The CAN SLIM investment methodology, created by William O'Neil, joins fundamental and technical analysis to find high-growth stocks with solid momentum possibility. This organized method assesses companies using seven main factors shown by the acronym CAN SLIM, concentrating on earnings speed, yearly growth patterns, new products or services, supply and demand forces, market leadership, institutional backing, and the general market direction. Stocks satisfying these strict conditions usually show solid fundamental traits while also displaying technical strength that supports market acknowledgment of their growth narrative.

IAMGOLD CORP (NYSE:IAG) offers an interesting situation for CAN SLIM investors, satisfying a number of main conditions of the method via its recent operational and financial results. The gold mining company, with operations in North America and West Africa, has shown notable betterment in fundamental measurements that match O'Neil's growth-centered method.

Current Quarterly Performance

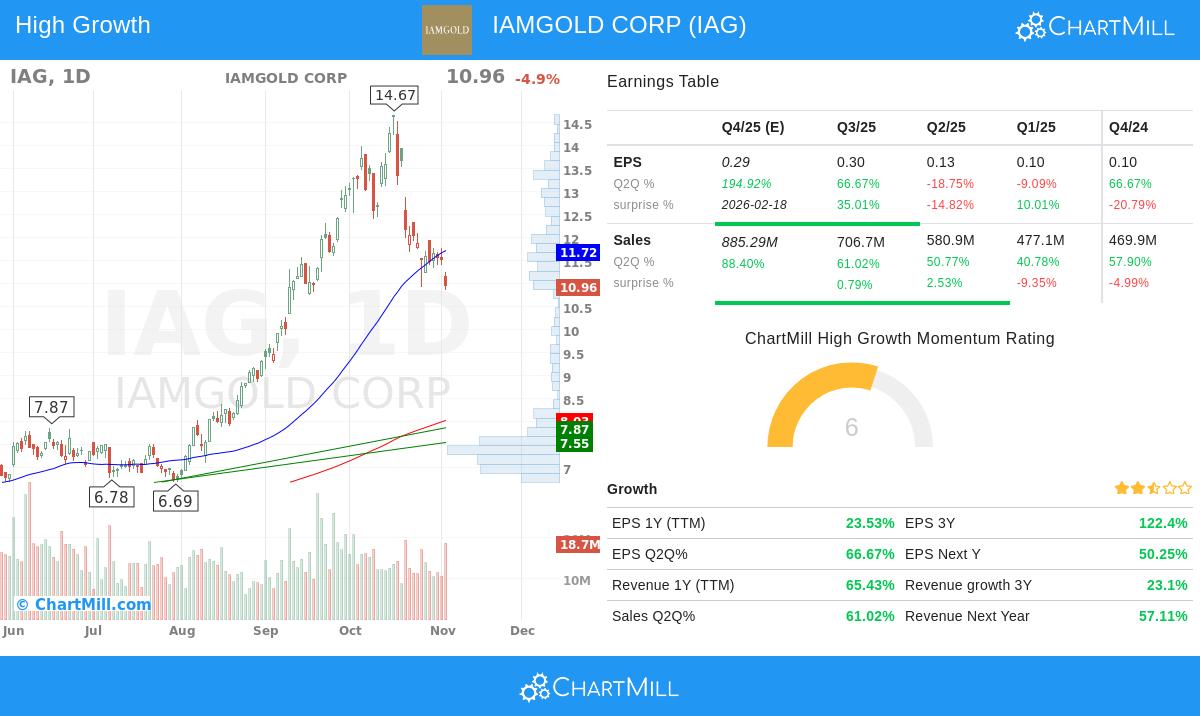

The CAN SLIM system highlights solid current quarterly earnings and sales growth as a main sign of momentum. IAMGOLD shows notable results in this area:

- Quarterly EPS growth of 66.7% year-over-year

- Revenue growth of 61.0% compared to the same quarter last year

These numbers greatly surpass O'Neil's suggested minimum level of 18-20% growth, showing solid operational momentum. The major revenue speed increase suggests the company is effectively running its mining operations and gaining from positive gold market situations, making it deserving of more study under the "C" condition of the CAN SLIM system.

Annual Earnings Growth

Beyond quarterly results, CAN SLIM needs steady yearly earnings growth to make sure companies are not having short-term jumps. IAMGOLD's long-term growth path shows outstanding strength:

- Three-year EPS compound annual growth rate of 122.4%

- Return on Equity of 23.3%, much higher than the 10% minimum level

The exceptional three-year growth rate greatly exceeds O'Neil's suggestion of 25-50% yearly rises, placing IAMGOLD with top growth companies. The solid ROE shows effective use of shareholder capital, meeting the "A" part of the method that looks for companies with set growth paths instead of one-quarter successes.

Market Leadership and Institutional Support

CAN SLIM favors market leaders with institutional backing but stays away from stocks where institutional ownership gets too high. IAMGOLD balances these parts well:

- Relative strength of 95.2, doing better than 95% of all stocks

- Institutional ownership of 75.6%, under the 85% level

The outstanding relative strength score meets the "L" condition for leadership, showing the market acknowledges IAMGOLD's fundamental betterment. The institutional ownership level is in the ideal range where professional investors are involved but have not totally filled ownership, allowing space for more institutional purchases that might push the stock upward.

Financial Health and Valuation

The system includes financial health checks and valuation thoughts:

- Debt-to-equity ratio of 0.34, much lower than the maximum 2.0 level

- Forward P/E ratio of 8.0, showing a large discount to industry averages

The careful debt level matches O'Neil's liking for companies with workable leverage, lowering financial risk. The good valuation multiples offer possible upside while the low debt level satisfies the "S" condition about supply factors and financial steadiness.

Technical and Fundamental Assessment

IAMGOLD's technical analysis shows a stock with solid longer-term momentum but recent sideways movement. The technical rating of 8/10 shows better performance than 95% of all stocks over the past year, although the short-term trend has lately become negative during a trading range between $10.87 and $14.67. The fundamental analysis shows a mixed view with a rating of 5/10, highlighting very good profitability measurements but worries about financial health, especially about liquidity ratios.

The mix of solid growth measurements, market leadership, and acceptable institutional backing makes IAMGOLD valuable to watch for CAN SLIM investors. However, the present technical position suggests waiting for a more favorable entry point, as the stock trades near the bottom of its recent range in spite of its solid longer-term results.

Investors curious about finding more companies that meet CAN SLIM conditions can explore our pre-configured screener for more possible chances that fit this growth investing method.

Disclaimer: This analysis is for informational purposes only and does not constitute investment advice, recommendation, or endorsement of any security. Investors should conduct their own research and consult with a qualified financial advisor before making investment decisions. Past performance is not indicative of future results.