Technical analysis often uses identifying stocks with strong basic momentum and good entry points. One method for seeing these chances involves judging both the technical condition of a stock and the nature of its current price consolidation. This method helps investors concentrate on securities that are not only in clear uptrends but also set for possible breakouts, giving a mix of trend force and controlled-risk entry levels.

FIRST HORIZON CORP (NYSE:FHN) has become a significant candidate from this method, showing traits that match solid technical patterns and consolidation nature.

Technical Force and Momentum

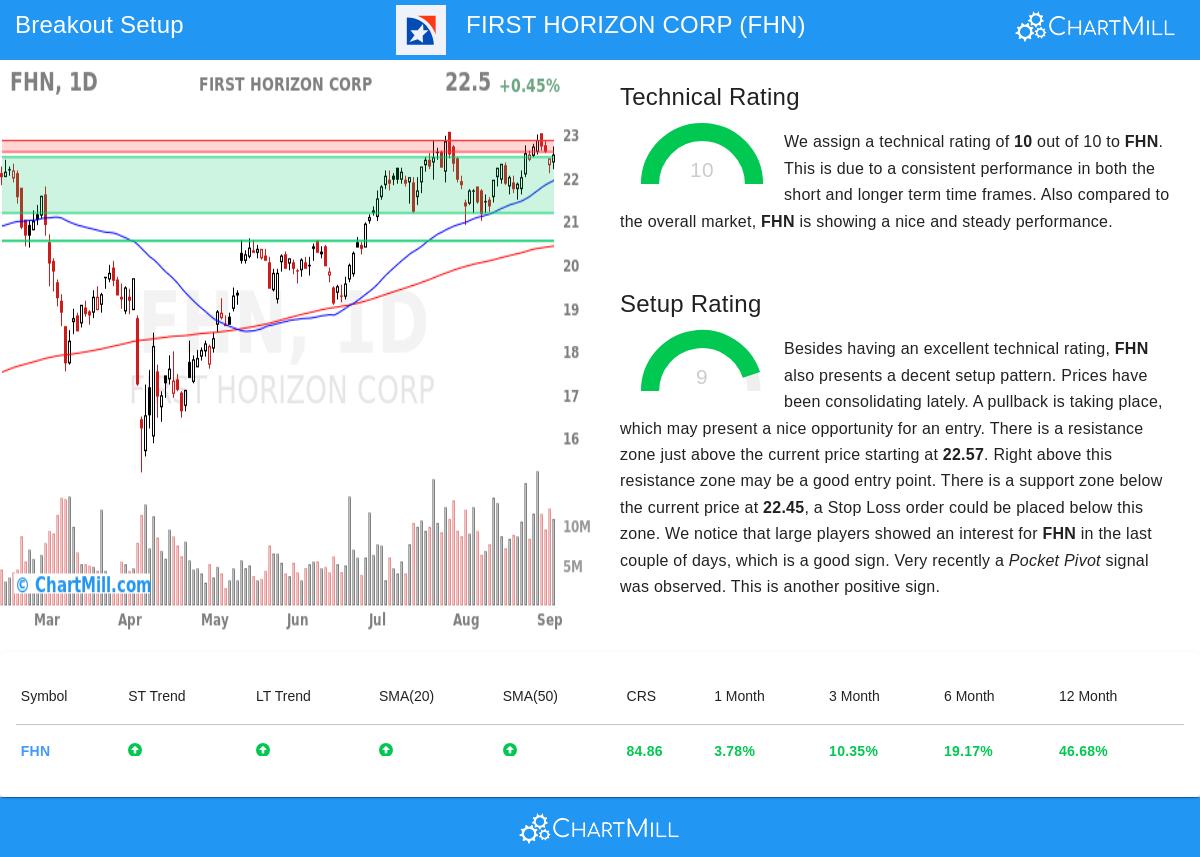

A high technical rating is important because it shows lasting positive momentum across different timeframes, lowering the chance of false breakouts and building trust in the stock’s directional tendency. FHN does very well here, getting a top technical rating of 10. This score includes things like relative strength, trend agreement, and moving average placement. Main strong points noted in the technical report are:

- Both short-term and long-term trends are positive.

- The stock is trading close to its 52-week high and shows better performance compared to 84% of all stocks in the market.

- It does better than 89% of stocks in the banking industry.

- All main moving averages (20-day, 50-day, 100-day, and 200-day) are increasing, confirming wide bullish momentum.

These traits show that FHN is not only trending well but also acting as a market leader, which is needed for technical plans focused on momentum continuing.

Setup Nature and Consolidation Pattern

While technical force finds which stocks to look at, setup nature deals with when to enter. A high setup rating implies the stock is consolidating in a narrow range, giving a clear support level for stop-loss orders and a specific resistance level for breakout entries. FHN’s setup rating of 9 points to a very good consolidation pattern. As stated in the report:

- Prices have been pulling back a bit inside a bull flag shape, which frequently comes before more gains.

- There is a support area between $21.16 and $22.45, providing a sensible place for protective stops.

- Resistance is grouped between $22.57 and $22.83; a move above this area might indicate the next rise.

- Recent signs, like pocket pivot patterns and attention from big players, add belief to the possible breakout.

This mix of narrow consolidation, clear support and resistance, and big money buying makes a good setting for a low-risk, high-chance entry.

Risk and Trade Points

For those thinking about a breakout plan, the technical report proposes an entry above $22.84 (just over resistance) with a stop-loss below $21.47. This setup suggests a possible risk of about 6% on the trade, which can be handled with position sizing. It is important to remember that while the pattern looks positive, breakouts are not certain, and basic factors, like coming earnings or industry news, should be watched.

Investors searching for related technical breakout chances can review more candidates using the Technical Breakout Setups screen, which looks for stocks with high technical and setup ratings.

Disclaimer: This analysis is from technical measures and pattern views and is not meant as investment guidance. Investors should do their own research and think about their risk comfort before making any trading choices.