For investors wanting a systematic, long-term method for increasing wealth, few plans have the substance of Peter Lynch's approach. The famous leader of the Fidelity Magellan Fund supported a "growth at a reasonable price" (GARP) idea, concentrating on firms with solid, maintainable earnings increase, sound financial condition, and prices that do not cost too much for that future possibility. His system, explained in One Up on Wall Street, stresses basic examination over market prediction, urging investors to discover clear companies before they gain widespread attention on Wall Street. A filter using Lynch's main measures recently identified DRDGOLD LTD-SPONSORED ADR (NYSE:DRD), a South African firm focused on the processing again of surface gold waste, indicating it could justify more study from GARP-focused investors.

A Solid Match for Lynch's Growth Measures

Central to Lynch's plan is the search for companies increasing earnings at a good, maintainable pace, not a risky rush. He looked for businesses with a five-year earnings per share (EPS) increase rate between 15% and 30%, thinking that increase above that level is often not maintainable, while increase below may show a lack of force. DRDGOLD shows a clear match here.

- EPS Increase (5-Year): 26.15%. This number fits well within Lynch's preferred range, showing a solid and steady history of profit growth. It represents a business that has effectively run its plan over a notable time, a main Lynch requirement before investor review.

The next vital stage in the Lynch method is to confirm an investor is not paying too much for that past increase. This is where the Price/Earnings to Growth (PEG) ratio is most important. Lynch preferred companies with a PEG ratio of 1 or lower, showing that the stock's price is fair compared to its earnings increase rate.

- PEG Ratio (5-Year): 0.59. With a PEG ratio notably below 1, DRDGOLD seems to be priced well when its past increase is considered. This measure speaks to a core Lynch rule: excellent companies are only excellent investments when bought at a logical price.

Financial Condition and Profit: The Foundation of Long-Term Ownership

Lynch highlighted the need for financial strength, letting a company endure economic changes and keep supporting its increase from within. His filters for a small debt amount and solid immediate cash availability are made to find durable businesses.

- Debt/Equity Ratio: 0.001. This is a very small level of financial borrowing, much better than Lynch's chosen limit of below 0.6 (and even his tighter choice for below 0.25). It shows a balance sheet supported almost completely by ownership value, reducing risk from interest costs and giving notable operational freedom.

- Current Ratio: 2.28. This ratio, which checks a company's ability to pay immediate debts with immediate assets, easily goes above Lynch's lowest need of 1. It suggests DRDGOLD has sufficient cash to handle its short-term duties without strain.

Finally, Lynch looked for companies that were not just increasing, but doing so profitably and effectively for owners. A high Return on Equity (ROE) was a main sign of good management and a profitable business plan.

- Return on Equity (ROE): 36.17%. This is a notable number, showing that for every dollar of owner equity, DRDGOLD creates over 36 cents in profit. It points to very effective use of investor money, a quality Lynch valued.

Basic Examination Summary

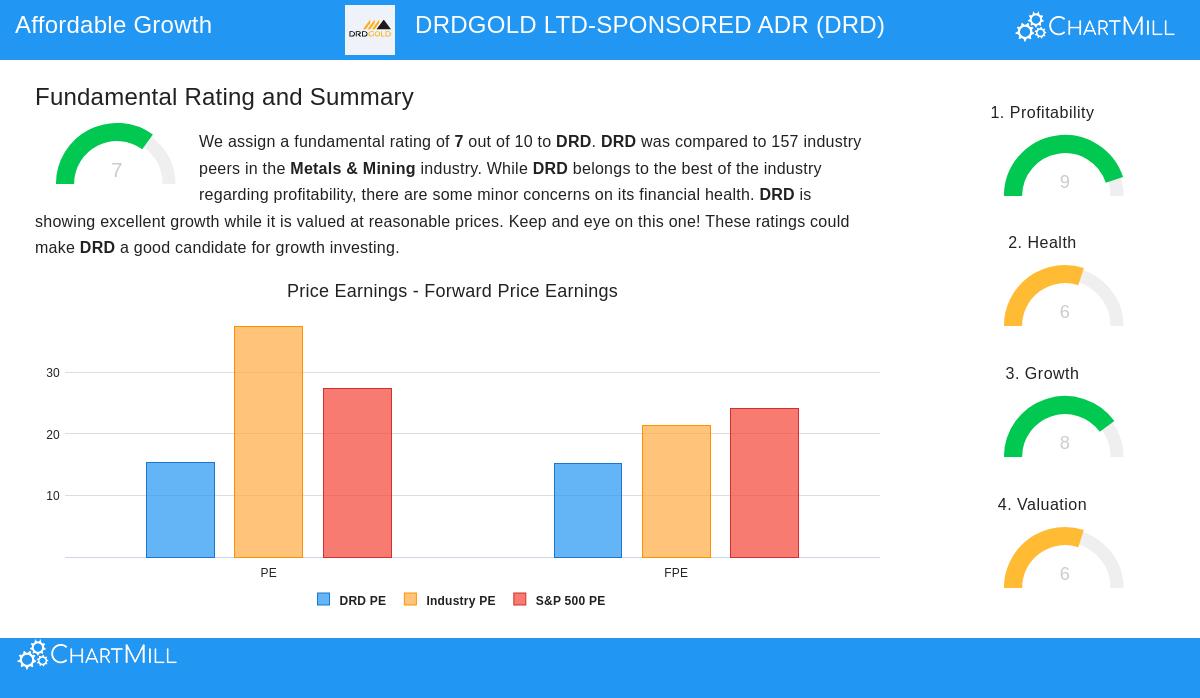

A detailed basic examination of DRDGOLD gives the company a total score of 7 out of 10, with specific strong points in profit and increase. The report notes an "excellent" profit score of 9/10, led by sector-leading returns on assets, equity, and invested money. Margins are solid and have been growing. The increase score is also sound at 8/10, mentioning very solid past EPS and sales increase, with speeding sales increase predicted later.

Price assessment gets a middle-to-good review, with the present P/E ratio seen as fair and less expensive than most industry competitors when changed for increase. The main point of care in the report connects to financial condition, which scores a 6/10. While ability to pay debts measures are excellent because of the very small debt, the report notes a rise in shares existing over a five-year time, which is a small weak point from a per-share value view.

Is DRDGOLD a Lynch-Method Chance?

Filtering for stocks is only the initial stage in the Peter Lynch method; the following, vital part is complete investigation to learn the business itself. DRDGOLD works in a specialized, perhaps "uninteresting" area, processing old mining leftovers to get gold again. This matches another Lynch rule: invest in what you can learn. The company's plan gives contact to gold prices with a possibly smaller risk picture than standard mining, as it does not face the high capital expenses and earth science risks of deep mining.

The number-based filter outcomes are strong. DRDGOLD satisfies the clear Lynch measures for maintainable increase, fair price (through PEG), a very strong balance sheet, and exceptional profit. For an investor making a varied, long-term collection based on the GARP idea, DRDGOLD offers an example fit for more detailed review.

Wanting to review other companies that pass the Peter Lynch filter? You can find the present list and change the measures yourself using the Peter Lynch Strategy stock filter.

Note: This article is for information only and is not financial guidance, a suggestion, or a deal to buy or sell any security. The examination uses data and a particular investment plan structure; investors should do their own investigation and think about their personal money situation before making any investment choices.