Ero Copper Corp (NYSE:ERO) offers an interesting case for investors using a high growth momentum plan joined with technical breakout review. This plan centers on finding companies showing solid earnings momentum and quickening growth basics while also displaying positive technical chart formations that indicate possible breakout chances. The process joins ChartMill's own ratings systems - the High Growth Momentum Rating judging earnings speed, profit margin improvement, and analyst changes, together with Technical and Setup Ratings that review trend force and consolidation forms.

Growth Momentum Basics

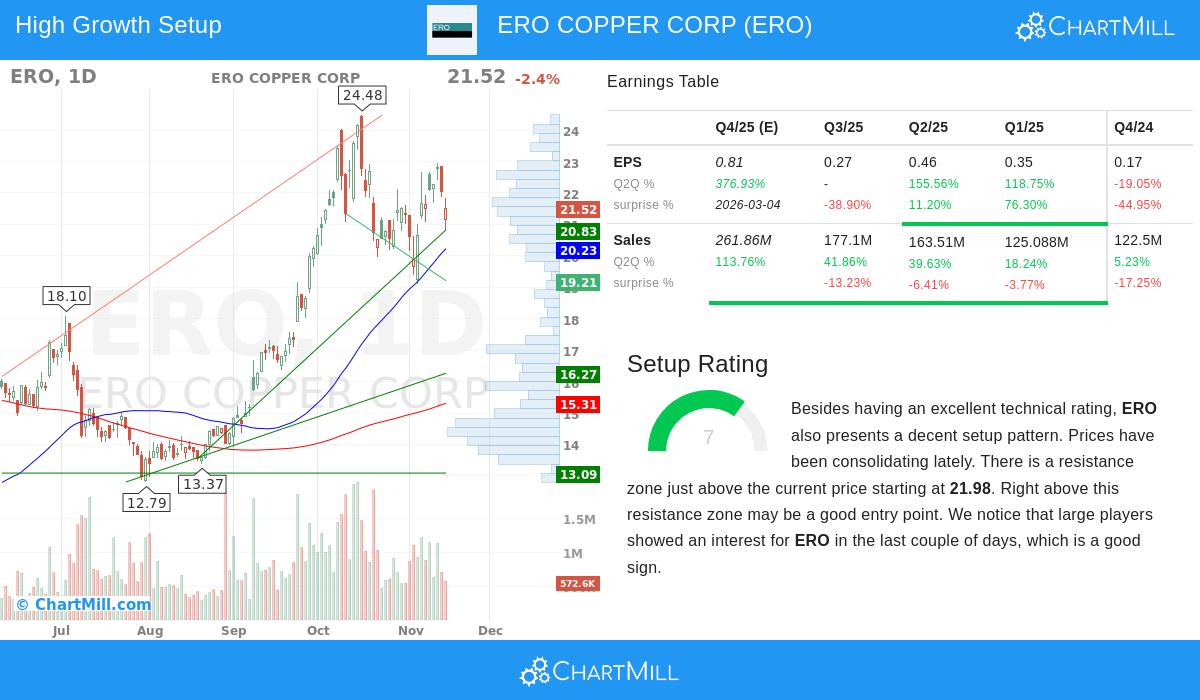

Ero Copper's High Growth Momentum Rating of 6 shows good basic growth traits that momentum investors usually look for. The company shows notable financial measures over several periods:

-

EPS Growth Path:

- 52.4% EPS growth over the last twelve months

- Latest quarterly EPS growth of 155.6% and 118.8% in the two earlier quarters

- Expected next quarter EPS growth of 376.9% from analyst forecasts

-

Revenue Speed:

- 26.7% revenue growth over the past year

- Quarterly revenue growth quickening to 41.9% in the latest quarter

- Good future revenue growth forecast of 113.8% for the next quarter

-

Cash Flow and Earnings:

- Free cash flow per share rose 115.6% year-over-year

- Showed capacity to exceed EPS forecasts in two of the past four quarters

- Average EPS beat of 0.9% over recent quarters

These growth measures are especially important for momentum investors as quickening earnings and revenue often come before continued price gains. The mix of good past results with solid future estimates indicates the company keeps its growth path, a main point in high growth momentum plans.

Technical Force and Setup Grade

The technical view for Ero Copper matches its basic strengths, with the stock getting a Technical Rating of 7 and Setup Rating of 7. As stated in the detailed technical review, several parts add to this view:

- Trend Makeup: The long-term trend stays positive while the short-term trend has become neutral, indicating the stock is settling within its larger uptrend

- Relative Results: Over the past year, ERO has done better than 92% of all stocks, though it is now slightly behind the S&P 500's recent new highs

- Consolidation Form: The stock has been trading between $19.09 and $22.96 over the past month, with present prices in the middle of this span showing a possible entry chance

- Support and Resistance: Clear support areas are present between $20.79-$20.83 and at $19.89, while resistance is between $21.98-$22.08

The setup grade is improved by recent institutional interest measured by the Effective Volume indicator, which finds large player action. For breakout traders, the consolidation inside a set uptrend gives the kind of form that often comes before notable moves upward.

Industry Setting and Market Place

As a copper mining company with work in Brazil, Ero Copper works in the Metals & Mining field, where it now places in the top 55% of performers within 154 peers. The company's main assets hold the Caraiba Operations in Bahia State and the Tucuma Operation in Para State, plus gold and silver mining by its NX Gold unit. The basic need forces for copper, pushed by global electrification and renewable energy patterns, give a positive setting for the company's growth story.

Trading Points

The technical review indicates a possible breakout setup with an entry point over $22.09, which would show a move through the found resistance area. The suggested stop loss at $20.78 gives a set risk measure of about 5.9%. For position size, the review shows that for a 1% total portfolio risk, investors could place about 16.9% of funds to this trade.

For investors wanting to find like chances that join good growth basics with technical breakout setups, more screening results can be seen by the High Growth Momentum Breakout Setups Screen. This screen methodically finds stocks meeting the needs of Technical Rating over 7, Setup Rating over 7, and High Growth Momentum Rating over 4.

Disclaimer: This review is for information only and does not make investment guidance, a suggestion, or a deal to buy or sell any securities. Investors should do their own study and talk with a skilled financial advisor before making any investment choices. Past results are not a sign of future results, and all investments hold risk including possible loss of principal.