Dividend investors frequently look for a mix of yield, sustainability, and financial strength when choosing stocks. A methodical screening process can help spot these opportunities by focusing on companies with high dividend ratings while also maintaining good profitability and financial stability. The "Best Dividend Stocks" screen on ChartMill uses this approach, picking stocks with a ChartMill Dividend Rating of 7 or higher, along with minimum Profitability and Health Ratings of 5. This guarantees that the companies not only offer appealing dividends but also have the foundation to maintain and increase those payouts in the long run.

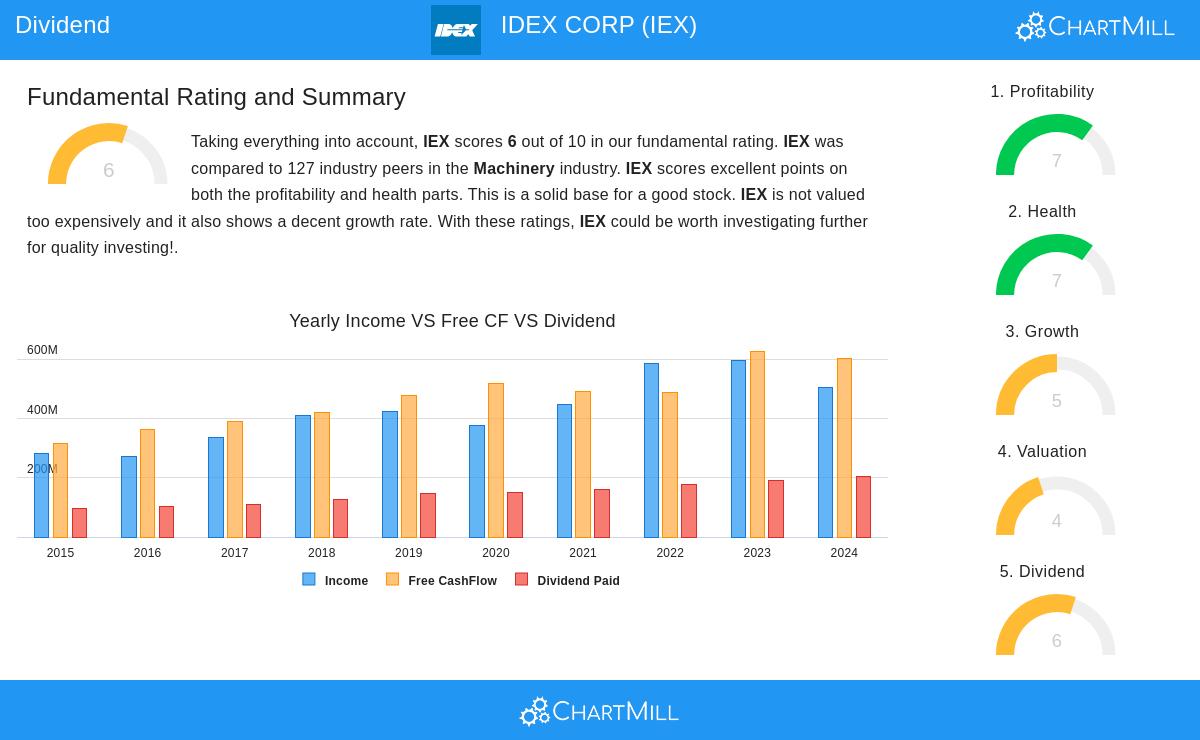

IDEX CORP (NYSE:IEX) is one stock that fits these requirements, making it a possible choice for dividend-focused portfolios.

What Makes IDEX Corp a Strong Pick for Dividend Investors

1. Steady Dividend Growth and Track Record

A crucial aspect of dividend investing is reliability—companies with a long history of paying and raising dividends tend to be more trustworthy. IDEX Corp shows this through:

- Over 10 years of continuous dividend payments, highlighting its dedication to sharing profits with shareholders.

- A 5-year average dividend growth rate of 6.95%, showing consistent increases in payouts.

- No reductions in dividends over the past 10 years, a mark of financial stability even in uncertain economic times.

This matches the screening criteria, as the ChartMill Dividend Rating places significant importance on historical consistency and growth potential.

2. Manageable Payout Ratio

A high yield isn’t meaningful if the dividend isn’t sustainable. IDEX Corp’s payout ratio of 44.84% (based on net income) means the company keeps more than half of its earnings for future growth while still paying shareholders. This falls within a sensible range—not so high as to threaten future cuts nor so low as to suggest inadequate payouts.

Moreover, the company’s projected annual earnings growth of 11.51% is faster than its dividend growth, adding to the sustainability of its payouts.

3. High Profitability Backs Dividend Reliability

The screen favors stocks with a Profitability Rating of at least 5, and IDEX Corp scores a 7, reflecting its strong financial performance:

- An operating margin of 20.87%, better than 92% of its machinery industry competitors.

- A solid return on equity of 11.70%, showing effective use of shareholder funds.

- Steady positive cash flow, confirming the company can afford dividends without financial stress.

These figures are vital because a profitable business is more likely to sustain and raise dividends over time.

4. Sound Financial Health Lowers Risk

Financial stability is another key part of the screening process, and IDEX Corp holds a Health Rating of 7, emphasizing its sturdy balance sheet:

- A low debt-to-equity ratio of 0.46, far from risky levels.

- Strong liquidity measures, including a current ratio of 3.05 and quick ratio of 2.13, indicating good short-term financial flexibility.

- An Altman-Z score of 4.40, well above the level indicating financial trouble.

A solid balance sheet reduces the chance of dividend cuts during economic challenges, making IDEX a safer option for income-focused investors.

5. Valuation Factors

While dividend investors focus on yield and sustainability, valuation still plays a role. IDEX trades at a P/E ratio of 20.39, slightly under the industry average, and a forward P/E of 17.67, which is fair given its growth outlook. Though not a bargain, the stock isn’t overvalued relative to its fundamentals.

Conclusion

IDEX Corp matches the traits of a strong dividend stock, offering a growing and sustainable payout alongside high profitability and financial health. While its 1.79% yield is lower than some high-yield stocks, the company’s consistent growth, low risk of payout cuts, and resilient operations make it a solid pick for investors seeking dependable income with room for gradual increases.

For investors searching for more dividend stock ideas, the Best Dividend Stocks screen offers a selected list of top-rated dividend payers.

Disclaimer: This article is not investment advice. Always conduct your own research or consult a financial advisor before making investment decisions.