CENOVUS ENERGY INC (NYSE:CVE) was identified as a strong dividend candidate by our screening process. The company combines an attractive yield with solid fundamentals, making it a potential fit for income-focused investors.

Dividend Strength

- High Yield: CVE currently offers a dividend yield of 4.07%, well above the S&P 500 average of 2.35%.

- Reliable History: The company has paid dividends for at least 10 years, demonstrating a commitment to shareholder returns.

- Strong Growth: Dividends have grown at an annual rate of 31.72% over recent years, though sustainability should be monitored given earnings trends.

- Payout Ratio: At 57.77%, the payout ratio is slightly elevated but still within a manageable range for the industry.

Profitability & Financial Health

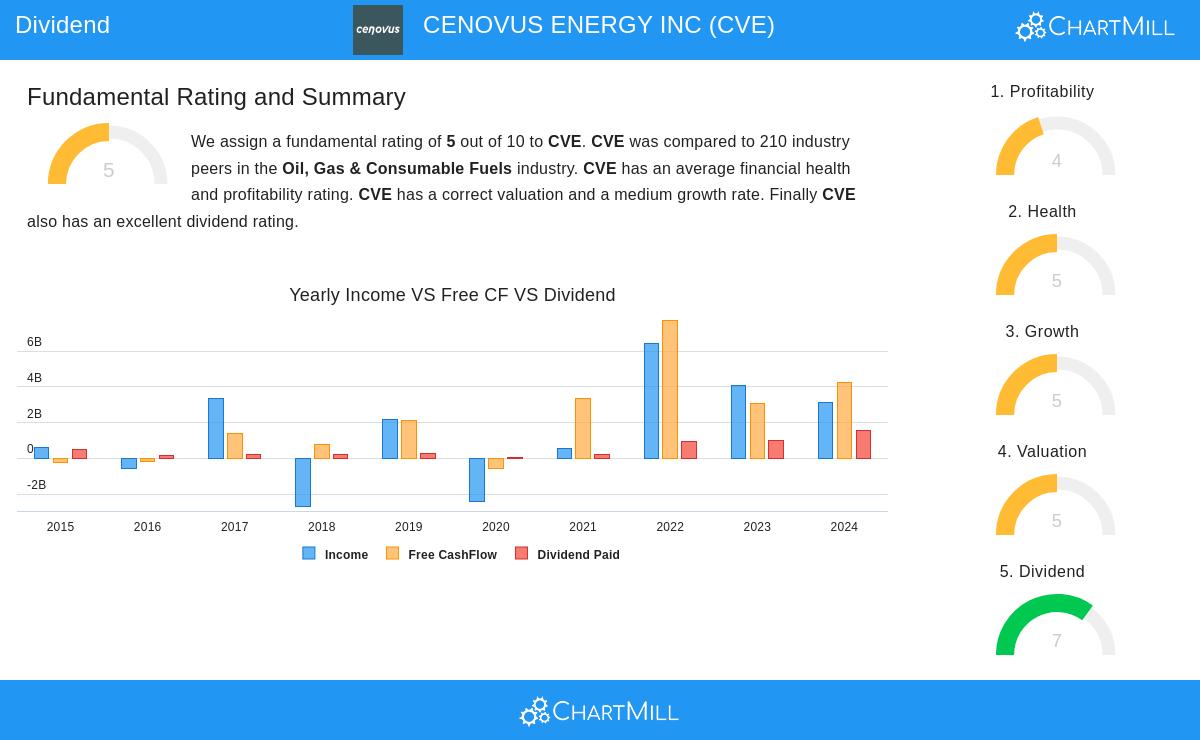

- Profitability Rating (5/10): CVE maintains reasonable profitability, with a Return on Invested Capital (ROIC) of 7.38%, outperforming 62% of industry peers.

- Health Rating (5/10): The company has a Debt-to-Equity ratio of 0.34, indicating moderate leverage, and a solid Altman-Z score of 2.40, suggesting limited near-term bankruptcy risk.

- Valuation: Trading at a P/E of 13.45, CVE appears reasonably priced compared to both its industry and the broader market.

Growth Outlook

While past earnings growth has been strong (33.97% annual EPS growth), analysts expect a slight decline in revenue (-5.74%) in the coming years. Investors should weigh this against the company’s ability to sustain its dividend.

For a deeper look, review the full fundamental analysis report for CVE.

Our Best Dividend Stocks screener provides more high-quality dividend ideas, updated daily.

Disclaimer

This is not investment advice. Always conduct your own research before making investment decisions.