A systematic method for finding possible investment chances uses several analytical models to judge securities from both fundamental and technical viewpoints. The process used here filters for stocks showing solid growth momentum traits together with positive technical breakout shapes. This two-part method looks for companies displaying strong earnings momentum and sales speed-up while also showing helpful chart patterns that might present good risk-reward situations for getting in. The filtering rules aim at securities with High Growth Momentum Ratings over 4, Technical Ratings above 7, and Setup Ratings above 7, forming a complete screen for growth-focused investors looking for technically good entry places.

Growth Momentum Fundamentals

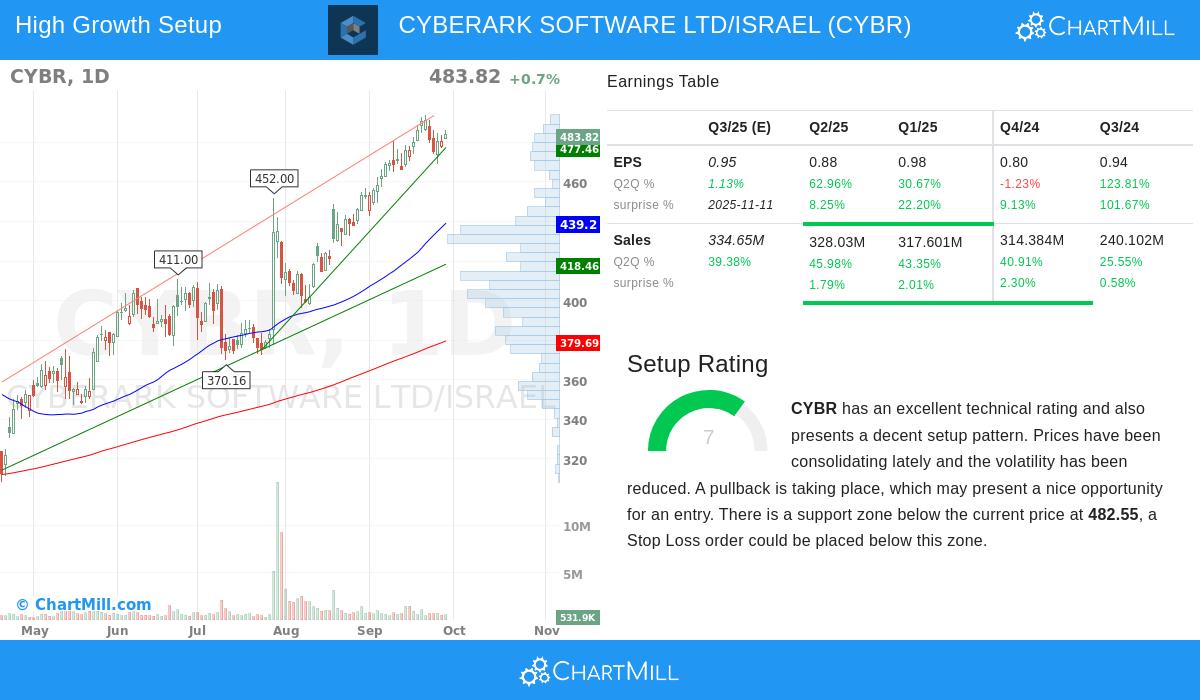

CyberArk Software Ltd (NASDAQ:CYBR) displays positive growth traits that fit with momentum investment ideas. The company's earnings and revenue path shows notable speed-up, a main part in high-growth investment methods that focus on companies with increasing business momentum.

- Earnings Per Share growth of 42.9% over the trailing twelve months

- Quarterly EPS growth of 63.0% in the most recent quarter compared to the same period last year

- Revenue growth of 39.5% over the past year, with recent quarterly sales growth speeding up to 46.0%

- Free Cash Flow per share rose by 834.7% year-over-year, showing good operational efficiency gains

- Complete earnings and revenue surprise history over the past four quarters, with average EPS beats of 35.3%

The company's growth numbers show the kind of speed-up that momentum investors look for, especially the step-by-step betterment in quarterly sales growth from 25.6% to 46.0% over recent quarters. This design of speeding growth often comes before continued good performance, making it a key part of the High Growth Momentum Rating model that judges both past performance and forward-looking momentum signs.

Technical Strength and Market Position

From a technical viewpoint, CyberArk shows a very strong profile that matches its fundamental growth narrative. The stock gets a complete Technical Rating of 10, showing high technical health across several time frames and placing it with the market's top performers.

- Both short-term and long-term trends are clearly positive

- The stock does better than 90% of all stocks in the market on a yearly performance basis

- Relative strength inside the software industry puts it in the top 18% of performers

- Trading close to 52-week highs along with the wider market strength

- All main moving averages (20, 50, 100, and 200-day) are going up and correctly ordered

The technical strength shows institutional backing and continued buying pressure, traits often linked with leading growth stocks. The stock's capacity to keep its upward path while the S&P 500 also trades near highs shows its leadership qualities inside a strong market setting.

Setup Quality and Trading Considerations

CyberArk currently shows a helpful setup pattern with a Setup Rating of 7, indicating the stock is making a consolidation inside its larger uptrend. This kind of pattern often comes before continuation moves and gives possible entry chances for momentum investors.

- The stock is currently making a bull flag pattern, a usually positive continuation shape

- Volume has gone down during the recent pullback, showing absence of heavy selling

- A clear support zone is present between $473.78 and $482.55

- Resistance is seen in the $490.65 to $491.11 range

- Average daily volume of 1.57 million shares gives enough liquidity

The setup indicates a possible entry above the resistance zone at $491.12 with a stop loss below the support area at $473.77, representing a contained risk of about 3.5%. This kind of clear risk-reward setup is especially useful for momentum investors wanting to take part in continued upside while handling possible downside exposure. The detailed technical analysis report gives more details into support and resistance levels that could help with position sizing choices.

Investment Implications

The mix of solid growth momentum fundamentals and technically good chart patterns makes CyberArk a noteworthy candidate for investors using growth momentum plans. The company's speeding revenue growth, widening profit margins, and steady earnings surprises create the fundamental background that momentum investors usually look for. At the same time, the technical image supports the fundamental story with good relative performance, set uptrends, and a helpful consolidation pattern that might give a positive entry point.

For investors looking for similar chances that mix growth momentum with technical breakout setups, more screening results can be found using the High Growth Momentum Breakout Setups screen. This screening process methodically finds companies showing both fundamental growth speed-up and technically good chart patterns, giving a beginning point for more study.

Disclaimer: This analysis is for informational purposes only and does not constitute investment advice, recommendation, or endorsement of any security. Investors should conduct their own research and consult with financial advisors before making investment decisions. Past performance does not guarantee future results, and all investments carry risk including potential loss of principal.