Investment methods that combine growth possibility with fair prices have long interested investors looking for lasting gains. The system made famous by Peter Lynch, which centers on finding companies with solid, but not extreme, growth available at reasonable prices, offers a defined process for this method. By using particular financial condition, earnings, and price assessment filters, this method tries to find businesses able to provide long-term worth without the speculative excitement often connected with high-growth stocks. Dorman Products Inc (NASDAQ:DORM) appears as a result from a filter created on these ideas, justifying a more detailed examination for investors who follow this thinking.

Following Lynch-Style Rules

A central idea of the Lynch method is locating companies with profit growth that is strong and durable, steering clear of firms whose very fast growth may be temporary. The strategy also requires financial strength and appealing price relative to that growth. Dorman Products shows a notable fit with these important filters:

- Durable Profit Growth: The company has reached a 5-year EPS growth rate of 21.83%. This number easily falls within the Lynch-favored range of 15% to 30%, pointing to a solid, and possibly continuing, growth path that avoids the warning sign of unsustainably fast increase.

- Sensible Price via PEG Ratio: A key Lynch measure is the Price/Earnings to Growth (PEG) ratio, which tries to find stocks that might be priced low considering their growth rate. Dorman's PEG ratio of 0.66 is far under the goal level of 1.0, implying the market may not be completely valuing its past growth, offering a possible value chance.

- Sound Financial Condition: Lynch stressed putting money into companies with firm balance sheets to handle economic slowdowns.

- Dorman's Debt-to-Equity ratio of 0.28 shows a careful financial setup, using ownership rather than too much debt to finance its activities. This not only fits the filter's need but matches Lynch's own liking for an even smaller ratio.

- The company's Current Ratio of 2.93 shows good cash availability, indicating a solid capacity to cover near-term debts, which is a basic requirement for any long-term investment.

- High Earnings Ability: A Return on Equity (ROE) of 16.72% is above the 15% lowest point set by the filter. This shows that Dorman is effectively creating earnings from owner capital, a sign of a capable and fundamentally healthy business.

Fundamental Examination Summary

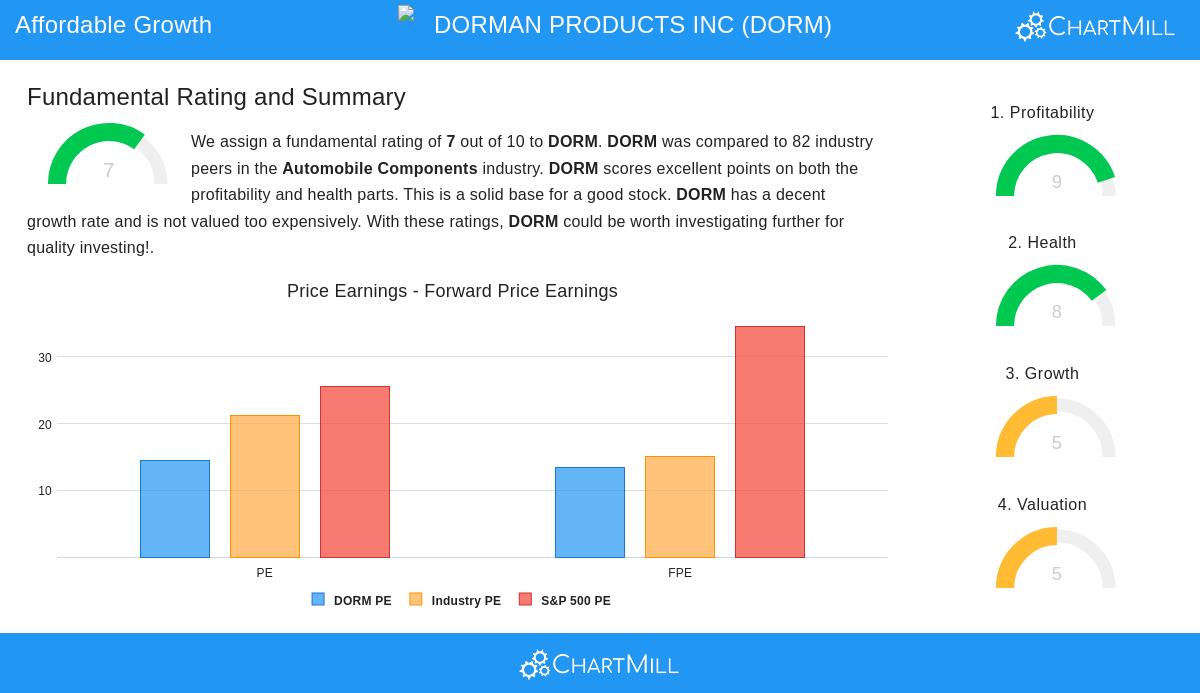

A wider fundamental analysis of Dorman Products supports the image shown by the Lynch filter. The company receives a solid overall fundamental score of 7 out of 10, with especially good marks in Profitability (9/10) and Financial Condition (8/10). Its earnings margins place very high inside the automobile parts field, and its balance sheet shows low failure risk, as seen by a good Altman-Z score. While price measures are varied, showing a fair P/E ratio but higher enterprise value multiples compared to similar companies, the solid earnings ability and financial condition offer a firm base. It is important to mention that analysts expect a slowing in future EPS and sales growth compared to the last five years, an element long-term investors should watch.

Company Model and Industry Standing

Dorman Products works in the car replacement parts field, providing substitute and improvement components. This business fits with another Lynch rule: putting money into what you understand. The company serves a required, though ordinary, market—vehicle upkeep and fixing—which is usually less tied to economic swings than new car purchases. Its sections dealing with passenger vehicles, large trucks, and special vehicles give variety. This "ordinary" field trait is often liked in this strategy, as it can be simpler to grasp and might be missed by the wider market, creating possible chances for careful investors.

A Beginning for More Investigation

For investors curious about using this structured method, the Peter Lynch strategy filter can work as a useful beginning step. The filter methodically reduces the market to companies that satisfy these strict rules for growth, price, and financial condition.

You can locate more companies that currently pass this investment filter and perform your own thorough research here.

Disclaimer: This article is for informational purposes only and does not constitute financial advice, a recommendation to buy or sell any security, or an endorsement of any investment strategy. All investments involve risk, including the possible loss of principal. Readers should conduct their own research and consult with a qualified financial advisor before making any investment decisions.