The CAN SLIM investment methodology, created by William O'Neil, integrates fundamental and technical analysis to find high-growth market leaders. This methodical process assesses companies using seven main factors represented by the acronym CAN SLIM, concentrating on earnings momentum, yearly growth patterns, new products or services, supply and demand forces, industry leadership, institutional investment, and the general market trend. The method looks for stocks with solid fundamental traits that also display technical health via price action and volume activity.

Futu Holdings Ltd. (NASDAQ:FUTU) functions as a digital financial services company, mainly providing online brokerage and margin financing services on its Futu NiuNiu platform. The company became publicly traded in March 2019 and has increased its workforce to more than 3,300 full-time employees while widening its service range in various markets and for different security kinds.

Earnings and Sales Momentum

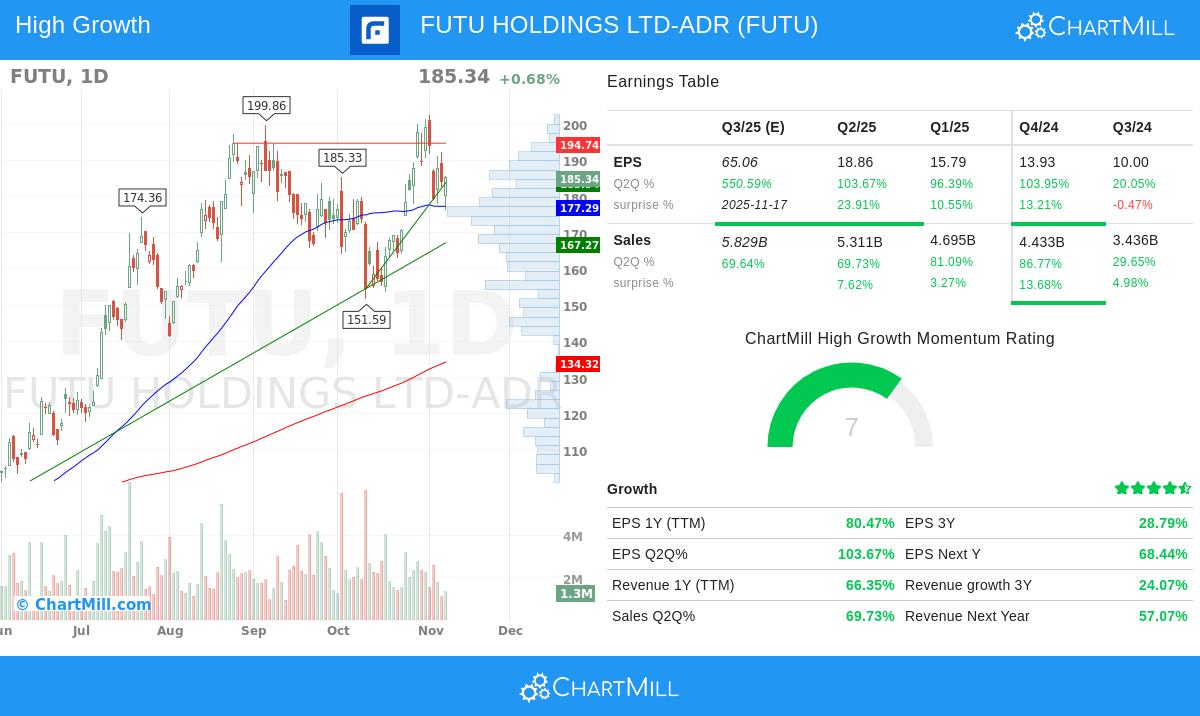

The "C" in CAN SLIM highlights current quarterly earnings and sales momentum, which FUTU shows notably:

- Quarterly EPS growth of 103.67% versus the same quarter last year

- Quarterly revenue growth of 69.73% year-over-year

- Three-year EPS growth rate of 28.79%

These numbers are well above O'Neil's suggested minimums of 18-20% for quarterly EPS growth and 25% for sales growth, pointing to good operational momentum. The outstanding quarterly EPS growth above 100% implies quickening profitability, a main trait CAN SLIM investors look for.

Annual Growth and Profitability

The "A" factor centers on yearly earnings growth and general profitability:

- Return on Equity of 23.77%, putting FUTU in the top 10% of its industry

- Steady profitability during the last five years

- Good three-year growth path

FUTU's ROE is much higher than the CAN SLIM minimum of 10%, showing effective use of shareholder money. The company's maintained profitability and better-than-average returns fit well with the system's focus on proven growth histories instead of speculative projects.

Technical Health and Market Leadership

The "L" part examines if a stock is an industry leader or follower:

- Relative Strength rating of 93.7, meaning FUTU performs better than 94% of all stocks

- Good price action with 96% gains over the last year

- Trading close to the high point of its 52-week range

This very high relative strength shows institutional acknowledgment and industry leadership, both important CAN SLIM elements. Stocks with such high relative performance often keep performing well, as institutions continue building positions in leading companies.

Financial Health and Institutional Sponsorship

FUTU satisfies several other CAN SLIM factors successfully:

- Debt-to-equity ratio of 0.28, much lower than the system's maximum limit of 2

- Institutional ownership of 44.45%, under the 85% ceiling indicating possibility for more institutional accumulation

- High trading volume averaging more than 2.3 million shares daily

The reasonable debt level offers financial room, while the institutional ownership level shows both support and chance for further institutional purchasing. The high volume provides liquidity, letting large investors take positions without majorly affecting the stock price.

Technical and Fundamental Assessment

Based on ChartMill's evaluation, FUTU offers an interesting profile for growth investors. The technical analysis report gives the stock a rating of 8 out of 10, observing its high relative performance and positive long-term direction. The fundamental analysis report rates FUTU at 6 out of 10, pointing out very good growth and profitability measures together with some questions about financial health.

The technical position shows FUTU trading with support at several levels from $166 to $185, while meeting resistance around $195 and $199. Even though the present technical rating is very good, the setup quality score of 3 implies investors could look for better base patterns before starting new positions.

Market Context

With the S&P 500 displaying a positive short-term direction and a neutral long-term trend, the wider market situation is suitable for the CAN SLIM method of finding leadership stocks during good market periods. FUTU's high relative performance in this time strengthens its position as an industry leader.

For investors looking for more CAN SLIM options, the screening results list several companies meeting these strict growth and technical factors.

Disclaimer: This evaluation is for information only and is not investment advice, a suggestion, or a support of any security. Investors must perform their own investigation and talk to financial consultants before making investment choices. Past results do not ensure future outcomes.