Investors looking for a disciplined, long-term method for assembling a portfolio frequently consider the principles of legendary fund manager Peter Lynch. His strategy, outlined in his book One Up on Wall Street, centers on finding growing companies that trade at sensible prices, a concept often called GARP, or Growth At a Reasonable Price. Lynch supported investing in businesses that are easy to understand, have good financial strength, maintainable growth, and appealing valuations, preferring a patient, buy-and-hold philosophy instead of short-term market timing. A filter using his main standards can highlight companies deserving of more study for this type of strategy.

One company that recently appeared from this Peter Lynch filter is Dorman Products Inc (NASDAQ:DORM). The company provides automotive replacement parts and fasteners for the motor vehicle aftermarket, working in areas that serve passenger vehicles, medium and heavy trucks, and the powersports market. This matches Lynch's liking for understandable, perhaps "ordinary," businesses that supply necessary goods and services.

How Dorman Products Matches Lynch's Standards

The Peter Lynch filter uses particular numerical tests to find companies with a mix of growth, profit, financial strength, and value. Dorman Products satisfies these central needs, as shown by the supplied data:

- Maintainable Earnings Growth: Lynch wanted companies increasing steadily, but not at an unmaintainable, extreme speed. The filter demands a 5-year earnings per share (EPS) growth rate between 15% and 30%. Dorman's EPS has increased at an average yearly rate of 21.83% over the last five years, putting it directly within this target zone and pointing to a record of controlled, regular expansion.

- Sensible Valuation (PEG Ratio): A key part of the GARP method is the PEG ratio, which modifies the common Price-to-Earnings (P/E) ratio for a company's growth rate. Lynch liked companies with a PEG ratio of 1 or lower, suggesting the stock price may not completely show the growth path. Dorman's PEG ratio, calculated from its past five-year growth, is 0.64, indicating a possibly interesting valuation when its growth history is examined.

- Good Profitability (Return on Equity): To confirm a company is using shareholder capital effectively, Lynch required a high Return on Equity (ROE). The filter selects for an ROE above 15%. Dorman's ROE of 16.70% easily passes this level, showing capable management and a profitable operation.

- Firm Financial Strength (Current Ratio & Debt/Equity): Lynch highlighted financial soundness. The filter needs a Current Ratio of at least 1 to make sure short-term bills can be paid, and a Debt-to-Equity ratio under 0.6 (with Lynch himself liking under 0.25). Dorman does very well here, with a strong Current Ratio of 2.94 and a careful Debt-to-Equity ratio of 0.28, showing a good balance sheet with little dependence on debt.

A High-Level Fundamental Summary

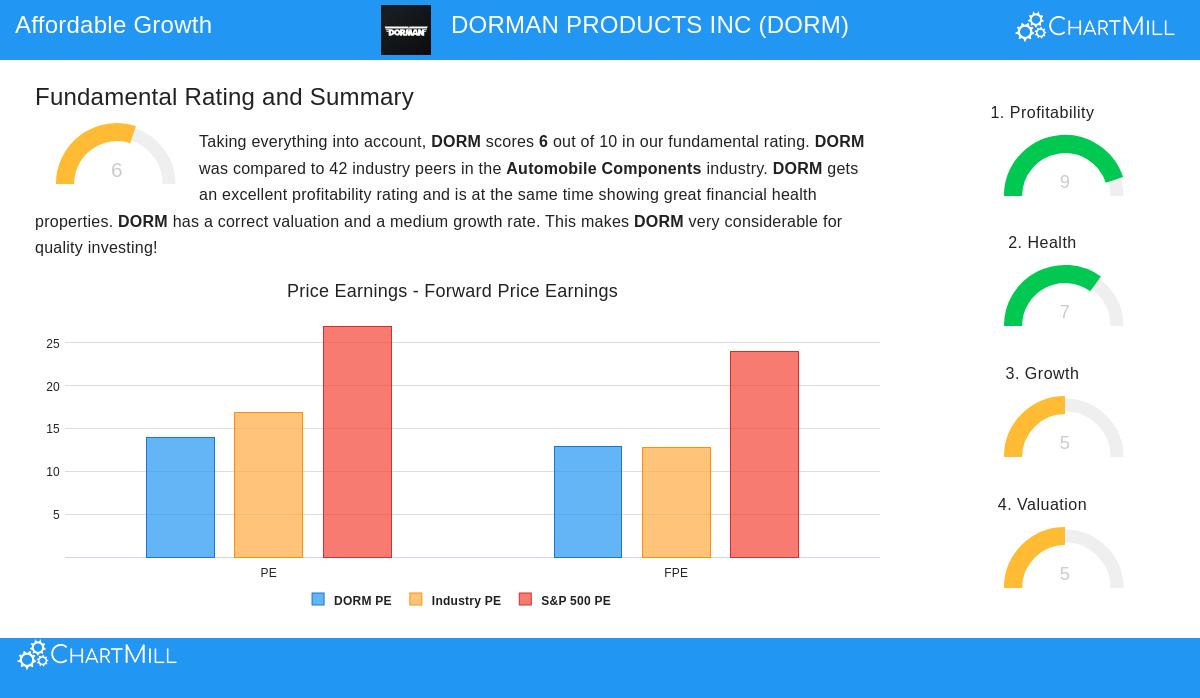

A closer look at Dorman's fundamental profile strengthens the image shown by the filter. The company's overall financial strength is good, marked by very good profit measures that place it near the best in its field. Its profit and operating margins have demonstrated gain, and important solvency ratios, like the Altman-Z score, show a small chance of financial trouble.

From a valuation view, Dorman's standard P/E ratio of 13.96 is seen as sensible, trading below both the wider S&P 500 and many industry competitors. This, joined with its low PEG ratio, backs the "reasonable price" part of the GARP idea. The growth record shows power in the past, although analysts forecast a slowing in the speed of future earnings and revenue growth. This anticipated moderation is a detail for investors to note and watch, as Lynch favored maintainable models.

You can examine the complete, itemized fundamental analysis for Dorman Products here.

Final Thoughts and Next Steps

For investors who follow Peter Lynch's thinking, Dorman Products offers an interesting example. It works in a needed, stable sector, shows a record of good and maintainable earnings growth, keeps a very strong balance sheet, and is valued at a level that seems to consider its growth picture. It represents the "growth at a reasonable price" idea that Lynch used well.

It is important to recall that a filter is a beginning for study, not a final signal to buy. Lynch himself noted the need to know the business behind the figures. Potential investors should examine Dorman's competitive standing, management plans, and the industry forces of the automotive aftermarket.

If you want to look at other companies that pass this disciplined investment filter, you can see the present Peter Lynch Strategy filter results here.

Disclaimer: This article is for informational purposes only and does not constitute financial advice, a recommendation, or an offer to buy or sell any security. Investing involves risk, including the potential loss of principal. You should conduct your own thorough research and consult with a qualified financial advisor before making any investment decisions.