Quality investing focuses on identifying companies with durable competitive advantages, strong financial health, and consistent profitability for long-term holding periods. The Caviar Cruise screening methodology, inspired by Luc Kroeze's work, systematically identifies such companies through quantifiable filters including revenue growth, EBIT expansion, high return on invested capital, manageable debt levels, and profit quality. This approach helps investors separate exceptional businesses from merely adequate ones.

Financial Metrics Assessment

Janus International Group Inc (NYSE:JBI) demonstrates several characteristics that align with quality investing principles. The company's performance across key Caviar Cruise screening criteria reveals a business with operational efficiency and financial discipline.

The screening methodology emphasizes:

- ROIC excluding cash and goodwill of 35.14%, substantially exceeding the 15% minimum threshold, indicating exceptional capital allocation efficiency

- Debt-to-Free Cash Flow ratio of 3.22, well below the 5.0 maximum, suggesting manageable leverage and financial flexibility

- 5-year EBIT CAGR of 12.84%, demonstrating consistent operational profit growth above the 5% requirement

- 5-year average profit quality of 140.07%, significantly surpassing the 75% benchmark, indicating strong cash conversion from accounting profits

Operational Performance

The company's EBIT growth exceeding revenue growth requirements demonstrates improving operational efficiency, a key quality investing criterion that suggests pricing power or economies of scale. Janus operates in the self-storage and industrial building solutions sector, providing essential infrastructure services with recurring revenue characteristics. The high profit quality metric is particularly noteworthy as it indicates the company converts accounting profits into actual cash flow effectively, providing financial stability and flexibility for strategic initiatives.

Fundamental Rating Context

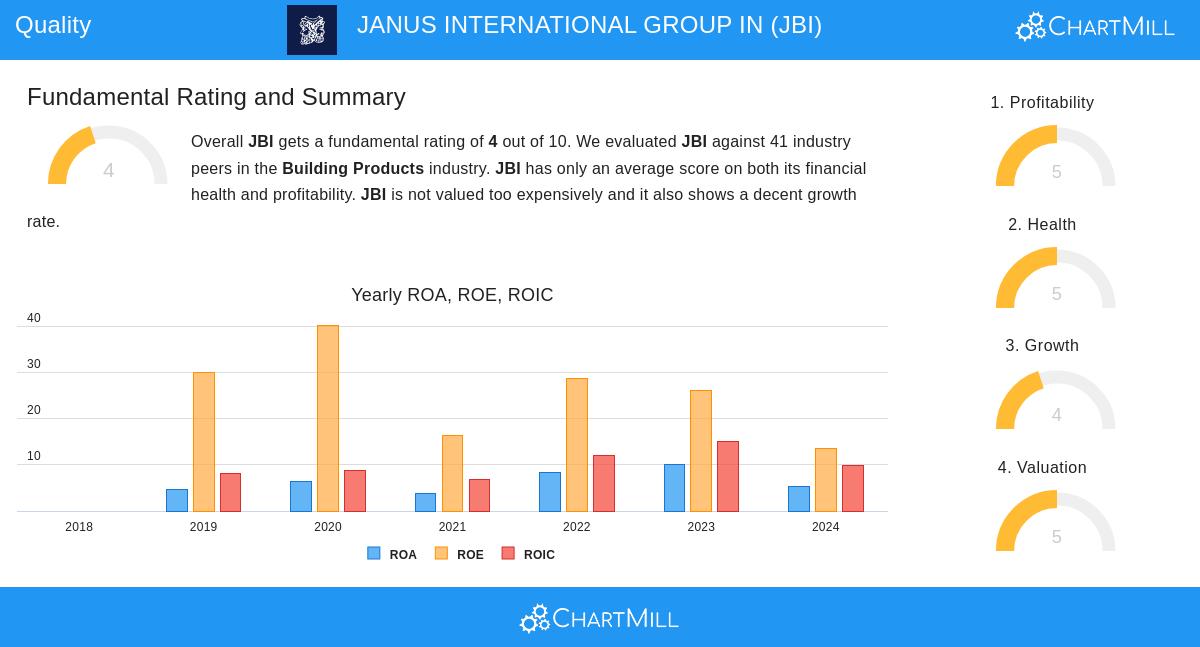

According to the detailed fundamental analysis, Janus scores 4 out of 10 overall compared to industry peers. While this moderate score suggests areas for consideration, several strengths stand out:

- Valuation metrics appear reasonable with forward P/E ratios trading below market averages

- Strong liquidity position with current and quick ratios indicating solid short-term financial health

- Gross margins of 39.30% outperform most industry competitors, suggesting competitive advantages

- Expected EPS growth of 14.23% indicates analyst confidence in future profitability

The fundamental report notes that while some profitability ratios like ROA and ROE trail industry averages, the company maintains positive earnings, consistent operating cash flow, and manageable debt levels.

Quality Investing Considerations

For quality investors, Janus presents an interesting case study in balancing quantitative screening results with qualitative business assessment. The company's focus on self-storage solutions positions it within a growing industry with defensive characteristics during economic cycles. Their integrated service model, covering planning, construction, and maintenance, creates customer stickiness and recurring revenue streams.

The Caviar Cruise screen identified Janus through its rigorous quantitative filters, but quality investors should also consider less quantifiable factors including management capability, global expansion potential, and competitive positioning within the building products industry.

Further Research Opportunities

Investors interested in applying similar quality screens can examine the Caviar Cruise screening methodology to discover additional companies meeting these criteria. The screen provides a systematic starting point for identifying businesses with strong fundamental characteristics worthy of deeper investigation.

Disclaimer: This analysis is for informational purposes only and does not constitute investment advice, recommendation, or endorsement of any security. Investors should conduct their own research and consult with financial advisors before making investment decisions. Past performance does not guarantee future results.