For investors looking for a structured, long-term market approach, few methods have the substance of Peter Lynch's system. The famous leader of Fidelity's Magellan Fund supported putting money into familiar companies, concentrating on businesses that are easy to understand, have sound finances, and reliable expansion available for a fair cost. This "Growth at a Reasonable Price" (GARP) idea steers clear of speculative, expensive stocks, choosing instead companies with good finances increasing at a constant, manageable rate. A filter using Lynch's main standards lately highlighted DHT Holdings Inc (NYSE:DHT) as a possible option deserving more examination.

A Lynchian Profile: Maintainable Growth and Financial Care

Peter Lynch stressed that profit expansion should be strong but not extreme, as very fast growth is frequently not lasting. He combined this with a value assessment using the PEG ratio (Price/Earnings to Growth) to confirm investors are not paying too much for that expansion. DHT Holdings seems to fit these basic ideas well.

- Maintainable Earnings Growth: The company's Earnings Per Share (EPS) has increased at an average yearly rate near 16.1% over the last five years. This fits directly into Lynch's chosen span of 15% to 30%, showing a good, steady rise in profits without entering possibly unsteady areas.

- Fair Valuation: The important Lynch check is the PEG ratio, which modifies the common P/E ratio for growth. A PEG of 1 or less implies the stock could be fairly valued compared to its growth path. DHT's PEG ratio, calculated from its past five-year growth, is 0.88, hinting the market might be pricing its historical growth performance too low.

Balance Sheet Soundness: A Key Part of the Method

Lynch was cautious of companies carrying too much debt, liking those with firm balance sheets that could endure economic slumps. His filters frequently involved firm rules for debt and cash availability, which are fields where DHT Holdings shows clear firmness.

- Cautious Capital Structure: Lynch liked a Debt-to-Equity ratio under 0.25. DHT's ratio of 0.22 shows a careful method to funding, with the company supported mainly by equity instead of debt. This gives a good safety buffer and operating room.

- Firm Short-Term Cash Position: The company's Current Ratio of 2.41 is much higher than Lynch's lowest limit of 1. This firm ratio shows DHT's full ability to meet its short-term debts with its short-term assets, a main sign of financial soundness and toughness.

Profitability and Investor Payouts

A last part of the Lynch method is judging management's skill in creating profits from investor equity. He searched for companies that produced high returns, which DHT achieves while also giving money back to investors.

- Effective Use of Equity: DHT's Return on Equity (ROE) of 18.25% is above Lynch's 15% reference point. This shows that management is successfully using investor money to create profits.

- Income Production: While not a main Lynch filter point, the company gives a notable dividend yield, which can be interesting for total return investors. Still, investors should see that the present payout ratio hints the dividend's rise could be moving faster than profit growth, a detail for more individual checking.

Basic Review

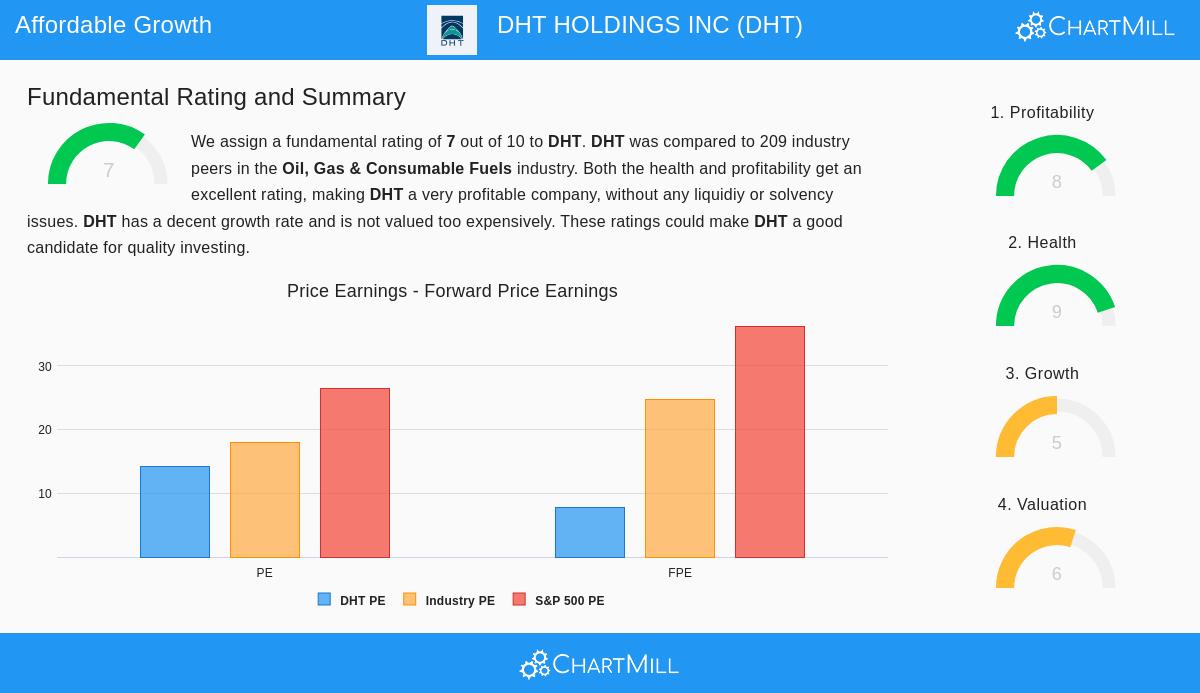

A look at DHT's detailed basic report supports the results from the Lynch filter. The report gives DHT a firm total score of 7 out of 10, noting its very good profitability and strong financial soundness. Main plus points include industry-best profit margins, a very firm ability to pay debts shown by a low Debt-to-Free-Cash-Flow ratio, and a low price based on future profit guesses. The main points to see are a recent drop in sales and profits (typical in the changing shipping industry) and points about the lasting ability of its dividend growth rate. Experts, though, forecast a speed-up in both EPS and sales growth in the next few years.

Is It a Lynch-Type "Tenbagger"?

No single filter can promise an investment success, and Peter Lynch himself noted that filtering is just the initial move toward detailed examination. DHT Holdings works in the changing crude oil tanker field, a part open to shifting freight costs and worldwide economic need, elements an investor must know and accept. The company's recent financial numbers and balance sheet firmness, however, make it an interesting example for the Lynch method. It shows a profile of a company with a record of maintainable growth, selling for a fair price (PEG < 1), and supported by a very sound balance sheet with little debt.

For investors curious about seeing other companies that meet similar strict, price-aware growth filters, you can see the complete Peter Lynch Strategy filter for more possible choices.

Disclaimer: This article is for information only and is not financial guidance, a suggestion, or a plan to buy or sell any securities. Investors should do their own full examination and think about their personal money situation and risk comfort before making any investment choices.