Futu Holdings Ltd-ADR (NASDAQ:FUTU) has become a possible choice for investors using the CANSLIM strategy, a growth-oriented investment method made popular by William O'Neil. This approach blends fundamental and technical analysis to find market leaders with high growth, strong earnings momentum, institutional support, and positive technical patterns. CANSLIM investors look for firms showing rising quarterly earnings, yearly growth trends, and price strength, while also watching market trends closely.

How FUTU Matches the CANSLIM Criteria

C – Current Quarterly Earnings & Sales Growth

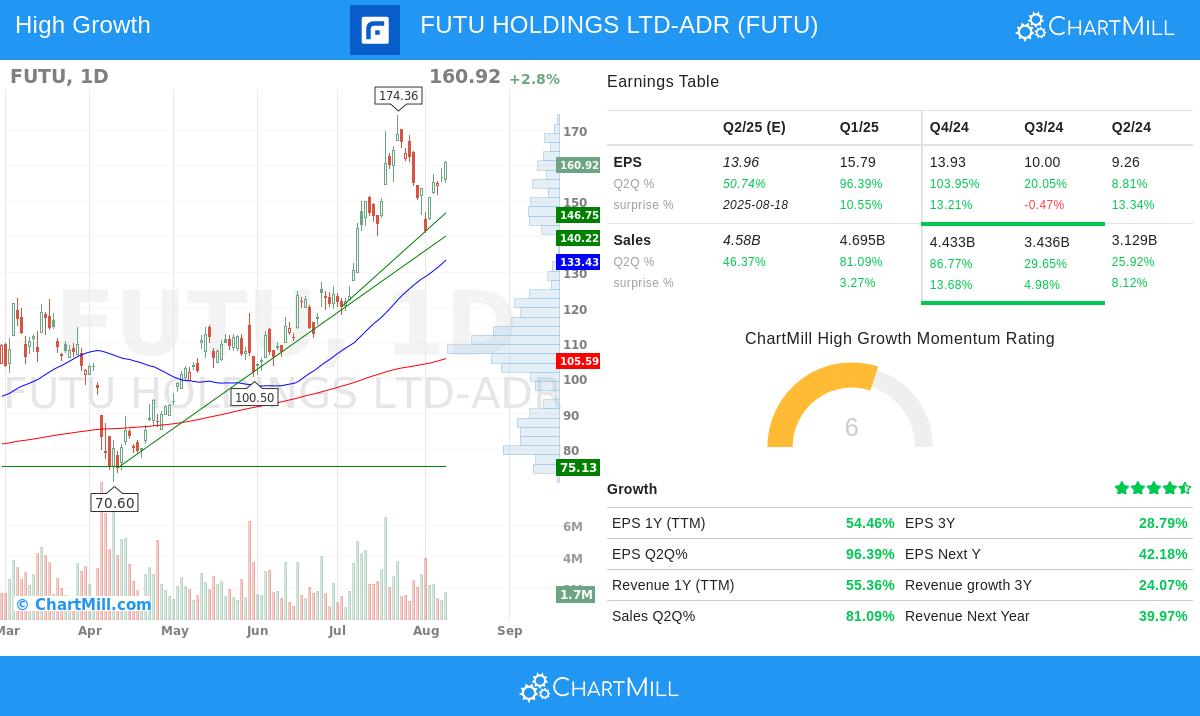

Futu Holdings shows strong quarterly growth, with EPS rising 96.4% year-over-year and revenue increasing 81.1%, well above CANSLIM's minimum requirement of 20-25% growth. This speed points to solid business performance, a core part of O'Neil's strategy, as firms with fast-growing earnings often keep doing well.

A – Annual Earnings Growth

The company’s 3-year EPS CAGR of 28.8% is higher than the 25% target, showing steady profitability. Its Return on Equity (ROE) of 21.6% also signals good use of capital, another plus for growth-focused investors.

N – New Products, Management, or Highs

As a digital brokerage platform, Futu works in the fast-changing fintech space, gaining from more retail investors in global markets. While not directly measurable, its fresh business model fits CANSLIM’s focus on innovative firms. On the technical side, the stock has been near its 52-week high, a positive sign in O’Neil’s approach.

S – Supply and Demand

Futu’s debt-to-equity ratio of 0.36 is much lower than the screener’s max limit of 2, showing a solid balance sheet. Though float details aren’t highlighted, the stock’s average daily volume of ~2.45 million shares provides enough liquidity, lowering risks for traders.

L – Market Leadership

With a relative strength of 97.28, Futu beats almost all other stocks in the market, a key trait of CANSLIM leaders. Its strong price movement compared to others in the Capital Markets industry also supports its leading position.

I – Institutional Sponsorship

Institutional ownership is at 42.8%, below the 85% cap, meaning there’s space for more institutional buying—a good sign for CANSLIM followers.

M – Market Direction

The S&P 500’s upward trends in both the short and long term fit CANSLIM’s rule of investing only in rising markets, creating a positive environment for Futu.

Fundamental and Technical Overview

- Fundamentals (6/10): Futu scores well on profit and growth but has some financial health issues, like a low Altman-Z score. Its valuation is fair given its growth path (Full FA Report).

- Technicals (10/10): The stock displays strong upward movement across all timeframes, with a 176% 12-month gain. However, recent swings suggest waiting for a pullback before buying (Full TA Report).

Why This Matters for CANSLIM Investors

The strategy focuses on buying high-growth stocks breaking out of patterns in rising markets—exactly what Futu offers. Its earnings speed, market position, and institutional interest resemble past CANSLIM winners like Apple and Amazon in their early stages.

For more CANSLIM-aligned stocks, check our pre-configured screener.

Disclaimer: This analysis is not investment advice. Do your own research or talk to a financial advisor before making decisions.