INCYTE CORP (NASDAQ:INCY) stands out as an intriguing candidate for value investors, according to our fundamental screening criteria. The biopharmaceutical company demonstrates a strong valuation profile while maintaining solid profitability and financial health. Below, we examine why INCY may be worth a closer look.

Valuation

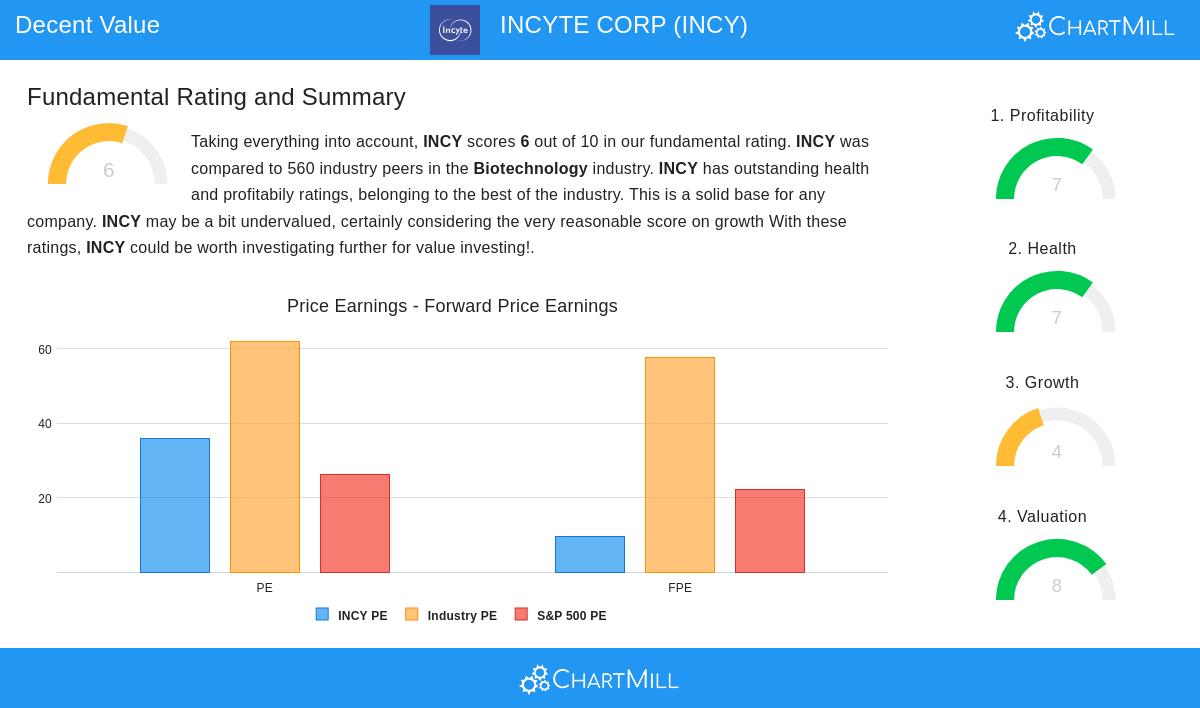

INCY scores an 8 out of 10 in valuation, indicating it is attractively priced relative to its fundamentals:

- Forward P/E of 9.46 – Significantly lower than both the industry average (57.58) and the S&P 500 (22.13).

- Price/Free Cash Flow – Cheaper than 93.75% of its biotechnology peers.

- Enterprise Value/EBITDA – More affordable than 93.39% of industry competitors.

Despite a high trailing P/E (35.89), the forward earnings multiple suggests the market may be undervaluing INCY’s future earnings potential.

Financial Health

With a health rating of 7, INCY maintains a stable balance sheet:

- Low Debt – A Debt/Equity ratio of 0.01 indicates minimal reliance on borrowing.

- Strong Solvency – A Debt-to-FCF ratio of 0.12 means the company could repay its debt quickly.

- Liquidity – Current and Quick Ratios above 2 confirm sufficient short-term financial flexibility.

Profitability

INCY earns a profitability score of 7, supported by:

- High Margins – Gross Margin of 93.19% outperforms 93.75% of industry peers.

- Strong ROIC – At 4.67%, it exceeds 92.86% of competitors.

- Operating Efficiency – An Operating Margin of 5.39% ranks in the top 7% of the sector.

Growth

While growth is more moderate (rating of 4), there are positive signs:

- Revenue Growth – Increased 17.13% over the past year, with a 5-year average of 14.46%.

- Future EPS Growth – Expected to rise by 25.93% annually, signaling improving profitability.

Our Decent Value Stocks screener lists more stocks with similar characteristics. For a deeper dive, review the full fundamental report on INCY.

Disclaimer

This is not investment advice. Always conduct your own research before making investment decisions.