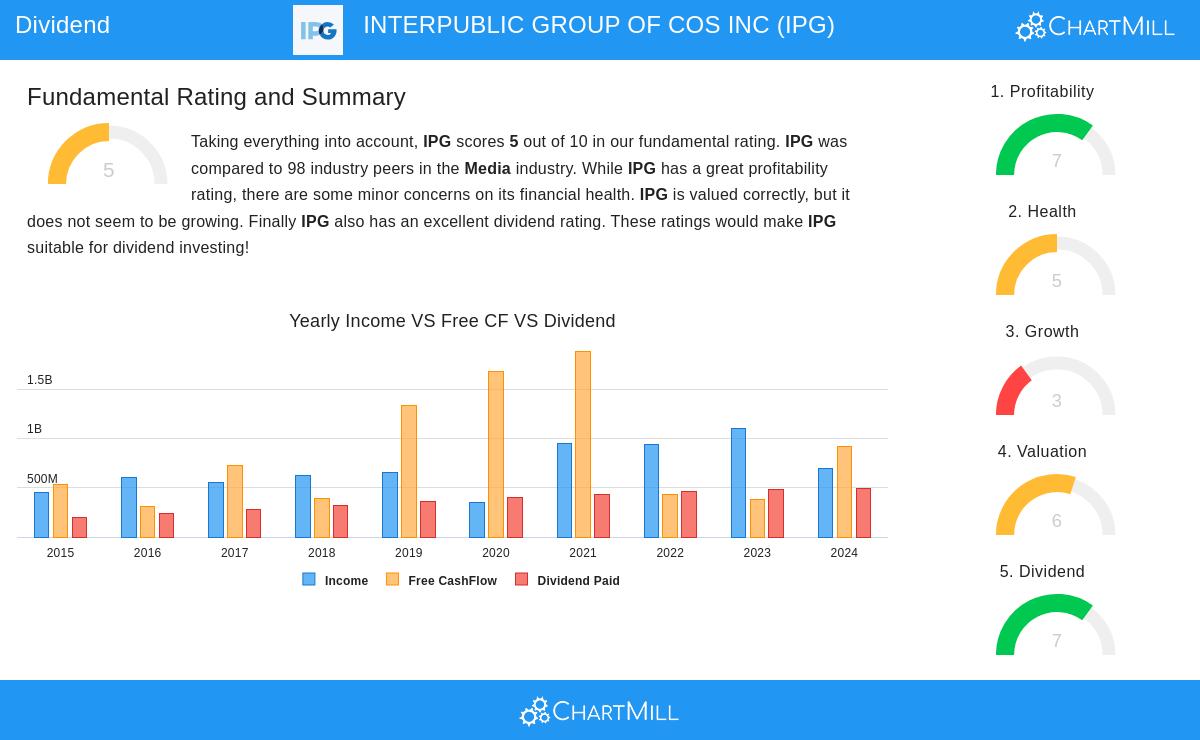

Interpublic Group of Cos Inc (NYSE:IPG) stands out as an option for dividend investors after meeting criteria that focus on steady income generation. The approach selects stocks with a ChartMill Dividend Rating of at least 7, ensuring strong dividend traits, while also demanding minimum scores of 5 for both profitability and financial stability. This method avoids pursuing unreliable yields by highlighting companies with sufficient earnings and solid financials to sustain dividends. The strategy follows key dividend investing principles: targeting dependable income backed by sound business fundamentals rather than risky high yields that could indicate financial trouble.

Dividend Strength: Attractive Yield and Growth

IPG offers notable income features, beginning with a 5.32% dividend yield that exceeds 90% of media industry competitors and is more than twice the S&P 500 average. The company has demonstrated dividend consistency with:

- Over 10 years of continuous payments

- 7.02% average yearly dividend growth across five years

- No cuts in the last decade

Although the payout ratio is currently 111% of earnings – a possible red flag – this reflects short-term earnings challenges rather than long-term problems. The company’s solid cash flow (14% operating margin) offers flexibility, and analysts expect earnings to grow at 3.3% annually, which may stabilize the payout ratio over time.

Profitability Backs Dividend Stability

IPG’s ChartMill Profitability Rating of 7/10 highlights lasting advantages in its advertising and marketing services. Key strengths include:

- Double-digit returns on capital (12.8% ROIC, better than 93% of industry peers)

- Growing operating margins, rising to 14% from past levels

- Steady positive cash flow over five years

These factors are critical because profitability directly supports dividend payments. IPG’s ability to turn 17.9% of revenue into free cash flow shows it can comfortably cover its dividend, even during weaker periods.

Financial Health: Balanced Risks

With a ChartMill Health Rating of 5/10, IPG displays a mixed but acceptable financial profile for dividend investors:

- Debt management: A 3.5-year debt/FCF coverage ratio is better than 83% of peers, indicating reasonable leverage

- Liquidity considerations: Current and quick ratios close to 1.0 suggest tighter working capital than rivals

- Shareholder-focused actions: A 5% reduction in share count over five years reflects disciplined capital use

The complete fundamental analysis report covers these details, including IPG’s valuation at just 8.9x earnings – a 67% discount to the S&P 500, offering a safety cushion.

Points for Dividend Investors

While IPG’s high yield and growth track record are appealing, investors should watch:

- Earnings rebound: Forecasted 2024 revenue growth of 0.7% must occur to help lower the payout ratio

- Industry challenges: Marketing spending remains tied to economic conditions

- Financial position: The Altman-Z score of 1.7 requires attention, though it ranks above 65% of peers

For investors looking for more screened dividend options, the Best Dividend Stocks screener provides an updated list of stocks with similar income traits.

Disclaimer: This analysis uses historical data and analyst forecasts from ChartMill.com. It is not investment advice and does not consider individual risk tolerance or portfolio goals. Investors should perform their own research before making decisions.