Investors looking for high-growth chances often mix strict technical screening with basic momentum study to find stocks with strong potential. One organized method becoming popular with growth-oriented traders is the Mark Minervini Trend Template, which selects for stocks showing clear uptrends, properly ordered moving averages, and closeness to new highs. When this technical structure is combined with a High Growth Momentum (HGM) rating,a measure checking earnings speed, sales increases, and profit margin improvement,the final screen finds companies that are not only technically healthy but also showing basic business energy. This two-part method tries to find leaders early in their growth periods, mixing chart health with core business momentum.

Technical Health and Trend Template Fit

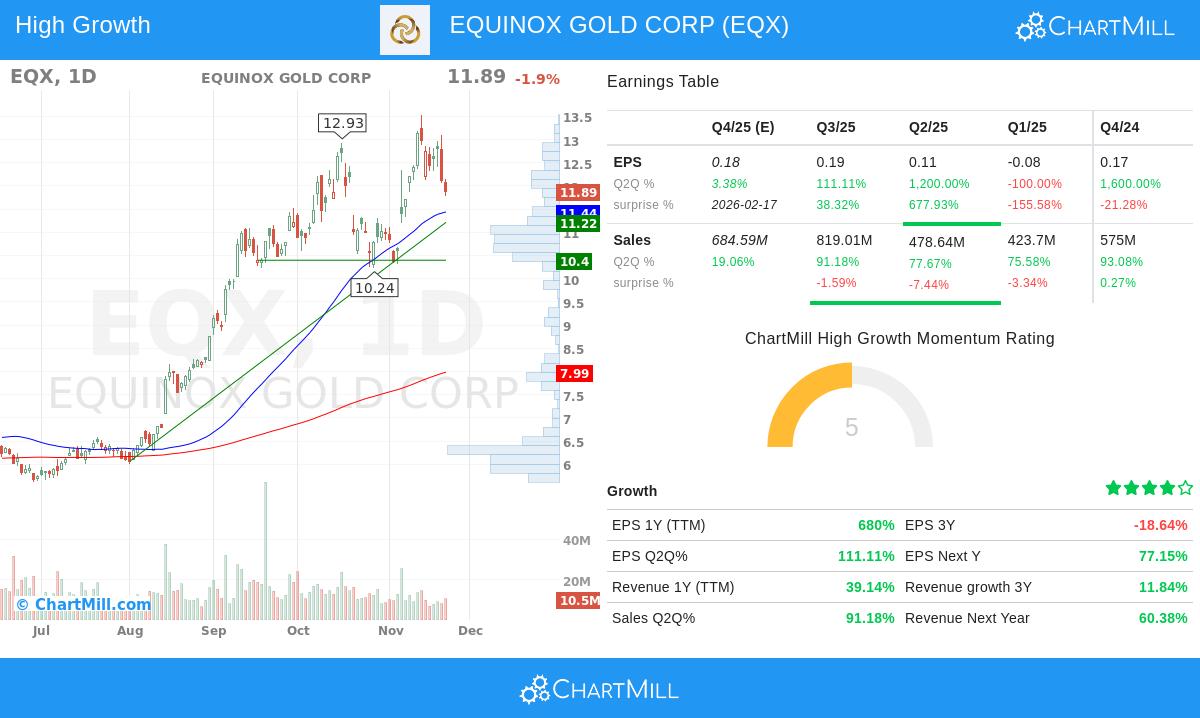

EQUINOX GOLD CORP (NYSEARCA:EQX) shows a strong technical picture that fits well with Minervini’s Trend Template rules. The template focuses on stocks in definite stage 2 uptrends, and EQX meets this with its price trading notably higher than important moving averages and a consistent pattern of higher highs.

Important technical rules met by EQX include:

- Price Above Moving Averages: The present price of $11.89 is higher than the increasing 50-day SMA ($11.44), 150-day SMA ($8.42), and 200-day SMA ($7.99).

- Moving Average Order: The 50-day SMA is higher than both the 150-day and 200-day SMAs, confirming the pattern of near-term health supporting the longer-term trend.

- Closeness to Highs: The stock is trading within 25% of its 52-week high of $13.53 and is more than 30% above its 52-week low of $4.95, showing continued momentum.

- Strong Relative Strength: With a ChartMill Relative Strength (CRS) score of 96.61, EQX is doing better than most of the market, a main idea of the Minervini approach that concentrates on market leaders.

This solid technical base is important because it points to institutional buying and a small chance of the stock being in a selling phase. The Minervini method suggests that stocks meeting all these rules are in a favorable area where momentum is expected to persist.

Basic Momentum and Growth Catalysts

Beyond a clean chart, EQX displays the basic business speed that High Growth Momentum screens look for. The HGM rating measures the rate of earnings and sales increases, and EQX's recent financial results show notable, though uneven, improvement.

Notable basic strengths include:

- Strong Earnings Growth: EPS growth on a trailing twelve-month (TTM) basis is 680%, while the last quarterly EPS grew 111% year-over-year. This kind of notable earnings speed is a characteristic of Minervini's "superperformance" stocks, as large earnings increases draw institutional interest.

- Good Revenue Growth: Revenue growth is also healthy, with a TTM increase of 39% and the last quarter showing a 91% jump compared to the same quarter last year. Increasing sales verify that earnings growth is fueled by real business growth.

- Better Profitability: The company's profit margin in the last fiscal year was 22.4%, a major gain from 2.65% the year before. Improving margins show pricing control and operational effectiveness, important features of lasting growth companies.

While there are some conflicting signs, like a recent lower adjustment in next-year EPS estimates, the large size of the present growth path meets the high-growth rules. In the Minervini structure, the mix of good technicals and notable basic momentum creates a good setting for major price gains.

Market Situation and Risk Factors

While EQX's individual picture is good, it is always assessed within the wider market situation. The S&P 500 is currently showing a positive short-term trend but a negative long-term trend, indicating a careful environment. However, the Minervini method often uses a bottom-up approach, where single stock health can come before a wider market improvement. EQX's high relative strength, performing better than 96% of all stocks, suggests it is already behaving as a market leader.

Possible investors should know that the stock's recent trading range has been broad ($10.24 - $13.53), and the present ChartMill Setup Rating of 4 shows that the price movement has been too unstable for a perfect, low-chance entry point. This indicates a plan of waiting for a narrower consolidation or a move back toward support areas, like the zone between $10.36 and $10.40, before starting a position.

Technical Report Overview

A look at the detailed technical analysis report for EQX gives the stock a top rating of 10 out of 10, showing outstanding technical condition. The report confirms a positive long-term and short-term trend, high relative strength versus both the market and its industry, and good volume liquidity. The main warning from the report matches the setup rating, noting that while the trend is very good, the present instability makes finding a best entry difficult.

Finding Additional High-Growth Choices

EQUINOX GOLD CORP is a prime example of the sort of chance that appears when mixing trend-following ideas with growth momentum filters. For investors curious about locating other stocks that meet this strict standard, the predefined "High Growth Momentum + Trend Template" screen is a good beginning for more study.

Disclaimer: This article is for informational and educational purposes only and does not constitute investment advice. The analysis is based on provided data and a specific methodology, and it should not be interpreted as a recommendation to buy or sell any security. All investing involves risk, including the possible loss of principal. Please conduct your own due diligence and consult with a qualified financial advisor before making any investment decisions.