Disney Achieves Q3 Profit in Streaming, Raises FY24 Earnings Outlook

By Kristoff De Turck - reviewed by Aldwin Keppens

Last update: Aug 7, 2024

Disney, a global entertainment giant, has reported significant profits for its third fiscal quarter, exceeding expectations. Known for its broad portfolio, including streaming services, theme parks, and sports networks, Disney continues to innovate and adapt in the dynamic entertainment landscape.

Third fiscal quarter results:

- Net income: $2.621 billion, compared to a loss of $460 million in the same period last year.

- Earnings per share: $1.43, compared to a loss of $0.25 in the prior-year quarter.

- Adjusted earnings: $2.782 billion or $1.39 per share, exceeding the expected $1.19 per share.

- Revenue: $23.155 billion, up 4% from $22.330 billion last year.

Streaming segment performance:

- Disney+ welcomed 700,000 new subscribers, reaching 118.3 million globally.

- Hulu's subscribers increased by 900,000 to 51.1 million.

- Positive profitability in streaming, driven by Direct-to-Consumer and ESPN+.

Price adjustments:

- In the US, Disney+, Hulu, and ESPN+ prices will increase:

- Ad-free Disney+ to $16/month (was $14).

- Ad-supported Disney+ to $10/month (was $8).

- EU price changes not yet announced; last increase was to €10.99/month.

Profit enhancement strategies:

- New features for Disney+ to enhance user experience, such as a playlist function.

- Focus on improving value proposition and profitability.

Partnerships and initiatives:

- Partnership with Instacart to add a "restaurants" tab for Uber Eats deliveries.

- Collaboration with BYD to introduce 100,000 EVs for Uber drivers in Europe and Latin America.

Outlook for fiscal 2024:

- Adjusted earnings per share expected to grow 30%, up from the previous estimate of 25%.

- Continued growth in Disney+ Core subscribers and overall streaming profitability.

Challenges and external factors:

- Potential impact on Experience segment operating income due to decreased travel during the Olympics and cyclical changes in China.

- Anticipated mid single-digit decline in operating income for the Experiences segment in Q4.

Conclusion:

Disney's impressive third-quarter performance underscores its strategic focus on streaming and diversified entertainment offerings. The company’s ability to exceed earnings expectations and achieve profitability in its streaming segment a quarter ahead of schedule highlights its robust growth trajectory. Despite somewhat disappointing numbers and future challenges in the Experience segment, Disney's continued innovations and strategic adjustments position the company well for continued success in the evolving entertainment market.

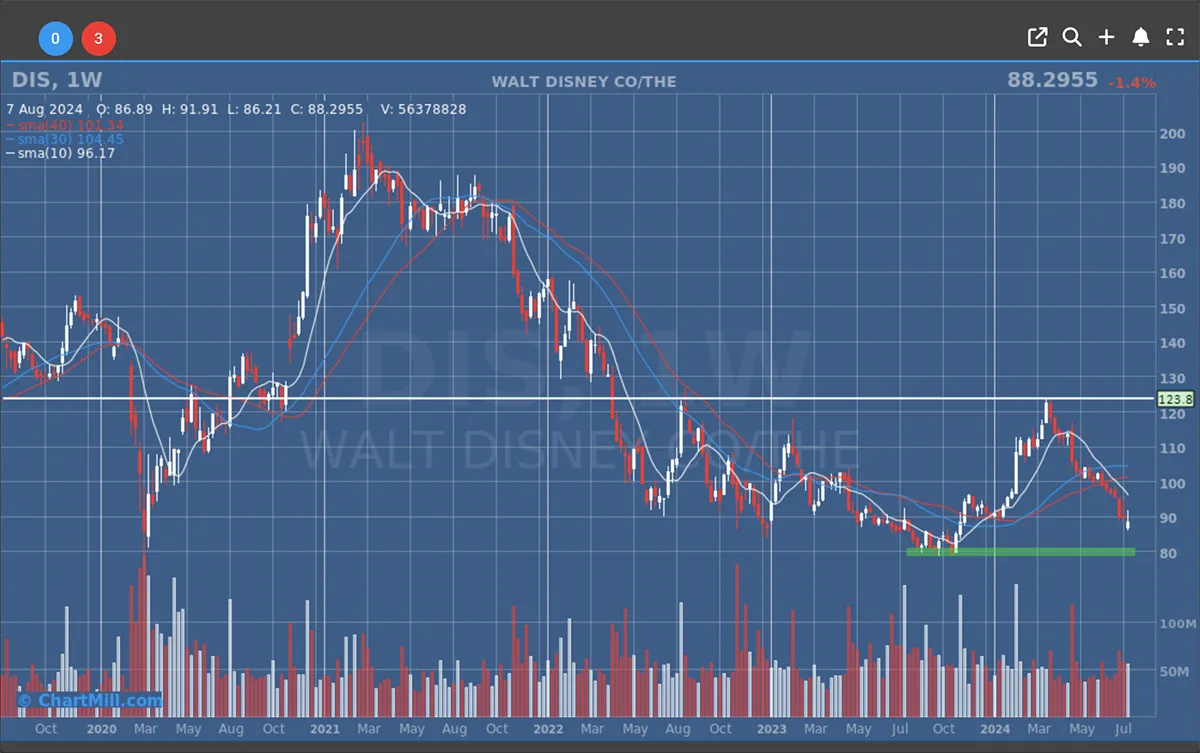

Longterm Weekly Chart

NYSE:DIS (1/6/2026, 12:26:08 PM)

114.49

+0.42 (+0.37%)

Find more stocks in the Stock Screener