For investors looking for opportunities where the market price of a company seems separated from its basic financial condition, a methodical value investing method can be a useful instrument. This tactic, established by Benjamin Graham and famously used by Warren Buffett, centers on finding stocks selling for less than their intrinsic value, the determined worth of a business founded on its assets, earnings, and growth potential. The aim is to locate good companies that are briefly priced too low by the market, offering a possible "margin of safety" for the patient investor. One way to find such prospects is by searching for stocks that mix appealing valuation measures with good basics in earnings, balance sheet condition, and expansion.

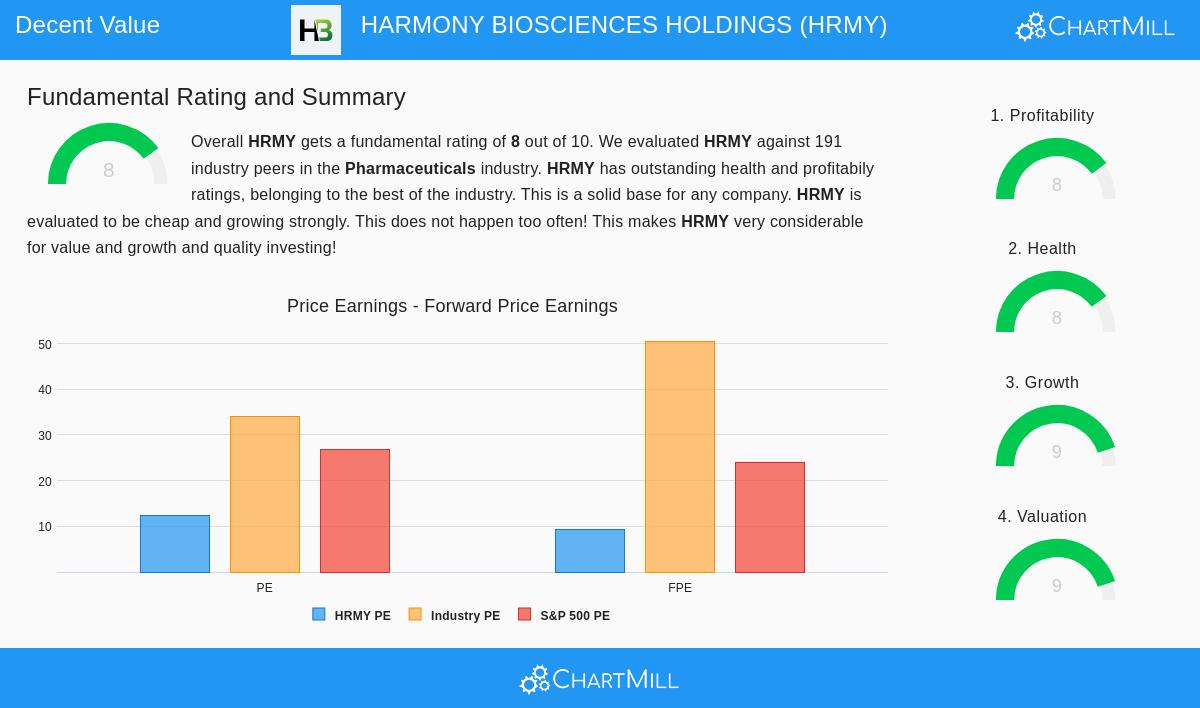

A recent search for "reasonable value" stocks, which selects for good valuation ratings together with satisfactory scores in other basic areas, has identified Harmony Biosciences Holdings (NASDAQ:HRMY) as a possible prospect. The company, a commercial-stage pharmaceutical business concentrated on treatments for neurological conditions, presents an interesting case when examined through the view of central value investing ideas.

