The investment philosophy of legendary fund manager Peter Lynch focuses on finding well-run companies with sustainable growth, solid financials, and reasonable valuations, a strategy often called Growth at a Reasonable Price (GARP). It is a disciplined, long-term method that prefers businesses an investor can grasp, with earnings increasing at a steady rate that can be kept up for years, not just quarters. A primary instrument for spotting such prospects is a stock screener using Lynch's particular financial measures, which sorts for profitability, health, and appealing price relative to growth.

One company that recently appeared from this sort is Enphase Energy Inc (NASDAQ:ENPH), a global leader in microinverter-based solar and battery systems. The company's intelligent energy management platform lets homeowners generate, store, and manage their own power. We will look at how Enphase fits the central ideas of a Lynch-style GARP investment.

Alignment with Peter Lynch Criteria

The Peter Lynch screen uses several number-based filters to find companies with the correct financial shape. Enphase Energy satisfies these important checks, which are made to find businesses with controlled growth and stable operations.

- Sustainable Earnings Growth: Lynch looked for companies increasing earnings per share (EPS) between 15% and 30% each year over five years, quick enough to be interesting, but not so fast as to be unmaintainable. Enphase's five-year EPS growth rate of 20.06% sits directly within this goal area, showing a record of strong yet possibly sustainable increase.

- Reasonable Valuation (PEG Ratio): Maybe the most well-known Lynch measure is the PEG ratio, which weighs a stock's Price-to-Earnings (P/E) ratio against its growth rate. A PEG of 1 or less implies the market might be pricing the company's growth potential too low. Enphase's PEG ratio, using its past five-year growth, is about 0.52, indicating a possibly appealing price when growth is considered.

- Strong Profitability (Return on Equity): Lynch preferred companies that produce high returns on shareholder equity, a mark of efficient management. Enphase's ROE of 19.66% easily passes the screen's 15% minimum, indicating the company turns its equity into earnings well.

- Financial Health (Debt & Liquidity): To limit high risk, the method stresses careful balance sheets. The screen demands a Debt-to-Equity ratio under 0.6 and a Current Ratio of at least 1. Enphase meets both:

- Its Debt-to-Equity ratio is 0.57, showing a balanced capital structure without too much dependence on loans.

- Its Current Ratio is 2.04, proving more than enough short-term assets to meet its near-term obligations.

Fundamental Health Check

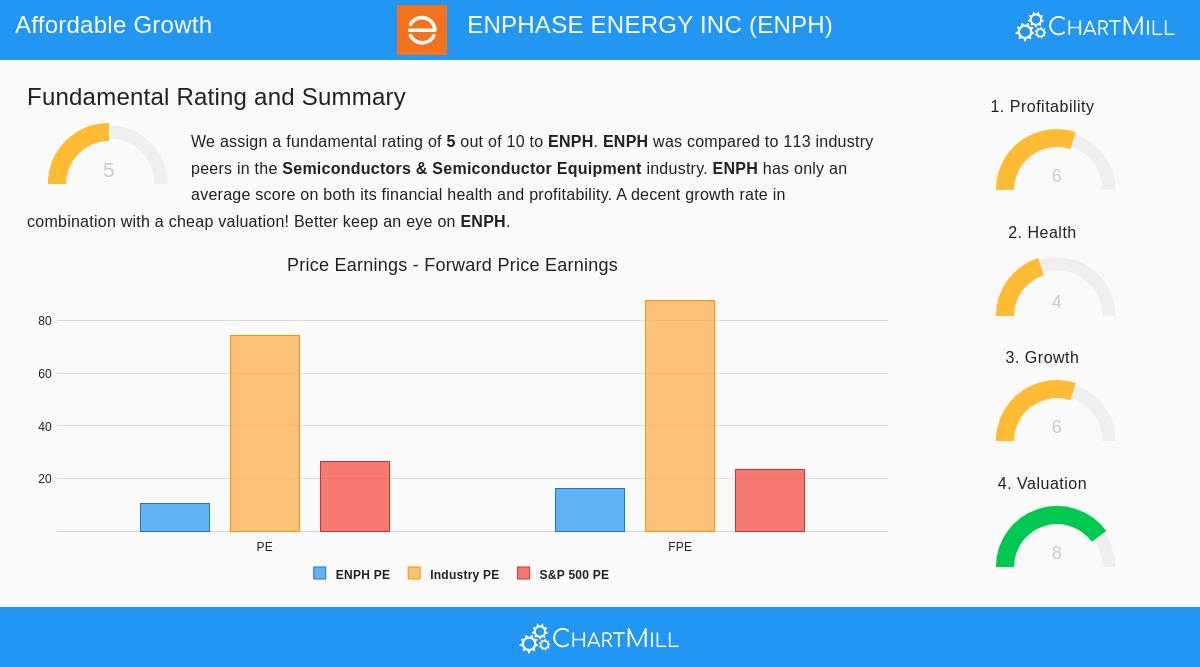

Beyond the specific screen checks, a wider view of Enphase's fundamental situation gives background. According to ChartMill's detailed fundamental report, Enphase gets an overall score of 5 out of 10, seen as neutral. This score shows a combination of good points and areas for watchfulness when measured against others in the Semiconductors & Semiconductor Equipment industry.

The report points out several favorable items that fit a GARP view. The company's valuation measures are notable, with its P/E ratio seeming low compared to both the wider S&P 500 and its own industry. Profitability is also a relative plus, with margins and returns on capital rating above many industry rivals. However, the analysis mentions some strain, as important margins have dropped lately. The financial health score is neutral, helped by good cash availability but affected by a debt level that is greater than many peers. Lastly, while past growth in revenue and EPS has been very good, analyst projections indicate a notable reduction in growth rates for the next few years.

Investment Considerations

For an investor using a Peter Lynch method, Enphase offers an interesting example. It works in the graspable, practical field of home energy technology, a sector with long-term favorable trends. Its financial numbers pass the number-based tests for sustainable growth, profitability, and reasonable price, shown by its good PEG ratio and ROE. The Lynch way prizes this mix of qualities for long-term building.

However, faithful to Lynch's thinking, passing a screen is just the beginning. The following "homework" is vital. Investors need to judge if the recent reduction in margin growth is a short-term issue or a more lasting pattern. More crucially, they must develop a belief on whether the company can manage a shifting competitive and regulatory environment to speed its growth nearer to its historical averages, supporting its current price. The method needs patience, as the market might require time to see the worth in a company that is not in very fast growth but is entering a more established, yet still profitable, growth stage.

If you want to look at other companies that currently fit the Peter Lynch investment checks, you can find the live screen and its outcomes here.

Disclaimer: This article is for informational purposes only and does not constitute financial advice, a recommendation, or an offer to buy or sell any security. Investing involves risk, including the potential loss of principal. You should conduct your own thorough research and consult with a qualified financial advisor before making any investment decisions.