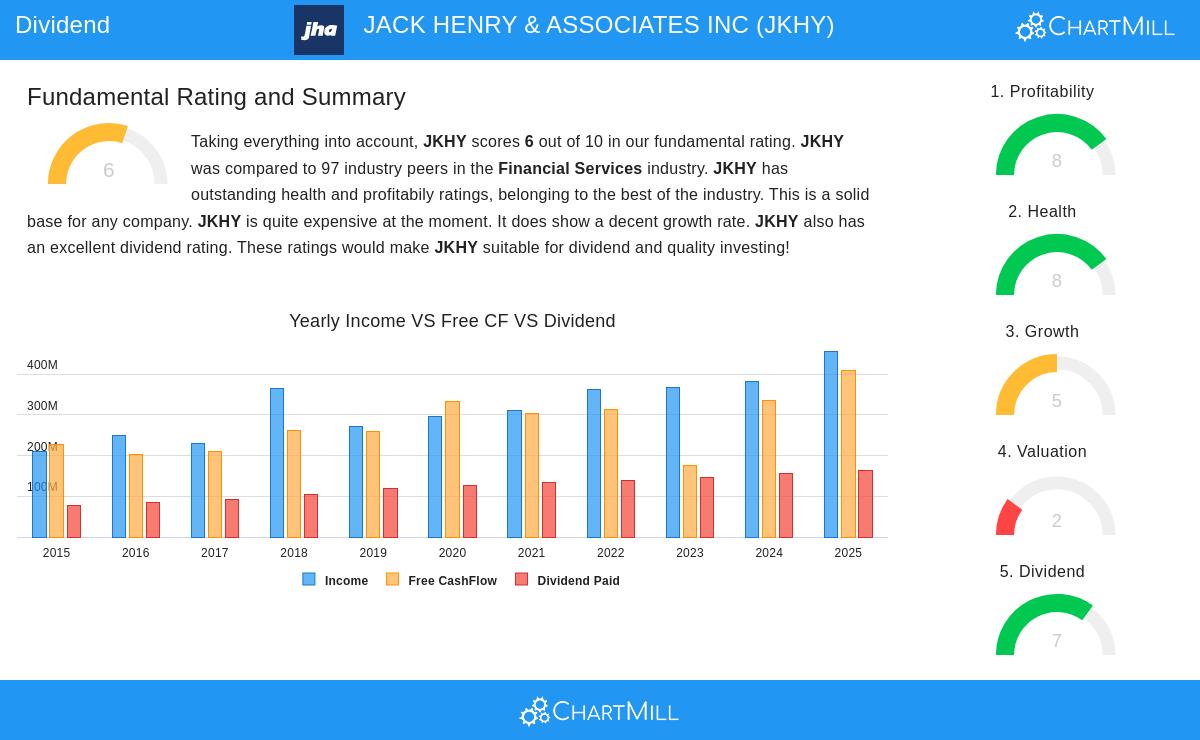

JACK HENRY & ASSOCIATES INC (NASDAQ:JKHY) appears as a noteworthy candidate from such a screening process. As a financial technology company providing core processing and payment services to banks and credit unions, it operates in a sector where reliability and steady performance are essential. The company's business model, which involves long-term contracts and repeating revenue streams, offers a steady base for its dividend program.

Dividend Reliability and Growth

For dividend investors, the maintainability and growth path of payouts are often more important than the current yield alone. JKHY displays a solid profile on these important points.

- Dividend Growth: The company has raised its dividend at an annualized rate of 6.38% over the past five years. This steady growth shows a dedication to returning capital to shareholders and helps counter the effects of inflation over time.

- Payout Sustainability: With a payout ratio of 36.13%, JKHY pays out a reasonable part of its earnings as dividends. This low ratio is a main sign of maintainability, leaving plenty of room for the company to put money back into its business and continue payouts even during times of lower earnings.

- Track Record: JKHY has not only paid but also raised its dividend for at least ten straight years. This long-standing history creates assurance for investors looking for a reliable income stream, as it shows the company's dividend policy is a long-term focus.

These dividend traits match well with a quality-focused screening method. A growing dividend supported by a low payout ratio indicates the payments are built on a solid financial base, lowering the chance of a future reduction that often troubles high-yield, low-quality stocks.

Profitability Supporting the Payout

A company's ability to create profits is the source that funds dividend payments. JKHY's profitability measurements are very good, offering solid support for its dividend.

- Return Metrics: The company's Return on Invested Capital (ROIC) of 17.51% and Return on Assets (ROA) of 14.97% are much higher than industry averages. These numbers show that JKHY is very effective at creating profits from its capital base, a sign of a well-run company.

- Healthy Margins: A Profit Margin of 19.19% and an Operating Margin of 23.94% are well above the middle for its industry peers. Good margins offer protection against economic challenges and make sure the company stays profitable enough to continue its shareholder returns.

This high level of profitability is a central part of the screening criteria. A company that regularly earns good returns on its capital is much more likely to have the financial ability to sustain and grow its dividend over the long term, making it a more secure choice for income investors.

Financial Health for Long-Term Steadiness

The financial health of a company decides its endurance. JKHY shows a very solid balance sheet, which is important for handling economic cycles without endangering its dividend.

- Debt-Free Operation: A notable feature is that JKHY operates with no interest-bearing debt. This removes the risk linked to debt agreements and interest payments, giving great financial room to maneuver.

- Solvency: An Altman-Z score of 10.68 shows a very low chance of financial trouble, putting the company in the top group of its industry for financial stability.

- Adequate Liquidity: The company keeps a Current Ratio and Quick Ratio of 1.27, which are enough to meet immediate responsibilities and are competitive within its sector.

This solid financial health is the final part of the screening method. A debt-free company with high solvency scores is in a good position to sustain its dividend through different market environments, as it is not weighed down by leverage or cash shortages that often push other companies to lower or stop payouts.

Valuation and Growth Considerations

While the focus for dividend investors may be on income, valuation and growth outlooks still matter. JKHY trades at a Price-to-Earnings (P/E) ratio of 24.44, which is similar to the wider S&P 500 but can be viewed as high compared to some value-focused peers. However, this higher valuation may be reasonable given the company's very good profitability, solid health, and reliable dividend, qualities that are highly regarded by long-term investors. The company also displays a satisfactory growth profile, with earnings per share expected to grow around 9-10% each year, indicating its business stays on a positive path.

For investors interested in examining other companies that meet similar standards for strong dividends, profitability, and financial health, the Best Dividend Stocks screen provides a changing list of potential ideas. A closer look at the full fundamental analysis for JKHY is available in its detailed fundamental report.

,

Disclaimer: This article is for informational purposes only and does not constitute investment advice, a recommendation, or an offer or solicitation to buy or sell any securities. The analysis is based on data believed to be reliable, but its accuracy cannot be guaranteed. Investors should conduct their own research and consult with a qualified financial advisor before making any investment decisions.