A Detailed View of the Basics

A thorough fundamental analysis report for HRMY shows a good financial picture that appears inconsistent with its present market price. The report combines data into five important areas: Valuation, Profitability, Financial Health, Growth, and Dividend. For a value investor, the relationship between these groups is vital; a low-priced stock is only a worthwhile purchase if the company is basically healthy and able to expand.

Notable Valuation Measures

The valuation rating for HRMY is high at 9 out of 10, signaling the stock is priced modestly compared to its financial results. This is the foundation of the value case. Important measures backing this include:

- Price-to-Earnings (P/E) Ratio: At 12.45, HRMY's P/E ratio is much lower than the current S&P 500 average of 26.76. Within its pharmaceuticals industry group, it is valued lower than almost 90% of companies.

- Forward P/E Ratio: An even more appealing number of 9.37 implies the market is pricing future earnings at a large discount.

- Price-to-Free Cash Flow & EV/EBITDA: Both ratios are in the high range of the industry, with HRMY priced lower than over 93% of similar companies on these measures.

For the value investor, these measures imply the market may be setting too low a price on HRMY's earnings capacity, forming a possible opening if the difference between price and intrinsic value narrows.

Good Profitability and Balance Sheet Condition

A low price loses its attraction if the company is failing to produce earnings or is weighed down by debt. Here, HRMY also receives high scores, with Profitability and Financial Health ratings of 8 each. This offers the "quality" cushion that value investors look for to steer clear of "value traps."

- Profitability Condition: The company has very good returns, with a Return on Invested Capital (ROIC) of 17.20%, doing better than 95% of its industry. Its Profit Margin of 22.48% and Operating Margin of 27.32% are also in the top tier of pharmaceutical companies, showing efficient turning of revenue into profit.

- Sound Financial Base: HRMY's balance sheet looks solid. Its Altman-Z score of 5.74 shows a low short-term bankruptcy danger. Maybe more notably, its Debt to Free Cash Flow ratio is only 0.57, meaning it could in theory pay off all its debt with less than seven months of its present cash flow production, a sign of very good financial adaptability.

This mix of high profitability and a clear, liquid balance sheet indicates the company is not just low-priced, but basically healthy.

Strong Growth Path

A strict value opportunity can sometimes involve companies that are not growing. HRMY, however, includes an expansion element, receiving a Growth rating of 9. This is significant because earnings expansion is a main force behind intrinsic value over the long term.

- Previous Results: The company has demonstrated fast growth, with Revenue increasing at an average yearly rate of over 160% in recent years and Earnings Per Share (EPS) increasing by nearly 45% on average.

- Future Predictions: While slowing from past peaks, expansion stays good. Analysts project future EPS growth of about 35% yearly and Revenue growth of nearly 15%.

This expansion picture, when paired with its low valuation multiples, leads to a very appealing PEG ratio, which modifies the P/E ratio for growth. It signals that investors are not paying extra for HRMY's expected growth.

Summary and Investor Points

Harmony Biosciences Holdings presents a picture that matches several central value investing principles: it seems priced too low based on standard earnings and cash flow measures, yet it is supported by good profitability, a sound balance sheet, and a satisfactory growth view. This mix seeks to offer the margin of safety that value investors value, as the basic condition of the business may help reduce risk while the valuation offers possible gain.

It is, naturally, very important for investors to perform their own research. The pharmaceutical sector holds built-in risks connected to clinical tests, regulatory processes, and patent protection. Also, while the financials are presently good, the company's major dependence on its main product, WAKIX, is a point to watch.

Find Other Possible Value Stocks The examination of HRMY came from a systematic search for stocks with good valuation basics. If this method fits your investment plan, you can review an updated list of similar prospects by using this Reasonable Value Stocks search.

,

Disclaimer: This article is for informational purposes only and does not constitute financial advice, a recommendation, or an offer to buy or sell any securities. The analysis is based on data and sources believed to be reliable, but its accuracy cannot be guaranteed. Investors should conduct their own independent research and consult with a qualified financial advisor before making any investment decisions.