Peter Lynch's investment philosophy focuses on finding companies with lasting growth paths that are available at fair prices. His method, explained in One Up on Wall Street, stresses fundamental study instead of trying to time the market, concentrating on businesses with good profitability, acceptable debt, and steady earnings growth. Lynch supported investing in companies that are easy to comprehend, show sound financials, and work in sectors where they can keep their competitive edges for a long time. This thinking matches the "growth at a reasonable price" (GARP) plan, which aims to mix growth possibility with price awareness.

JD.COM INC-ADR (NASDAQ:JD) functions as a technology-based e-commerce company based in Beijing, with business areas including retail, logistics, on-demand delivery, and new projects. The company's large-scale activities and staff of more than 570,000 people make it a major force in China's online market, supplying necessary consumer products and services through various channels.

Lasting Earnings Expansion

A key part of Lynch's plan is finding companies with solid but maintainable earnings expansion. JD shows this via its past results and upcoming estimates:

- Five-year EPS growth rate: 26.75%

- Expected future EPS growth: 24.90%

- Revenue growth over the past year: 14.47%

These numbers show the company has kept up good growth while staying inside Lynch's chosen growth limits. The steadiness between past performance and future estimates implies management has built a maintainable business framework instead of chasing fast but possibly unreliable growth.

Price Metrics

Lynch focused heavily on price, especially using the PEG ratio, which measures a company's price-to-earnings ratio against its growth rate. JD displays interesting price features:

- PEG ratio: 0.29

- P/E ratio: 7.66

- Forward P/E ratio: 7.76

The very low PEG ratio, far under Lynch's limit of 1.0, shows the market might be pricing JD's growth possibilities too low. This price difference forms a possible opening for long-term investors looking for growth at fair prices.

Financial Condition and Earnings

Lynch favored companies with good financial statements and reliable earnings. JD's financial numbers show several positive points:

- Return on Equity: 17.02%

- Debt-to-Equity ratio: 0.25

- Current Ratio: 1.22

The ROE is well above Lynch's 15% limit, showing effective use of shareholder money. The low debt-to-equity ratio fits with Lynch's liking for companies funded mainly through stock instead of debt. While the current ratio meets Lynch's lowest need, it should be watched given industry contrasts.

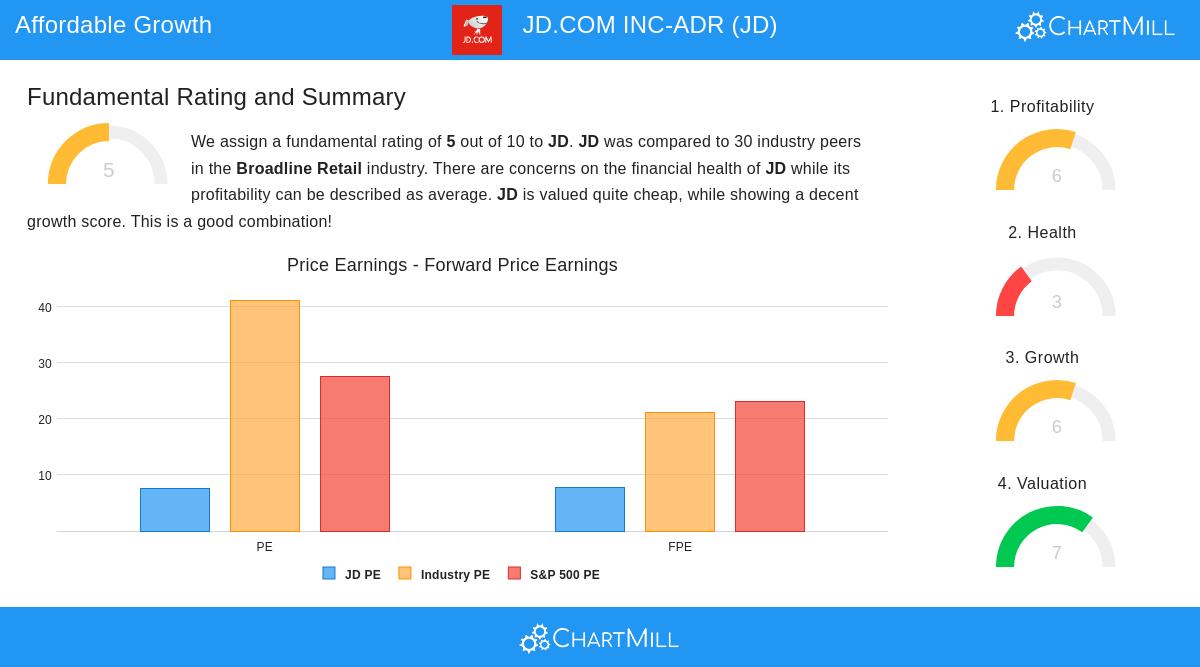

Basic Evaluation Summary

The full fundamental analysis report gives JD an average rating of 5 out of 10, showing a varied but mostly good view. The company shows force in price and earnings numbers while having some questions in financial condition, especially about cash measures. JD's price looks good compared to both industry rivals and wider market indicators, with the analysis stating the company "may be a bit undervalued, certainly considering the very reasonable score on growth."

Investment Points

For investors using Lynch's method, JD stands as an interesting example of growth at reasonable price investing. The company works in the well-known e-commerce field, fitting Lynch's "invest in what you know" idea. Its reliable earnings growth, fair price multiples, and good return numbers match important Lynch measures. The average institutional ownership and continuing stock buyback work, factors Lynch appreciated, give more support to the investment idea.

While the company deals with tests in gross margin contrasts and near-term cash measures, these are weighed against good solvency numbers and getting better earnings directions. The present price seems to account for much of the company's growth possibility, forming what Lynch might call a possible opening for steady investors.

Looking at Other Possibilities

Investors curious about finding other companies that fit Peter Lynch's investment rules can look at the full screening results for more study options.

Disclaimer: This analysis is for informational purposes only and does not constitute investment advice, recommendation, or endorsement of any security. Investors should conduct their own research and consult with a qualified financial advisor before making investment decisions.