In the world of growth investing, identifying stocks that show both solid technical momentum and strong fundamental growth is a good combination. One method that successfully joins these parts is the strategy made popular by Mark Minervini, which uses a Trend Template to find stocks in established uptrends, added to by standards for high growth momentum. This technique concentrates on securities that not only show positive price action, moving average agreements, and relative strength but also prove speeding up earnings, sales growth, and getting better profit margins. By using these two filters, investors can more easily separate companies set for possible outperformance.

DRDGOLD LTD-SPONSORED ADR (NYSE:DRD) appears as a noteworthy candidate under this joined screening system. The company, which focuses on the retreatment of surface gold tailings in South Africa, has lately displayed traits that match well with both the technical discipline of the Minervini method and the strict needs of high-growth investing.

Technical Strength and Trend Template Agreement

A main part of the Minervini strategy is the Trend Template, which needs a stock to fulfill several technical conditions confirming a solid and lasting uptrend. DRD at this time meets these standards, showing notable price momentum and market leadership.

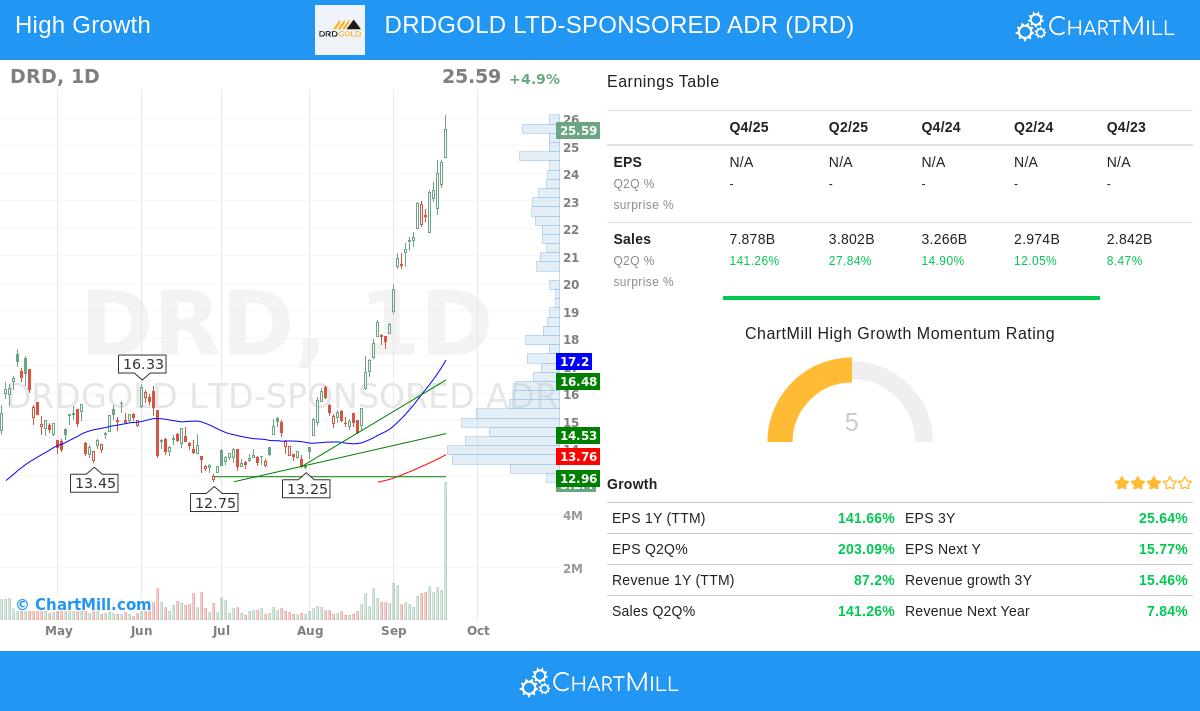

- Price Above Key Moving Averages: DRD’s last price of $25.59 is trading well above its 50-day ($17.20), 150-day ($15.15), and 200-day ($13.76) simple moving averages. This agreement points to continued buying interest and a good long-term trend.

- Rising Moving Averages: The 200-day SMA has been moving upward, changing from a prior value of 13.68 to 13.76, supporting the strength of the long-term bullish momentum.

- Proximity to Highs: With a current price only 2% below its 52-week high of $26.11 and over 200% above its 52-week low of $8.38, DRD shows the type of strength that Minervini links with leading stocks—those that are not only bouncing back but also testing new highs.

- Superior Relative Strength: Having a ChartMill Relative Strength rating of 96.9, DRD is doing better than almost 97% of all stocks in the market. This degree of relative performance is important, as Minervini notes that real market leaders display lasting strength compared to the wider market.

These technical signs are necessary because they help remove stocks in poor or corrective stages, concentrating instead on those with confirmed momentum and a greater chance of continued progress.

Fundamentals and Growth Momentum

Apart from technicals, the Minervini strategy also highlights the significance of fundamental speeding up—especially in earnings, revenue, and profit margins. DRD’s recent financial performance shows significant growth dynamics that support its inclusion for high-growth investors.

- Earnings Growth: DRD’s EPS growth on a trailing twelve-month basis is at an outstanding 141.66%, while its most recent quarterly EPS growth year-over-year is a notable 203.09%. This speeding up in profitability is a main belief of the strategy, as strong earnings surprises often pull in institutional interest and push further price appreciation.

- Revenue Expansion: The company has also reached remarkable top-line growth, with TTM revenue going up by 87.20% and the latest quarterly sales growing by 141.26%. Such energetic revenue expansion backs lasting earnings growth and points to solid market demand for its services.

- Profit Margin Improvement: DRD’s profit margin in the last reported quarter was 28.47%, up from 21.29% in the prior fiscal year, stressing better operational efficiency and pricing power. Increasing margins are a positive signal that the company can change revenue rises into higher profits, a factor Minervini often connects with continued stock outperformance.

- Analyst Revisions: The average EPS estimate for the next year has been changed upward by 31.19% over the last three months, showing growing analyst confidence in DRD’s future profitability. Such revisions often come before times of positive price momentum.

These fundamental measures are important because they give the underlying reason for the stock’s technical breakouts, making sure that the momentum is backed by real business improvement instead of only speculation.

Technical Overview and Risk Considerations

According to the detailed technical analysis report available for DRD, the stock has a perfect rating of 10 out of 10, showing very good technical health and bullish trend characteristics. The short-term and long-term trends are both positive, and the stock is trading near new highs with supportive volume rises in recent sessions. However, the report also states that the setup quality is at this time rated lower (2 out of 10), suggesting that after a solid upward move, the stock may be extended and might gain from a time of consolidation before giving a more ideal entry point.

Review the full technical report for DRD here.

Exploring Similar Opportunities

For investors interested in finding other stocks that meet this mix of technical excellence and high growth momentum, more research can be done using predefined screens made for these standards.

Discover more high-growth momentum stocks following the Trend Template here.

Conclusion

DRDGOLD LTD shows a significant case where a company meets the strict technical needs of the Minervini Trend Template while also displaying fundamental growth features wanted by momentum investors. Its strong price trend, together with explosive earnings and revenue growth, places it as a candidate deserving of attention for those following a disciplined, growth-focused method. That said, investors should stay aware of the current extended technical levels and think about waiting for more favorable risk/reward entry points, always matching decisions with their personal risk tolerance and investment horizon.

Disclaimer: This article is for informational and educational purposes only and does not constitute investment advice. Investors should conduct their own research and consult with a qualified financial advisor before making any investment decisions.