Investors looking for growth chances at fair prices often consider methods that mix expansion possibility with financial steadiness. The "Affordable Growth" method looks for companies showing good growth paths while keeping up acceptable profitability and financial condition, all without needing high price tags. This process tries to find businesses that mix expansion ability with careful financial control, possibly providing good returns for the risk. Harmony Biosciences Holdings (NASDAQ:HRMY) recently came up in a search like this, fitting the rules for strong growth, fair price, and good basic health.

Growth Path and Expansion Possibility

Harmony Biosciences shows notable growth features that are central to its appeal for investment. The company's expansion numbers are much higher than industry averages, showing its successful sales work for WAKIX and progress in its development pipeline.

- Earnings Per Share (EPS) increased by 49.76% over the last year, with an average yearly increase rate of 44.61% over recent years

- Revenue rose by 17.74% in the last year, following a very high historical average increase of 160.13%

- Future estimates show continued progress with expected EPS increase of 39.17% and revenue increase of 16.93% each year

These growth numbers are especially significant considering the company's work on rare neurological conditions, a specialty drug area with little competition and good ability to set prices. The steady upward path in both past performance and future forecasts indicates the company has built a lasting growth pattern, not just short-term jumps.

Price Assessment

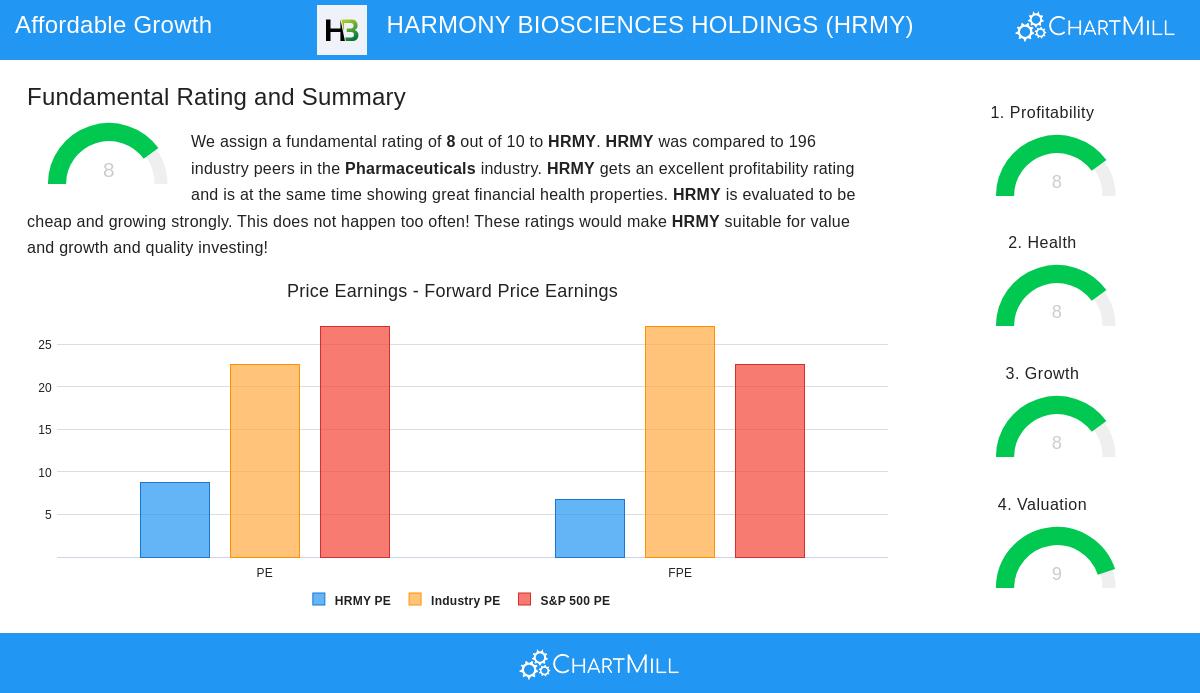

Even with its good growth picture, Harmony Biosciences trades at price levels that seem fair compared to its industry and the wider market. This mix of growth and price creates the "affordable" part key to the search method.

- Current Price/Earnings ratio of 8.72 looks good next to industry averages of 22.64 and the S&P 500's 27.06

- Forward P/E ratio of 6.72 shows expectations for continued profit growth

- Enterprise Value/EBITDA and Price/Free Cash Flow ratios are higher than 98.98% and 94.90% of industry competitors, respectively

The price measurements suggest the market might be setting too low a value on Harmony's growth possibility compared to other drug company counterparts. For investors seeking growth at a fair price, this gap between basic performance and market price could be a chance.

Profitability and Financial Condition

Beyond growth and price, Harmony Biosciences displays good basic business fundamentals that back its lasting expansion. The company's profitability numbers show effective operations and ability to set prices within its treatment areas.

- Return on Invested Capital of 17.95% is higher than 95.92% of industry competitors

- Operating margin of 28.72% and profit margin of 23.42% are in the top group of drug companies

- Gross margin of 78.34% shows the high prices possible in rare disease treatments

The company's financial condition gives more stability, with solvency and cash measures showing very little risk of failure and good short-term financial flexibility.

- Altman-Z score of 4.81 shows low failure risk, better than 79.59% of industry competitors

- Debt-to-Free Cash Flow ratio of 0.67 suggests the company could pay off all debt in less than eight months

- Current ratio of 3.84 and quick ratio of 3.80 show plenty of cash for daily operations

Investment Points

The mix of good growth, fair price, and sound financial basics makes Harmony Biosciences a noteworthy option for investors using affordable growth methods. The company's focus on rare neurological conditions gives a defensive quality to its growth picture, as these treatments usually have less payment pressure than drugs for large markets. Still, investors should think about the natural risks of biotechnology investing, including pipeline problems, regulatory issues, and competitive risks.

The basic analysis report for Harmony Biosciences gives more detailed numbers supporting this evaluation. Investors can see the full analysis through the Harmony Biosciences Fundamental Analysis Report.

For investors wanting to find similar chances, the affordable growth search method can provide more options. View more affordable growth stock results to see other companies meeting these rules.

Disclaimer: This article gives factual information based on basic data and should not be taken as investment advice. All investment choices should be made after your own research and talking with financial experts.