EXELIXIS INC (NASDAQ:EXEL) was identified as a decent value stock by our screener, which looks for companies with solid fundamentals and attractive valuations. The biotech firm stands out with strong profitability, financial health, and growth potential, while trading at a reasonable price. Below, we break down why EXEL could be an interesting opportunity for value investors.

Valuation

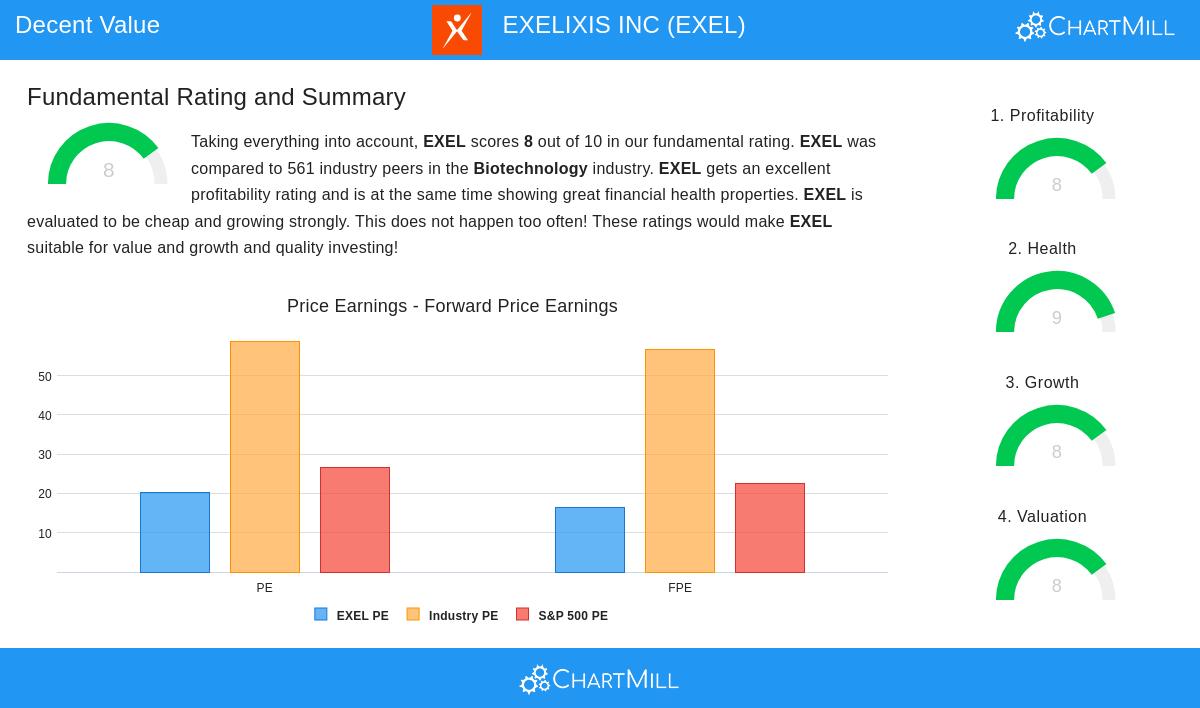

EXELIXIS appears undervalued relative to its industry peers, with a Valuation Rating of 8/10. Key highlights include:

- A Price/Earnings (P/E) ratio of 20.31, which is cheaper than 95% of biotech firms.

- A Forward P/E of 16.45, suggesting earnings growth is not fully priced in.

- An Enterprise Value/EBITDA ratio that ranks better than 95% of competitors.

Financial Health

The company earns a Health Rating of 9/10, reflecting a strong balance sheet:

- No outstanding debt, reducing financial risk.

- A current ratio of 3.63, indicating ample liquidity to cover short-term obligations.

- A high Altman-Z score of 12.40, signaling low bankruptcy risk.

Profitability

EXELIXIS scores 8/10 for Profitability, driven by:

- A Return on Equity (ROE) of 23.23%, outperforming 97% of industry peers.

- A Profit Margin of 24.04%, ranking among the top in biotech.

- Consistent positive cash flow over the past five years.

Growth

With a Growth Rating of 8/10, the company shows promising expansion:

- Revenue growth of 18.49% YoY, well above industry averages.

- EPS surged 205.56% in the past year, with expected annual growth of 26.65% moving forward.

Our Decent Value Stocks screener lists more stocks with similar characteristics. For a deeper dive, review the full fundamental report on EXELIXIS.

Disclaimer

This is not investment advice. Always conduct your own research before making financial decisions.