In the world of growth investing, combining a strict technical plan with attention to fundamental momentum can be a strong method for finding possible leaders. One way that shows this is the strategy made known by trader Mark Minervini, which depends on his "Trend Template" to find stocks in clear, strong uptrends. This template works as a quality screen, making sure a security is showing good price movement, correct moving average positions, and better relative strength before it is even reviewed. To this technical base, investors frequently add fundamental screens for "High Growth Momentum" (HGM), looking for companies that are not only trending but are also showing faster earnings, sales, and good analyst changes. This two-part method tries to find stocks where good price trends are supported by getting better business fundamentals, possibly creating the conditions for continued high performance.

A recent screen made on this exact method has identified Guardian Pharmacy Services, Inc. (NYSE:GRDN) as a candidate worth more detailed review. The company, which gives pharmacy services and technology to long-term care facilities, seems to satisfy the strict requirements from both a technical and growth momentum view.

Satisfying the Minervini Trend Template

The center of Minervini's strategy is removing weak stocks by applying exact technical rules. Guardian Pharmacy's present chart formation indicates it succeeds in this first review step. The Trend Template needs a stock to be in a definite "Stage 2" rise, and the technical information supports this view.

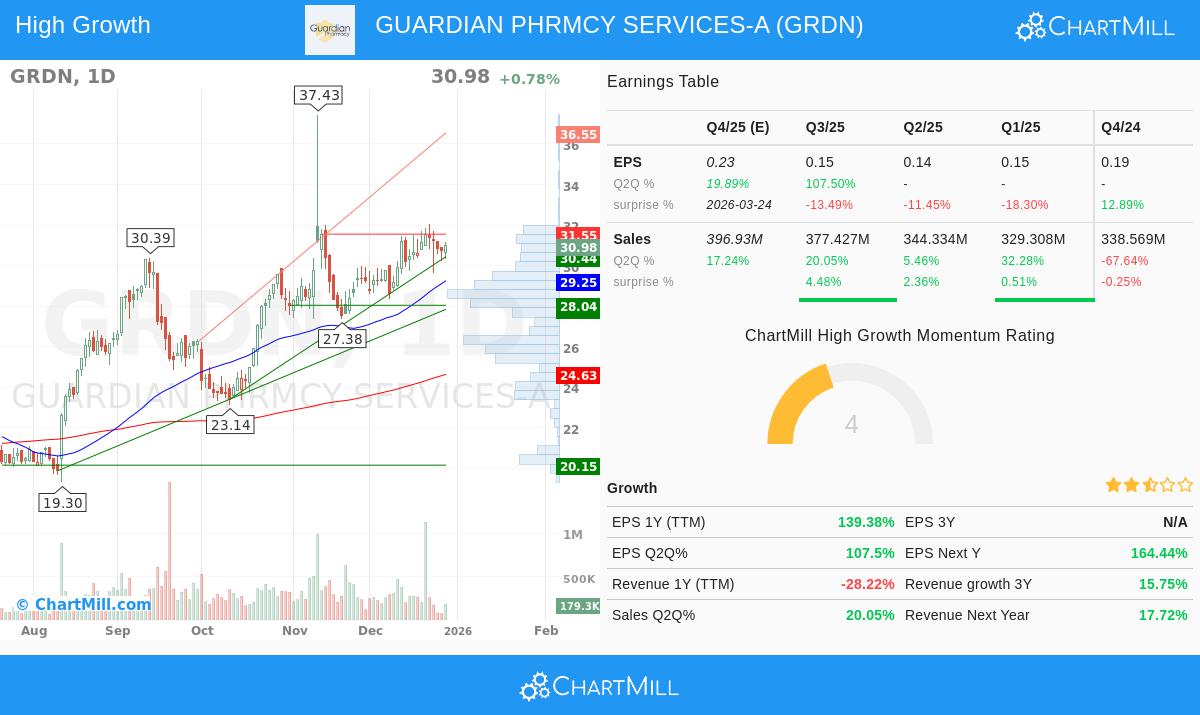

- Trend Position: The stock's price is trading above all its main simple moving averages (SMAs), the 50-day ($29.25), 150-day ($25.16), and 200-day ($24.63). Also, these averages are in the right bullish order: the 50-day SMA is above the 150-day, which is above the 200-day. This ordered, rising arrangement shows continued buying pressure across several time periods.

