NEW ORIENTAL EDUCATIO-SP ADR (NYSE:EDU) was identified by our Decent Value screener as a stock with an attractive valuation while maintaining solid fundamentals. The company operates in China’s education sector, offering a range of services from test preparation to online education and overseas study consulting. Let’s examine why EDU stands out as a potential value opportunity.

Valuation

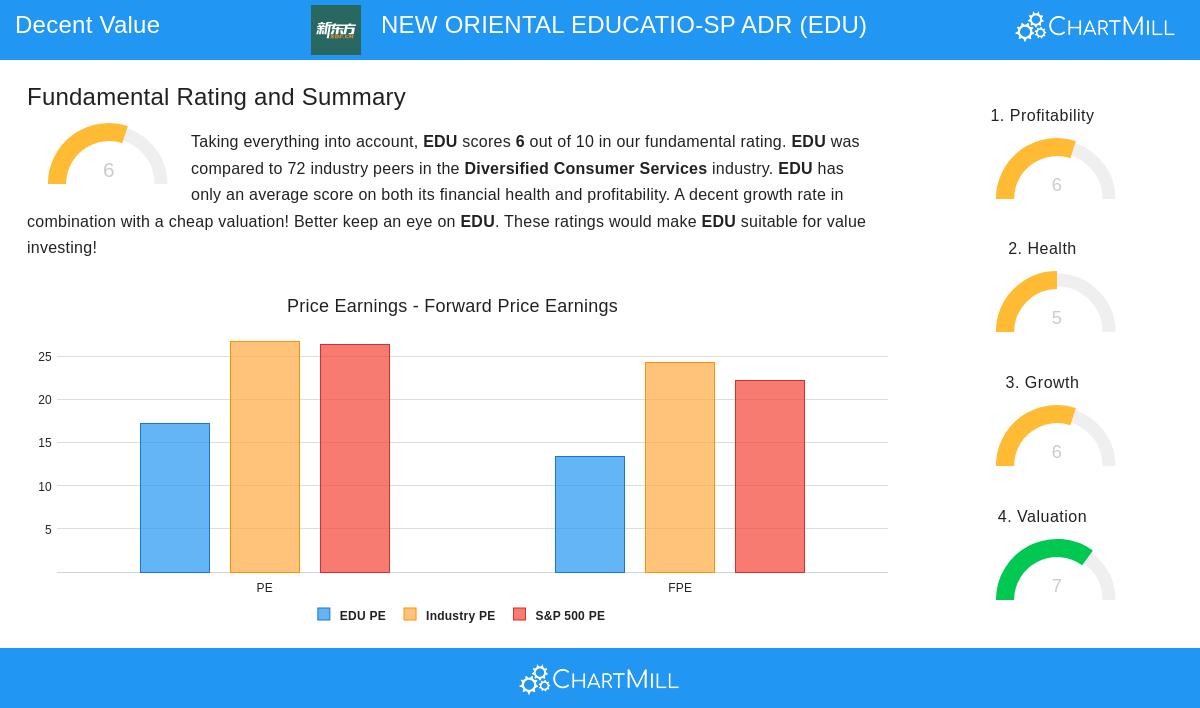

EDU’s valuation metrics suggest it is trading at a discount compared to peers and the broader market:

- P/E Ratio (17.18): While slightly high in absolute terms, it is cheaper than 77.8% of industry peers.

- Forward P/E (13.42): More attractive, indicating a reasonable valuation relative to future earnings.

- Price/Free Cash Flow: EDU is cheaper than 93% of its industry, highlighting strong cash generation.

- Enterprise Value/EBITDA: The company trades at a significant discount, outperforming 95.8% of competitors.

Growth

Despite past volatility, EDU shows promising growth trends:

- Revenue Growth (18.7% YoY): A strong rebound in recent performance.

- Expected EPS Growth (22.5% annually): Analysts project accelerating earnings.

- Improving Trends: Both revenue and earnings growth are expected to outpace historical averages.

Profitability

The company maintains solid profitability metrics:

- Return on Invested Capital (7.77%): Better than 80.6% of industry peers.

- Profit Margin (8.17%): Above average for the sector.

- Gross Margin (55%): Reflects strong pricing power and cost efficiency.

Financial Health

EDU’s balance sheet remains stable:

- Low Debt (Debt/Equity 0.00): No significant leverage concerns.

- Strong Liquidity (Current Ratio 1.66): Comfortably covers short-term obligations.

- Positive Cash Flow: Reinforces financial stability.

Dividend Yield

With a 13.8% dividend yield, EDU offers one of the highest payouts in its industry, though investors should note its relatively short dividend history.

Our Decent Value screener lists more stocks with strong valuations and fundamentals. For a deeper dive, review the full fundamental report on EDU.

Disclaimer

This is not investing advice! The article highlights observations at the time of writing, but you should conduct your own analysis before making investment decisions.