Harmony Biosciences Holdings (NASDAQ:HRMY) was identified by our stock screener as a strong candidate for value investors. The company combines solid financial health, strong profitability, and notable growth prospects—all while trading at an attractive valuation. Below, we examine why HRMY stands out based on its fundamental metrics.

Valuation

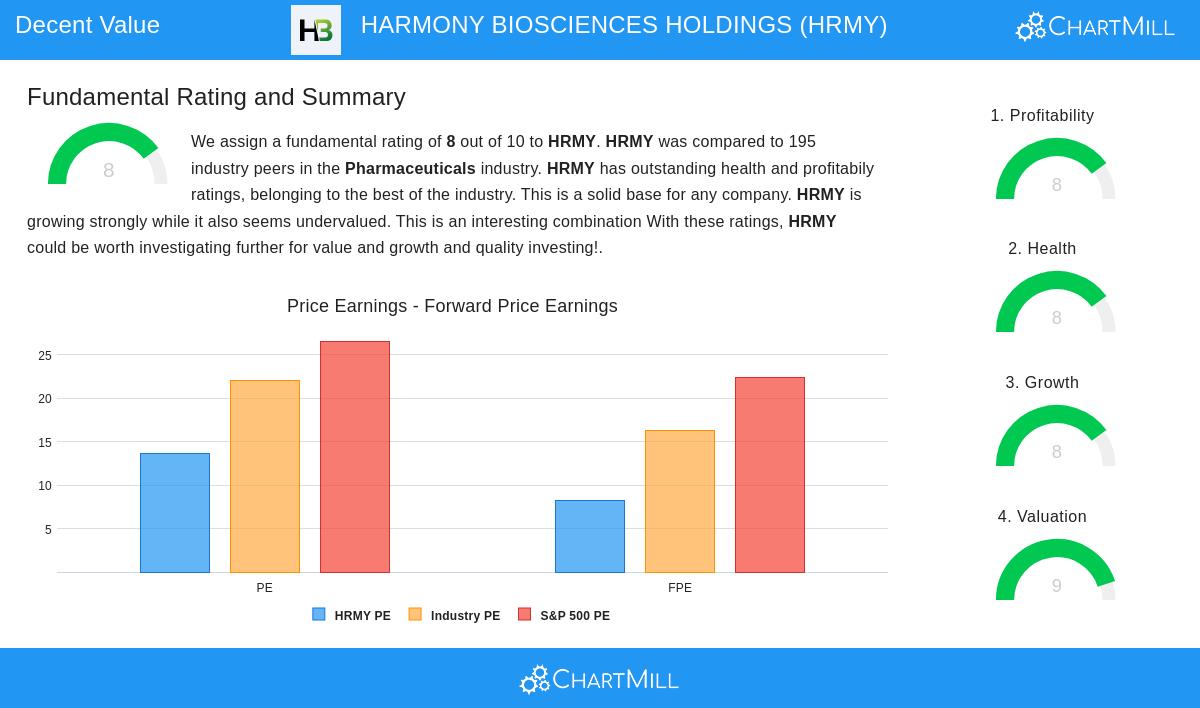

HRMY’s valuation metrics suggest the stock is priced below its intrinsic value:

- P/E Ratio: At 13.68, it is cheaper than 87.69% of its pharmaceutical industry peers.

- Forward P/E: A ratio of 8.26 indicates further upside potential.

- Enterprise Value/EBITDA: The stock trades at a discount compared to nearly 90% of competitors.

- Price/Free Cash Flow: HRMY is priced more attractively than 92.82% of industry peers.

Financial Health

The company maintains a strong balance sheet:

- Altman-Z Score: 5.65 signals low bankruptcy risk.

- Debt/Equity Ratio: A conservative 0.22 suggests minimal reliance on debt.

- Current Ratio: 3.67 indicates ample liquidity to cover short-term obligations.

Profitability

HRMY excels in profitability metrics:

- Return on Assets (ROA): 14.49% outperforms 96.41% of industry peers.

- Return on Equity (ROE): 21.22% ranks in the top 6.67% of the sector.

- Profit Margin: 20.54% is among the best in the industry.

Growth Prospects

The company has demonstrated strong historical and expected growth:

- Revenue Growth: 160.13% average annual growth over recent years.

- EPS Growth: Expected to rise by 35.76% annually in the coming years.

Our Decent Value screener lists more stocks with similar characteristics and is updated daily.

For a deeper dive, review the full fundamental report on HRMY.

Disclaimer

This is not investment advice. The observations here are based on current data, but investors should conduct their own research before making decisions.