Hudbay Minerals Inc (NYSE:HBM) has emerged as a possible choice for investors using the CAN SLIM strategy, a growth-oriented investment method developed by William O'Neil. This system blends fundamental and technical analysis to find high-growth market leaders with solid earnings momentum, institutional backing, and positive market trends. It focuses on stocks showing rising quarterly earnings, strong yearly growth, and notable price performance, along with other key factors.

How HBM Matches the CAN SLIM Criteria

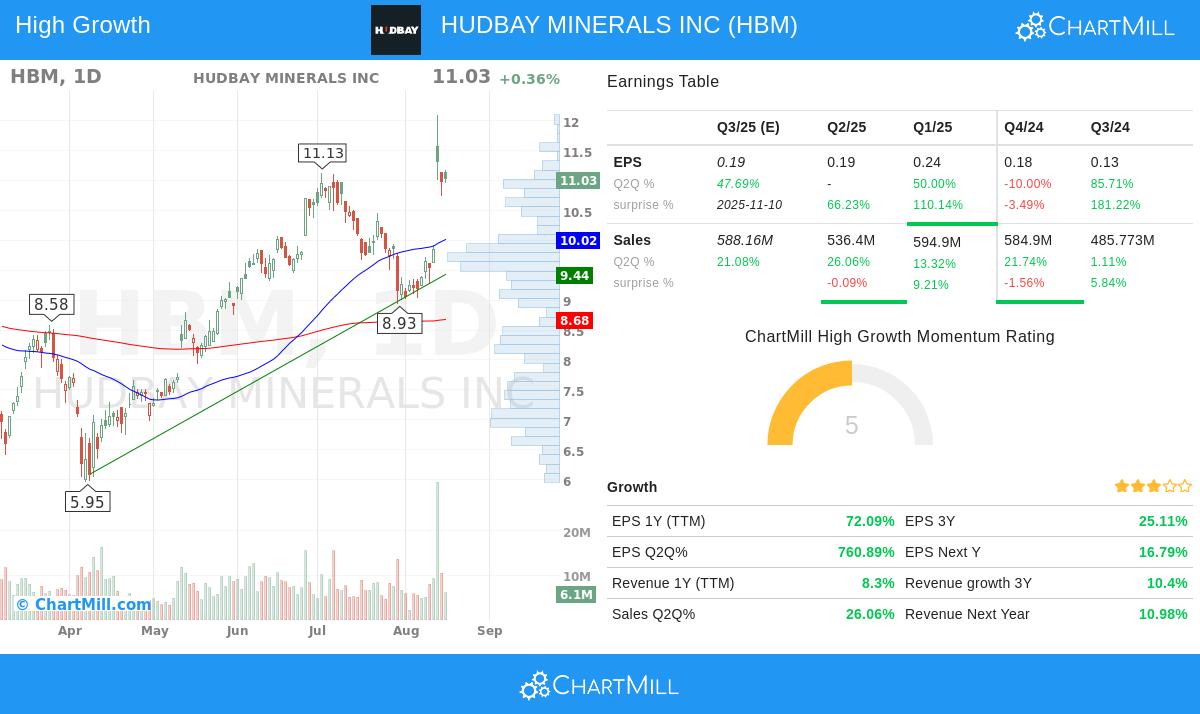

C – Current Quarterly Earnings & Sales Growth

The CAN SLIM strategy looks for significant quarterly earnings and revenue growth. HBM posted a remarkable 760.89% year-over-year EPS increase in its latest quarter, well above the 20-25% minimum requirement. Revenue growth also reached 26.06%, surpassing the 25% target. This improvement points to efficient operations and high demand for its copper-focused mining activities.

A – Annual Earnings Growth

Consistent yearly earnings growth is essential. HBM’s 3-year EPS compound annual growth rate (CAGR) of 25.11% fits the strategy’s preference for companies with steady profit growth. The firm’s return on equity (ROE) of 10.09% further highlights its ability to create value for shareholders.

N – New Products, Management, or Highs

Though not directly measurable, HBM’s growth projects in Arizona, Nevada, and Peru place it in the growing copper market, a vital material for electrification and renewable energy. Technically, the stock is near its 52-week high, a positive sign under CAN SLIM’s "new highs" rule.

S – Supply & Demand

The strategy prefers stocks with reasonable debt and notable institutional interest. HBM’s debt-to-equity ratio of 0.22 is far below the screener’s maximum limit of 2, showing a cautious financial approach. Institutional ownership is at 66.56%, below the 85% cap, indicating potential for more institutional buying.

L – Market Leadership

Price performance is a key part of CAN SLIM, and HBM performs well here with a 90.14 relative strength rating, meaning it beats 90% of the market. This confirms its leading position in the metals and mining industry.

I – Institutional Sponsorship

Moderate but increasing institutional ownership is ideal to prevent overexposure. HBM’s current institutional ownership level leaves room for additional investment without the risk of overcrowding.

M – Market Direction

The overall market trend stays positive, with the S&P 500 in an upward move both short- and long-term. This matches CAN SLIM’s rule of investing only during confirmed bull markets.

Technical & Fundamental Overview

- Technical Rating: 10/10 – The stock shows strong upward movement, trading near yearly highs with rising averages. Recent volume increases support the bullish trend. (Full Technical Analysis)

- Fundamental Rating: 5/10 – While profitability metrics are good (ROE, margins), liquidity issues (low quick ratio) and a borderline Altman-Z score (1.75) call for caution. Valuation remains appealing, with a P/E of 14.91, below industry and S&P 500 averages. (Full Fundamental Analysis)

Final Thoughts

HBM meets many key CAN SLIM standards, especially in earnings growth, price performance, and institutional interest. Though its financial health metrics are uneven, the company’s role in the copper market—a crucial element of the energy shift—adds a favorable trend. Investors should watch liquidity and debt levels but may consider HBM a strong option for a growth-focused portfolio.

For more CAN SLIM-aligned stock ideas, check our predefined screener setup.

Disclaimer: This analysis is for informational purposes only and does not constitute investment advice. Always conduct your own research or consult a financial advisor before making investment decisions.