- Nearness to Highs: A sign of leading stocks is their skill to trade close to new highs. GRDN's present price of $30.98 is within 25% of its 52-week high of $37.43, and it is a notable 74% above its 52-week low of $17.78. This shows the stock has already made a large rise and is settling in a higher price area, a sign of strength.

- Better Relative Strength: Maybe most importantly, GRDN has a ChartMill Relative Strength (CRS) score of 92.98. This means it has done better than about 93% of all stocks in the market over the past year. Minervini notes that real market leaders nearly always show high relative strength, as it points to institutional buying and a move away from general market softness.

This combination of factors, a price above rising moving averages, a place of strength compared to its yearly range, and top-level relative performance, is exactly what the Trend Template is made to find. It screens out stocks in forming or falling patterns, focusing attention on those already in a strong uptrend.

Satisfying High Growth Momentum

While a good chart is necessary, the Minervini method also highlights the need for fundamental speed to support continued price gains. This is where the High Growth Momentum (HGM) rating becomes important. A rating of at least 4 suggests GRDN is displaying the type of operational gain that can draw more investor attention. Main numbers from its recent reports emphasize this momentum:

- Fast Earnings Growth: The company is showing notable profit increase. Earnings per share (EPS) growth on a trailing twelve-month (TTM) basis is up 139%. More significantly, the latest quarterly EPS grew 107.5% compared to the same quarter last year, showing the speed is present and strong.

- Good Analyst Changes: Forward-looking opinion is getting better. Analyst guesses for next year's earnings have been changed upward by 8.16% over the last three months. Such upward changes are a key part of growth momentum, as they show growing belief in the company's future earnings and often come before more institutional buying.

- Strong Sales and Margin Patterns: While TTM revenue growth shows a decrease, the latest quarter reported a solid 20% year-over-year sales gain. Also, the company has kept a steady profit margin around 2.6% over the last two reported quarters, suggesting it is turning its growing sales into profits well during a time of operational growth.

These fundamental points, quickly speeding earnings, good estimate changes, and recent sales momentum, give the "fuel" that can maintain the technical "fire" found by the Trend Template. In Minervini's plan, this mix is often seen in stocks before they make their largest price moves.

Technical Condition and Position

Beyond just meeting list requirements, GRDN's general technical condition is solid. According to ChartMill's own analysis, the stock gets a complete Technical Rating of 10 out of 10, putting it in the top group of all stocks from a trend condition view. Both its short-term and long-term trends are rated as good. The analysis also mentions a satisfactory Setup Rating of 8, showing the stock is now in a settling phase within its uptrend, which can give a clearer area for setting risk.

The technical report finds a close resistance area around $31.54-$31.55. A clear move above this point could be seen as a restart of the uptrend. On the other hand, support is seen in an area between $30.25 and $30.44, supported by moving averages and trendlines. This set range allows for an organized review of possible entry and exit points, matching the controlled trade management that is central to the strategy. You can see the full, detailed technical review for GRDN here.

A Candidate for More Study

Guardian Pharmacy Services presents a situation where a strict, rules-based screening process has found a stock that fits both the technical ideas of the Minervini Trend Template and the fundamental traits wanted by high-growth momentum investors. Its chart shows a stock in a strong uptrend with better market-relative strength, while its financials show a company in the middle of notable earnings speed and improving analyst opinion.

Interested in reviewing other stocks that pass this two-part technical and growth momentum screen? You can run the "High Growth Momentum + Trend Template" screen yourself to see a current list of qualifying securities here.

Disclaimer: This article is for information and learning only. It is not a suggestion to buy or sell any security. The analysis is based on given information and specific screening rules; it does not form investment advice. Always do your own complete study, think about your personal risk comfort, and talk with a qualified financial advisor before making any investment choices.