INTERPUBLIC GROUP OF COS INC (NYSE:IPG) stands out as a compelling choice for dividend investors, according to our Best Dividend Stocks screener. The company combines an attractive yield with solid profitability and reasonable financial health, making it a noteworthy candidate for income-focused portfolios.

Dividend Strength

- High Yield: IPG offers a 5.23% dividend yield, well above the S&P 500 average of 2.40% and competitive within its industry.

- Reliable Track Record: The company has paid dividends for at least 10 consecutive years without reductions, signaling stability.

- Growing Payouts: Dividends have grown at an average annual rate of 7.02% over the past five years, demonstrating management’s commitment to shareholder returns.

Profitability Supports Payouts

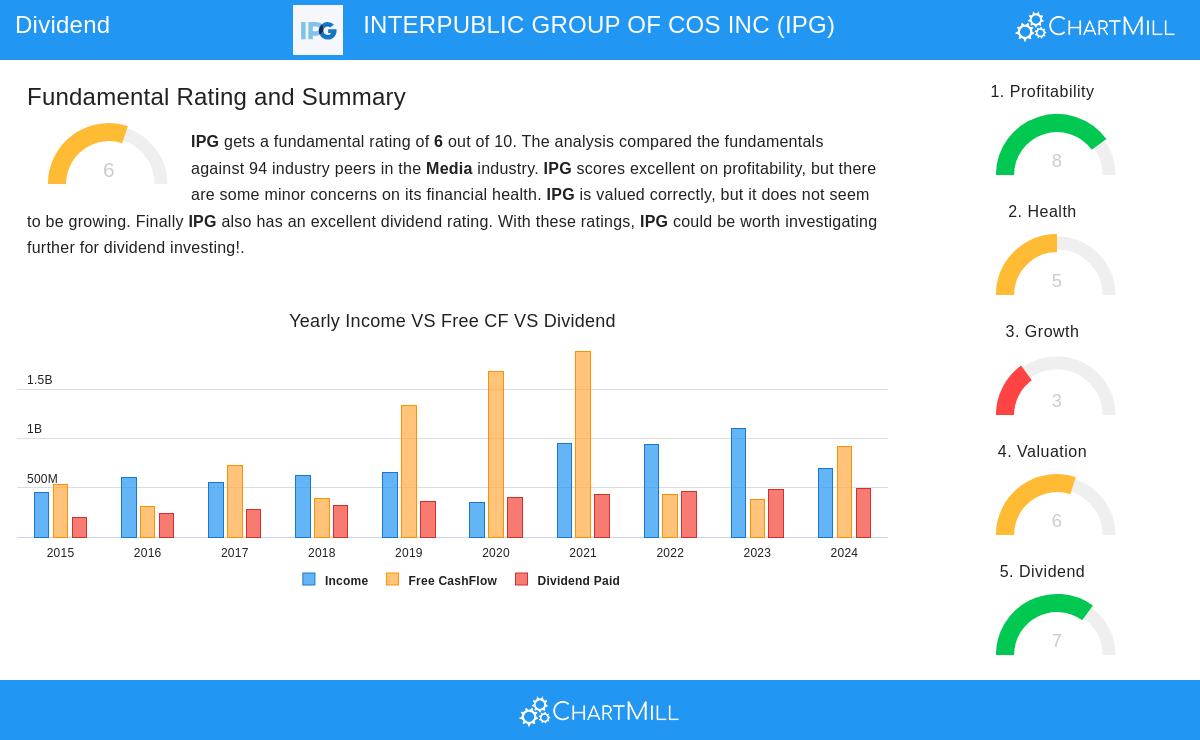

IPG earns a Profitability Rating of 8/10, reflecting strong operational performance:

- High Return on Invested Capital (12.47%), outperforming 94.68% of industry peers.

- Solid Margins: An operating margin of 13.37% places it in the top quartile of its sector.

- Consistent Earnings: Positive earnings and cash flow over the past five years reinforce dividend sustainability.

Financial Health Considerations

While IPG’s Health Rating of 5/10 indicates moderate financial strength, key positives include:

- Manageable Debt: A debt-to-FCF ratio of 2.82 suggests the company can service its obligations comfortably.

- Share Reduction: A declining share count over time supports per-share earnings growth.

Valuation

Trading at a P/E of 9.27, IPG appears reasonably priced compared to both the broader market and its industry.

For a deeper dive, review the full fundamental analysis of IPG.

Our Best Dividend Stocks screener provides more high-quality dividend ideas updated daily.

Disclaimer

This is not investment advice. Always conduct your own research before making investment decisions.