For investors looking for a systematic way to find high-growth stocks, the method in Louis Navellier's "The Little Book That Makes You Rich" offers a strong framework. The plan is based on eight basic rules meant to find companies showing better earnings quality, faster growth, and sound financial condition. These rules center on good earnings revisions and surprises, rising sales, widening margins, strong cash flow, earnings growth, positive earnings momentum, and a high return on equity. By sorting the market using these exact, number-based views, the plan tries to find businesses that are not only growing, but doing so with greater efficiency and profit, traits the market often values over time.

One company that now meets this strict test is Comfort Systems USA Inc (NYSE:FIX), a national provider of mechanical and electrical contracting services. A detailed look shows how FIX matches the central ideas of Navellier's growth-centered plan.

Meeting the "Little Book" Criteria

The data shows Comfort Systems USA is performing well across several of the plan's main measures:

-

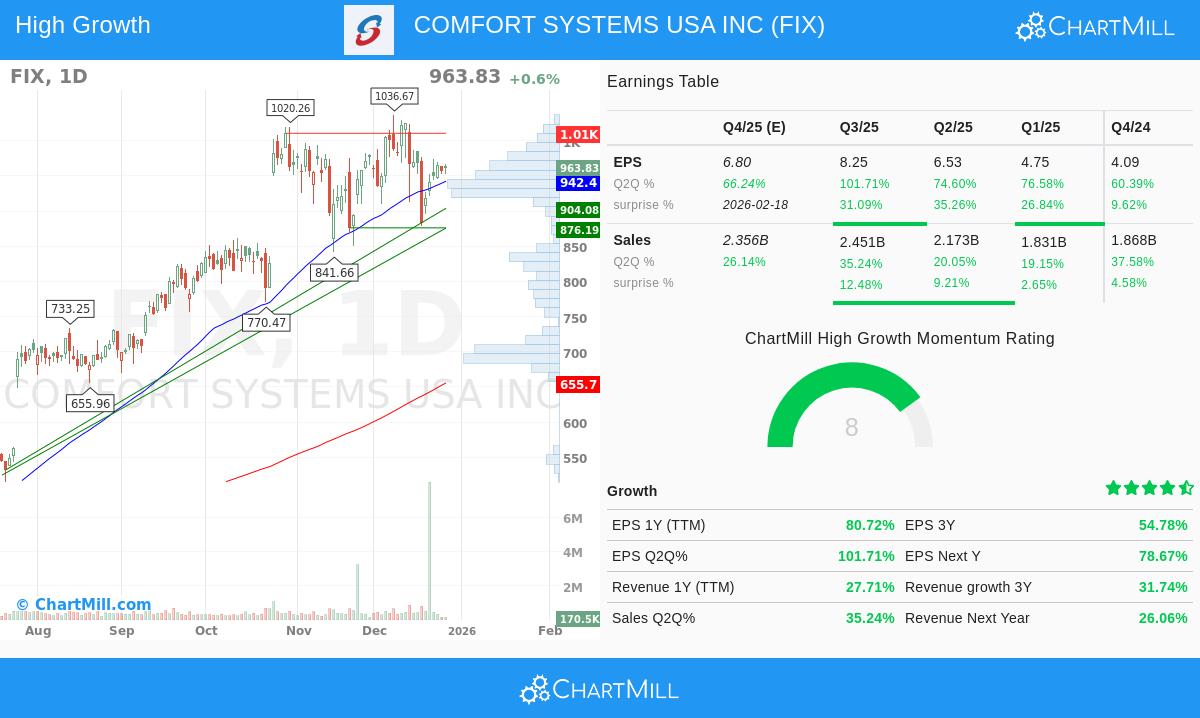

Positive Earnings Revisions & Surprises: Analysts have greatly increased their short-term forecasts, with the EPS estimate for the next quarter moved up by 19.7% in the past three months. This meets the test's requirement and points to rising confidence in the company's near-term future. Also, FIX has a flawless history of beating forecasts, exceeding EPS estimates in all of the last four quarters by an average of 25.7%. Steady positive surprises are a sign of companies skilled at running their operations and often result in more estimate increases.

-

Strong and Speeding Growth: The company is showing forceful top and bottom-line increase.

- Sales growth is solid, with revenue up 27.7% year-over-year and 35.2% in the latest quarter.

- Earnings growth is more notable, with EPS jumping 80.7% over the last year and a remarkable 101.7% in the last quarter.

- Importantly, this earnings growth is speeding up. The current quarterly EPS growth of 101.7% is much higher than the growth rate from the same quarter a year ago (49.3%), meeting the "positive earnings momentum" rule. This quickening shows the company's profit increase is building force.

-

Getting Better Profitability and Financial Condition: Growth is most useful when it becomes more profitable. FIX shows this clearly, with its operating margin increasing by 36.1% over the past year. This widening means the company is turning more of its higher revenue into operating income, a signal of operational effectiveness and pricing ability. The plan also highlights strong cash flow, and FIX provides this with free cash flow growth of 55.0% over the past year, giving good support for internal spending or shareholder benefits. Finally, the company has a very good Return on Equity (ROE) of 37.5%, well above the plan's lowest limit and showing very good use of shareholder money.

A Broad Fundamental View

Outside the exact test rules, a wider look at Comfort Systems USA's fundamental picture supports its position. The company receives a high total fundamental score, with special force in Profitability and Financial Health. Its margins lead its industry and are getting better, and its balance sheet is solid, marked by very low debt compared to cash flow. While its Price-to-Earnings (P/E) ratio seems high alone, it is mostly similar to its industry group. More significantly, this price is backed by the company's excellent growth picture and high quality of earnings. A more complete list of these strong points and factors is in the full Fundamental Analysis Report for FIX.

Conclusion

For investors using the strict, growth-focused method explained by Louis Navellier, Comfort Systems USA offers a strong example. The company is not just growing; it is doing so with speeding earnings, widening profitability, and very good returns on equity, all while regularly beating analyst forecasts. This mix of number-based factors matches the "Little Book" plan's aim of finding better growth stocks before their possibility is completely seen by the wider market.

The example of FIX was found using a set test based on this plan. Investors wanting to find other companies that now fit these exact growth and quality filters can view the full test results here.

Disclaimer: This article is for information only and is not investment advice, a suggestion, or an offer to buy or sell any security. The study is based on data and a set testing method; past results do not show future outcomes. Investors should do their own research and think about their personal money situation and risk comfort before making any investment choices.