GAP INC/THE (NYSE:GAP) stands out as a potential value opportunity, scoring well on valuation while maintaining solid profitability and financial health. The company operates as a global apparel retailer with brands like Old Navy, Gap, Banana Republic, and Athleta. Our analysis suggests the stock may be trading below its intrinsic value.

Key Strengths

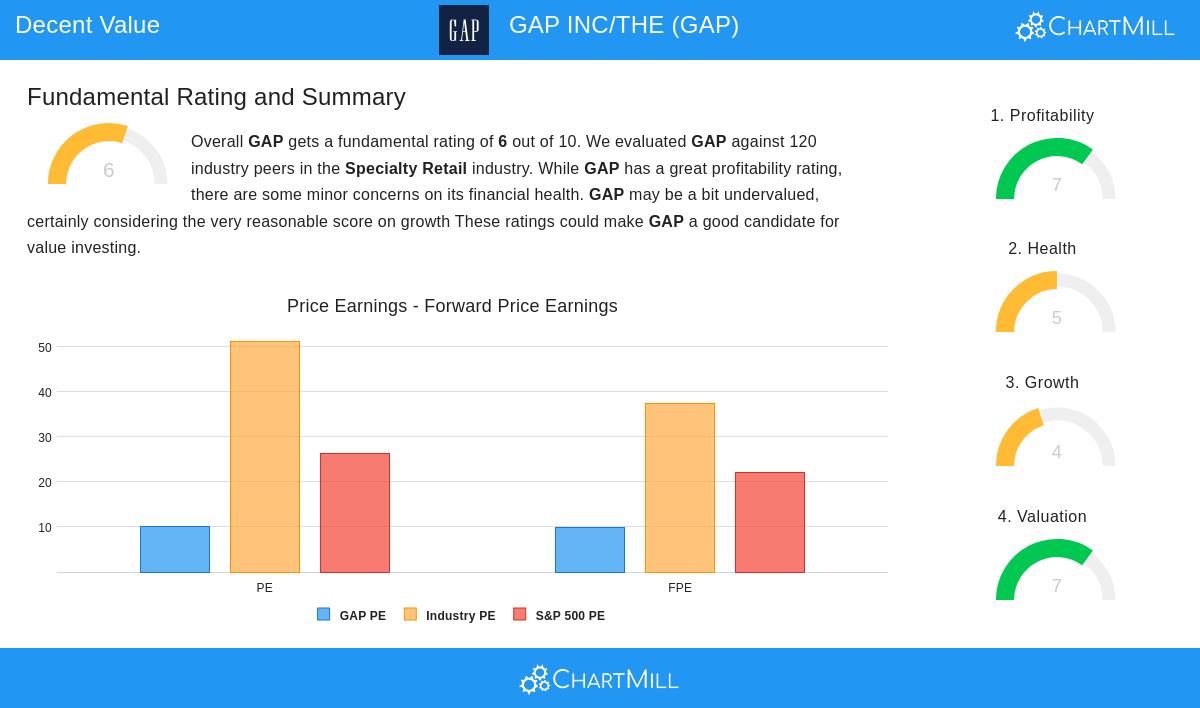

Valuation (Score: 7/10)

- The stock trades at a Price/Earnings (P/E) ratio of 10.10, significantly below the industry average of 51.25 and the S&P 500 average of 26.25.

- 83% of industry peers are more expensive based on P/E.

- The Price/Forward Earnings ratio of 9.77 is also favorable compared to the sector.

- Enterprise Value/EBITDA and Price/Free Cash Flow ratios suggest the stock is attractively priced.

Profitability (Score: 7/10)

- Return on Equity (ROE) of 25.86% outperforms 82.5% of industry peers.

- Operating Margin of 7.42% is better than 76.67% of competitors.

- Profit Margin of 5.59% places GAP in the top tier of its sector.

- Margins have improved over recent years, indicating operational efficiency.

Financial Health (Score: 5/10)

- Debt/Equity ratio of 0.46 suggests manageable leverage.

- Debt-to-Free Cash Flow ratio of 1.43 means the company could pay off debt quickly.

- Altman-Z score of 2.72 indicates limited bankruptcy risk.

- Liquidity metrics are mixed, with a Current Ratio of 1.60 but a weaker Quick Ratio.

Growth (Score: 4/10)

- EPS grew 54.55% over the past year, though long-term revenue trends have been slightly negative.

- Future EPS growth is projected at 6.09% annually, with accelerating trends.

- Revenue growth expectations are modest at 1.79% per year.

Dividend Considerations

- Dividend yield of 2.96% is above the S&P 500 average (2.38%).

- Payout ratio of 26.66% is sustainable.

- However, dividends have declined by 9.10% annually over the past years.

Risks to Consider

- Revenue has declined slightly over the past five years.

- The retail sector faces competition and shifting consumer trends.

- Dividend cuts in recent years may concern income-focused investors.

For a deeper dive, review the full fundamental analysis of GAP.

Our Decent Value Stock Screener provides more stocks that fit this criteria.

Disclaimer

This is not investment advice. Always conduct your own research before making investment decisions.