IDEXX LABORATORIES INC (NASDAQ:IDXX) stands out as a compelling candidate for quality investors, based on our Caviar Cruise screening methodology. The company demonstrates strong revenue and profit growth, high returns on capital, and solid financial health, making it a noteworthy option for long-term investors.

Key Strengths of IDXX

- Revenue and EBIT Growth: Over the past five years, IDEXX has delivered annual revenue growth of 7.4% and EBIT growth of 15.4%, indicating not only top-line expansion but also improving operational efficiency.

- High Return on Invested Capital (ROIC): With an ROIC of 53.2%, the company generates substantial returns from its investments, far exceeding industry benchmarks.

- Strong Profit Quality: The five-year average profit quality stands at 83.2%, reflecting the company’s ability to convert net income into free cash flow consistently.

- Manageable Debt: The debt-to-free cash flow ratio of 1.1 suggests IDEXX can repay its obligations quickly, reinforcing financial stability.

Fundamental Analysis Highlights

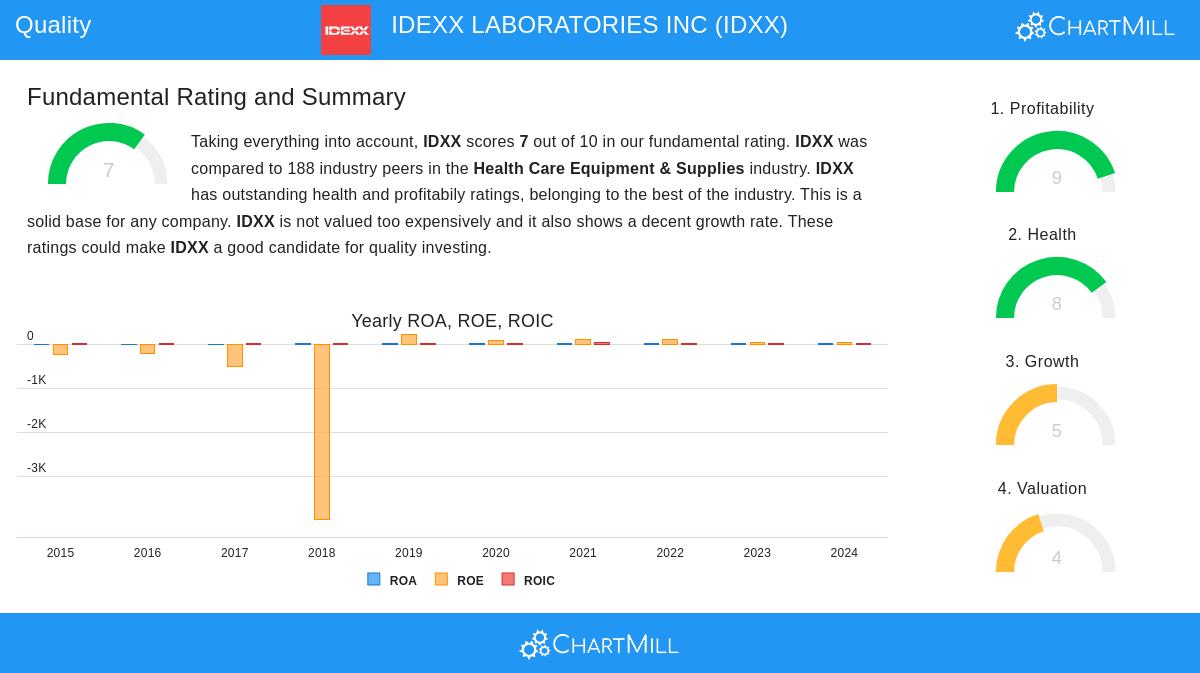

Our fundamental report assigns IDXX a rating of 7 out of 10, with particularly high scores in profitability (9/10) and financial health (8/10). Key takeaways include:

- Profitability: The company outperforms nearly all peers in return on equity (61.8%) and operating margin (29.1%).

- Valuation: While the P/E ratio of 45 may appear high, it is justified by strong growth prospects and industry-leading margins.

- Growth Outlook: Analysts expect continued revenue growth of 7.4% annually, supported by stable demand in veterinary diagnostics and water testing.

For investors seeking high-quality companies with durable competitive advantages, IDEXX Laboratories presents a strong case.

Our Caviar Cruise screener lists more quality stocks meeting these criteria.

Disclaimer

This is not investment advice. Always conduct your own research before making investment decisions.