Legendary investor Peter Lynch's method for picking stocks has stayed important for many years after his historic time leading Fidelity's Magellan Fund. His system, frequently described as Growth at a Reasonable Price (GARP), centers on finding companies with good, steady earnings increases that are available at costs which do not exaggerate their future. This idea stays away from highly speculative growth companies, preferring businesses with sound foundations, fair prices, and good financial standing, establishing it as an interesting model for people investing for the future.

One firm that recently appeared from a filter using Lynch's measures is JD.COM INC-ADR (NASDAQ:JD). As a leading technology and e-commerce firm based in Beijing, JD.com runs a strong retail and supply chain system throughout China and other areas. We will look at how this firm fits with the ideas of a long-term GARP investment.

Following Lynch's Main Measures

Peter Lynch liked companies with steady, but not extremely fast, earnings increases, fair prices compared to that growth, and a good financial position. JD.com's basic numbers show a good fit with these ideas.

- Steady Earnings Increase: A key part of Lynch's method is a 5-year earnings per share (EPS) increase percentage between 15% and 30%. He thought growth over 30% was frequently not maintainable. JD.com's 5-year EPS increase of 26.75% fits well inside this goal area, pointing to a good and likely maintainable growth path.

- Good Price via PEG Ratio: Lynch made the PEG ratio (P/E ratio divided by earnings growth) common to find fairly priced growth companies. He wanted companies with a PEG ratio of 1 or lower. JD.com's PEG ratio of 0.28 is much lower than this level, indicating the market might be pricing its growth future too low compared to its present earnings.

- Good Profitability (ROE): A high Return on Equity (ROE) was important for Lynch because it shows efficient use of investor money. He searched for companies with an ROE over 15%. JD.com's ROE of 17.02% meets this standard, showing acceptable profitability.

- Careful Financial Standing: Lynch was cautious about too much debt. His filters often used a Debt/Equity ratio below 0.6, with a personal liking for numbers under 0.25. JD.com's Debt/Equity ratio of 0.25 matches his stricter preference, indicating a business with careful financing.

- Acceptable Immediate Cash Flow: The method also needs a Current Ratio of at least 1 to make sure a company can pay its immediate bills. JD.com's Current Ratio of 1.22 meets this basic financial condition.

Basic Analysis Summary

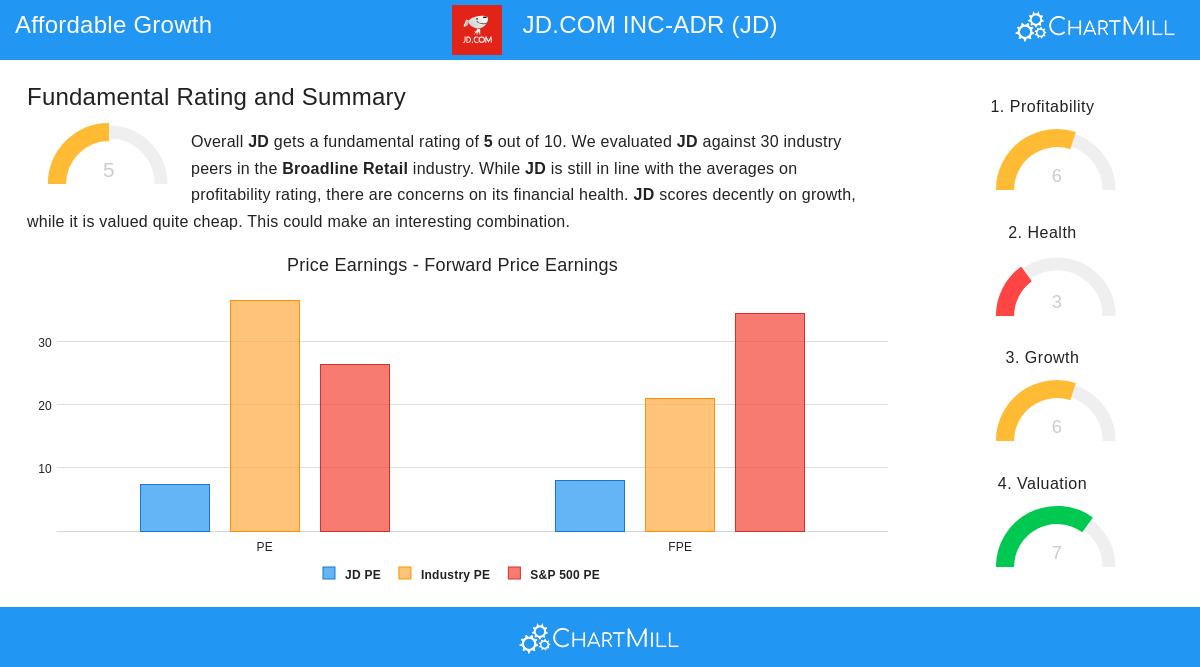

A more detailed review of JD.com's full basic report shows a varied but mostly good situation that backs the GARP idea. The firm gets a total basic rating of 5 out of 10, showing a medium position against similar firms in its field.

The study points out several positive areas, including JD.com's low price across different measures, like its small P/E and P/Forward Earning ratios compared to both the field and the wider S&P 500. Its profitability is rated as medium, with good points being an acceptable ROE and getting better profit margins over recent years. Growth is also a main positive, with good past growth in both EPS and income.

Still, the report also notes areas for watch, mainly about financial health, which gets a lower mark. While the company's ability to pay long-term bills, shown in its low debt-to-equity ratio, is a positive, its cash flow measures, like the Quick Ratio, are seen as not strong compared to similar firms. This means that while the company does not have too much debt, its capacity to cover urgent bills without selling stock might be less than wanted.

An Option for the Long-Term Collection

For people using a Peter Lynch-type method, JD.com offers an interesting possibility. It shows the main features Lynch appreciated: good and maintainable past earnings growth, a low price when growth is considered, high profitability on equity, and a careful amount of debt. While the points about immediate cash flow mentioned in the basic report need watching, the general profile is of a growing company found at a fair price.

This mix of growth and price is exactly what GARP investors look to add to a long-term, varied collection. The filtering method based on Lynch's measures is made to find such chances.

You can find more companies that fit the Peter Lynch investment method by using our special stock screener.

,

Disclaimer: This article is for information only and is not financial guidance, a suggestion, or a bid to buy or sell any investments. The views given are from present study and filtering measures, which can change. All investing has risk, including the chance of losing the original amount. You should do your own investigation and talk with a registered financial consultant before making any investment choices.