The Mark Minervini Trend Template is a methodical process used to find stocks showing strong upward trends, mixing defined technical rules with basic growth attributes. This system centers on stocks trading higher than important moving averages, showing upward price speed, and being near 52-week peaks, all while having better performance compared to the market. When used with a High Growth Momentum filter, this method further sorts for firms with quickening profits, sales increases, and good analyst changes, aiming for stocks set for possible strong performance.

Technical Strength and Trend Agreement

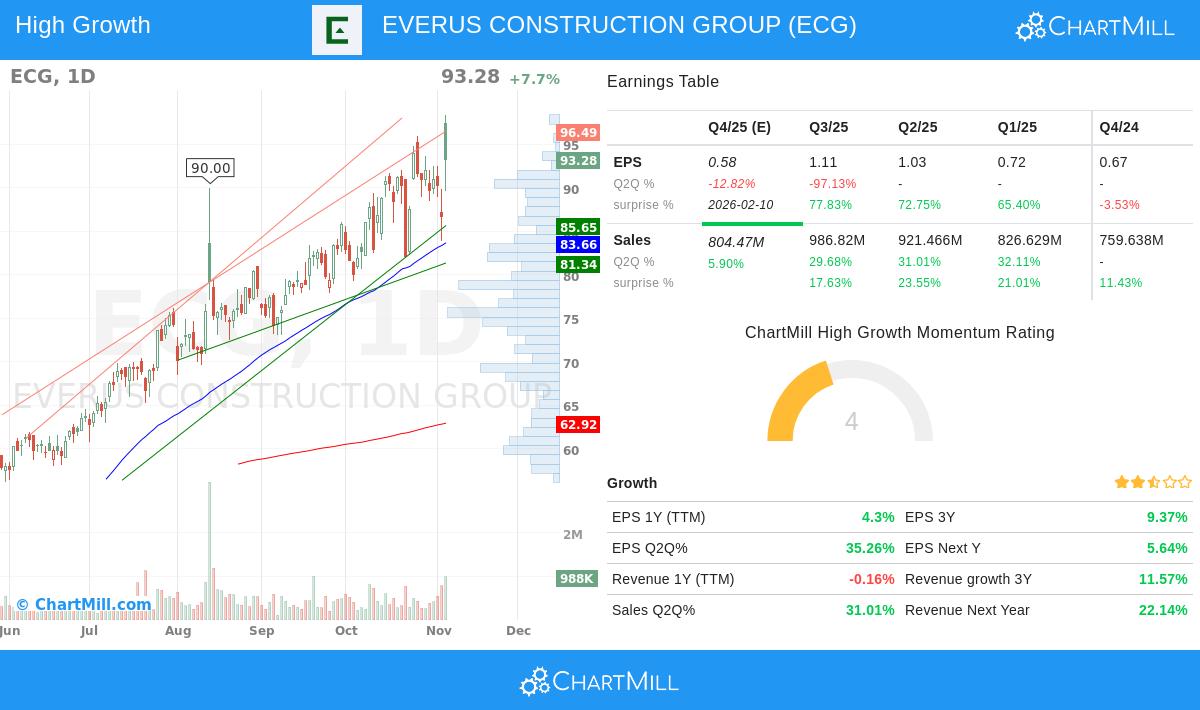

Everus Construction Group (NYSE:ECG) shows a strong technical picture that matches Minervini's Trend Template needs. The stock's present price movement and moving average setup mirror the organized upward trend features that Minervini highlights for spotting leading stocks.

Important technical measures include:

- Present price ($93.28) trading notably higher than the 50-day ($83.66), 150-day ($67.32), and 200-day ($62.92) moving averages

- All main moving averages moving upward, verifying continued speed

- Price located 197% above its 52-week bottom of $31.38

- Trading within 5% of its 52-week peak of $98.35

- Performance comparison score of 90.63, showing results better than 90% of all stocks

These features meet the main Minervini Trend Template rules, which favor stocks in clear upward trends with good performance comparison. The template's moving average rules make sure a stock shows agreement across different time periods, while the nearness to 52-week peaks concentrates on stocks showing leadership instead of bounce-back possibility.

Growth Momentum Basics

Apart from technical strength, ECG shows basic attributes that interest growth investors looking for quickening company results. The firm's latest financial reports indicate notable gains across important growth measures.

Recent results summary:

- Quarterly EPS increase of 35.3% year-over-year

- Quarterly sales increase of 31.0% year-over-year

- Four straight quarters of sales forecasts exceeded, averaging 14.9% above estimates

- Analyst EPS changes for next year raised 17.0% over last three months

- Sales forecasts for next year changed upward by 9.0%

These growth measures match Minervini's focus on basic improvement as a driver for price speed. The method acknowledges that stocks displaying better earnings and sales patterns, especially with good analyst changes, often draw professional interest that can push continued price gains.

Profitability and Margin Improvement

Backing the growth story, ECG shows getting better profitability measures that hint at gains in operational efficiency along with sales growth. Margin gain is a main part of lasting growth stories, indicating control over pricing and costs.

Profitability directions:

- Last quarter profit margin of 5.73%, up from 4.44% in the quarter before

- Full-year profit margin of 5.03%, better than 4.81% from the last year

- Steady margin growth over recent reporting times

Minervini's method appreciates companies that not only increase sales but also widen margins, as this pairing often points to competitive edges and operational skill. Getting better profitability during growth phases hints the company can grow in size effectively, possibly leading to fast earnings growth that pushes major stock price gains.

Industry Place and Market Position

ECG works in the Construction & Engineering field, where it shows clear position inside its area. The stock does better than 81% of its industry friends, indicating good performance comparison inside its competitive environment. This area position is important within the Minervini structure, which stresses investing in market front-runners instead of slower ones, as leading stocks often keep leading during market rises.

Technical Review Summary

According to ChartMill's technical study report, ECG gets a strong technical score of 9 out of 10, mirroring very good technical condition across both short and long-term time periods. The report mentions the stock's steady performance compared to the whole market and its recent move to new 52-week peaks. While the setup score of 4 hints present price movement may be too unstable for perfect entry spots, the basic technical strength stays interesting for investors following trend-based methods.

View the complete technical analysis report for ECG

Finding Like Chances

For investors curious about spotting more stocks that meet both Minervini Trend Template rules and High Growth Momentum attributes, this predefined screen gives a methodical way to find possible high-growth picks with good technical bases.

Disclaimer: This study is for information and learning only and is not investment advice. All investments carry risk, and past results are no promise of future outcomes. Readers should do their own research and talk with a qualified financial advisor before making any investment choices.