Investors looking for companies with solid growth paths often search for stocks that join strong basic features with encouraging technical formations. This method blends measurable financial condition with market entry points, trying to find stocks set for possible price increases. The plan focuses on companies showing quick growth in earnings and revenue, good profitability, and a stable financial position, while also displaying technical chart formations that indicate a chance to move higher after a period of sideways movement.

Fabrinet (NYSE:FN) appears as an interesting candidate from a filter made to find these chances. The company offers optical packaging and electronic manufacturing services, concentrating on low-volume, high-mix products for original equipment manufacturers. This positions it centrally within several modern technology fields.

Fundamental Strength: The Foundation for Growth

The fundamental argument for Fabrinet is solid, as described in its detailed fundamental analysis report. The company achieves high scores in several important categories vital for a growth investment, which match the filtering method's emphasis on good core business condition.

-

Outstanding Growth Profile: Fabrinet displays strong momentum, receiving a Growth Rating of 8 out of 10.

- Its Earnings Per Share (EPS) has increased by an average of 22.15% each year over recent years.

- Revenue has risen by 19.71% over the past year, with an average yearly growth of 15.80%.

- Future projections are also positive, with EPS and Revenue expected to grow by 24.46% and 20.98% per year, respectively.

-

Excellent Financial Condition: A company's capability to maintain growth is linked to its financial statements, and Fabrinet performs well here with a Health Rating of 9.

- The company has no debt, removing solvency worries and putting it in a select category in its industry.

- It holds good liquidity, with a Current Ratio of 2.83 and a Quick Ratio of 2.03, showing sufficient ability to cover immediate liabilities.

-

Good Profitability: Growth is most beneficial when it generates earnings. Fabrinet's Profitability Rating of 7 is backed by effective operations.

- It achieves a Return on Invested Capital (ROIC) of 12.89%, doing better than most of its competitors.

- Its Profit Margin of 9.77% and Operating Margin of 9.55% are both viewed as good within the competitive Electronic Equipment, Instruments & Components industry.

While its Valuation Rating of 3 indicates a higher Price-to-Earnings ratio, this is frequently a trait of fast-growth companies where investors are prepared to pay more for future earnings growth. The company does not provide a dividend, which is common for growth stocks as money is put back into the business to support more expansion.

Technical Setup: The Timing Signal

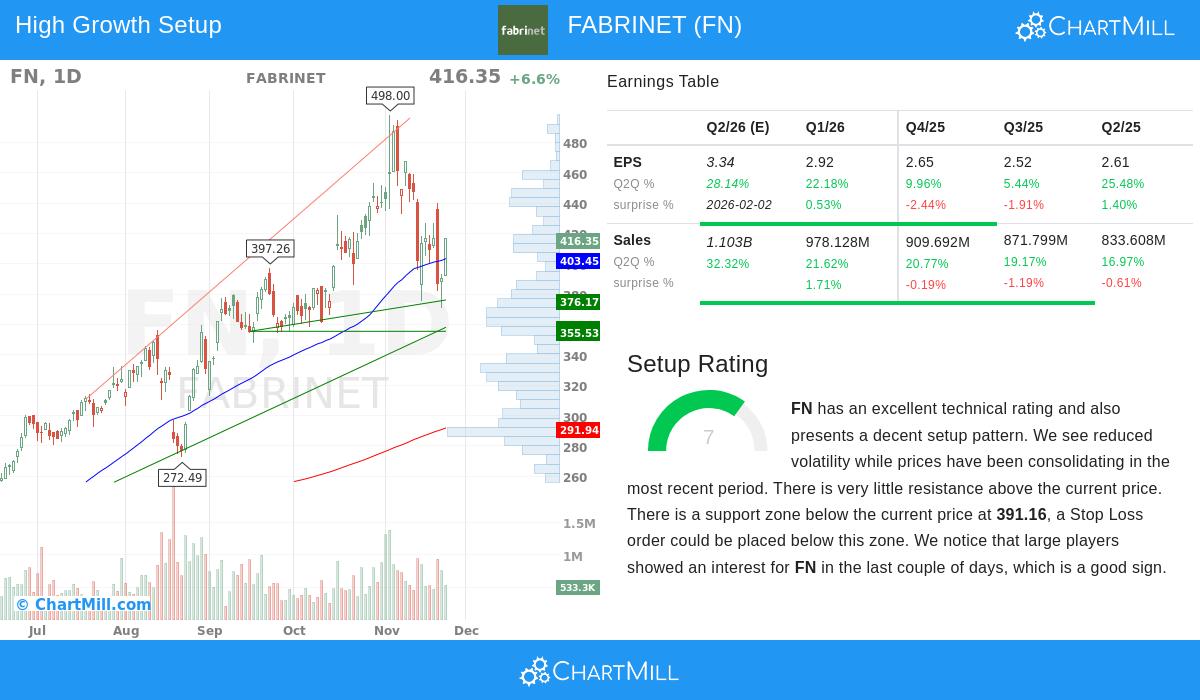

Adding to its good fundamentals, Fabrinet's chart shows an encouraging technical view, getting a firm Technical Rating of 9 and a Setup Rating of 7. This pairing is exactly what the filtering plan looks for: a fundamentally healthy company appearing at a technically favorable time.

The stock is in a steady long-term upward trend but has lately been moving sideways, which is a frequent formation before a possible new phase of gains. The technical analysis report points out a defined resistance level just above the present price. A clear move above this resistance might indicate the beginning of a new positive period. Also, the report mentions lower volatility recently and important support areas below the current price, which can assist in setting risk parameters for possible entry plans. The stock's performance has been very good, doing better than 94% of all stocks over the past year and 87% of its industry competitors, showing firm relative performance even within a good market setting.

A Cohesive Investment Thesis

The combination of Fabrinet's fundamental and technical information forms an interesting story. The company's fast revenue and earnings growth, clean financial statements, and high profitability create a base that supports investor attention. This fundamental strength gives the "why" for a stock's potential. The technical setup then provides the "when," indicating that after a time of sideways movement, the stock might be getting ready for its next upward step. This combination is the center of the merged analysis plan, intending to invest in high-quality growth companies at technically favorable moments.

For investors wanting to find other companies that match this description of firm growth joined with encouraging technical formations, more results can be viewed using the Strong Growth Stock Technical Setups screen.

Disclaimer: This article is for informational purposes only and does not constitute a recommendation to buy or sell any security. All investment decisions involve risk, and readers should conduct their own research and consult with a qualified financial advisor before making any investment decisions.