In today's market, finding stocks that join solid fundamental growth with positive technical setups can give investors chances that fit with momentum approaches. Our screening process centers on three main proprietary measures: the ChartMill High Growth Momentum Rating (HGM), which looks at earnings speed, sales expansion, and analyst changes; the Technical Rating, judging total trend force and comparative performance; and the Setup Rating, finding consolidation shapes ready for possible breakouts. Stocks with high marks in these areas frequently show the traits wanted by growth and momentum investors.

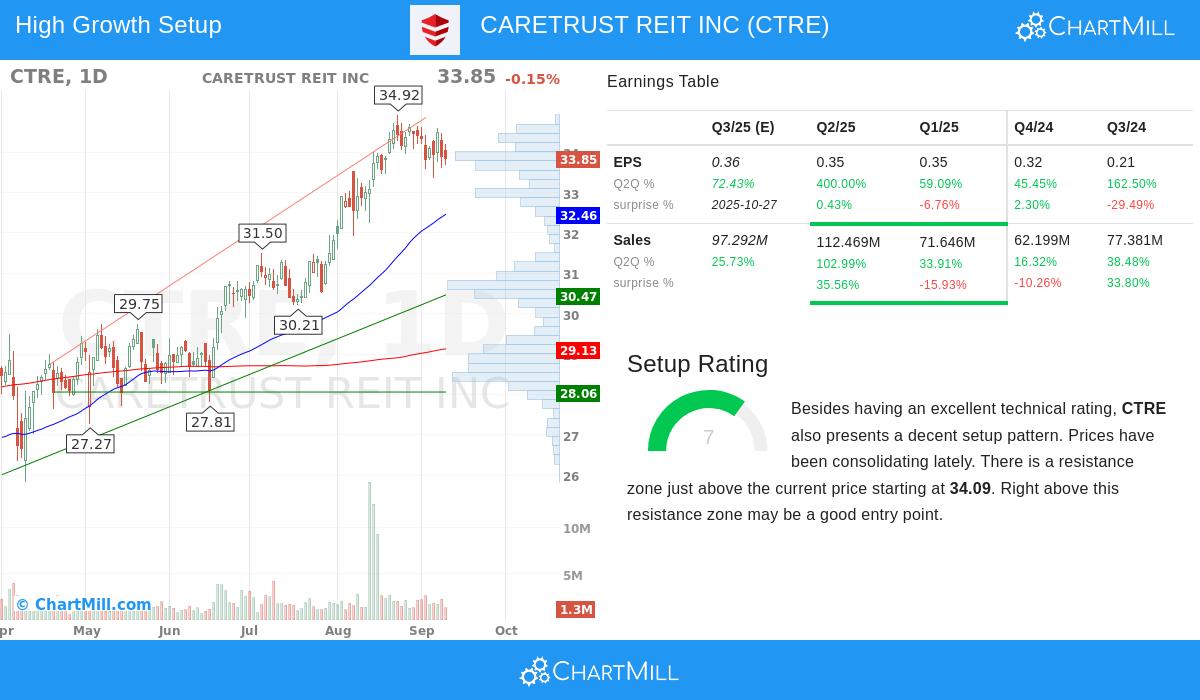

CARETRUST REIT INC (NYSE:CTRE) comes from our screen with an HGM Rating of 7, showing solid fundamental momentum. The company, which owns and leases healthcare-related properties across the U.S. and U.K., shows notable growth measures that match what high-growth investors look for.

Growth and Momentum Fundamentals

The HGM Rating includes several parts where CareTrust does very well, especially in earnings and revenue growth. These parts are key because maintained growth speed often comes before continued price gains, a main idea of momentum investing.

-

Earnings Per Share Growth:

- TTM EPS growth of 108.47% year-over-year

- Most recent quarter showing 400% EPS growth compared to the same quarter last year

- Forward quarter estimates show 72.43% growth

-

Revenue Expansion:

- TTM revenue growth of 50.83%

- Last quarter revenue increased 102.99% year-over-year

- Steady quarterly revenue growth speed seen in recent times

-

Profit Margin Expansion:

- Quarterly profit margins have grown from 43.09% to 60.78% over the past year

- Yearly profit margin got better from 24.49% to 42.07% in latest report

These measures show why CareTrust gets good marks on growth momentum factors—the company displays speeding fundamental performance across many areas that usually push investor interest in growth stocks.

Technical Strength and Setup Quality

From a technical view, CareTrust shows an equally positive case. The stock gets a Technical Rating of 8 and a Setup Rating of 7, pointing to both good trend traits and a positive consolidation shape. As per the detailed technical analysis, several parts add to this view.

The technical report notes that CTRE shows good trends in both short-term and long-term periods, trading near its 52-week high while displaying better performance within the Diversified REITs industry—doing better than 88% of industry peers. The stock now shows a bull flag pattern, which often comes before continuation of the current upward trend.

Important technical notes include:

- Price trading above all main moving averages (20, 50, 100, and 200-day)

- Support levels found between $24.90 and $30.47 giving downside protection

- Resistance area between $34.09 and $34.61 showing a possible breakout level

- The setup indicates a possible entry above $34.62 with a stop below $33.34

This technical picture is especially important for momentum investors because it finds not only a stock with good trend traits but also one that has pulled back lately, possibly giving a positive risk/reward entry point for continuation of the upward move.

Investment Considerations

While the mix of good growth measures and technical setup shows an interesting chance, investors should think about several parts specific to CareTrust. The healthcare REIT sector deals with special regulatory points and population trends that might change long-term performance. Also, the company's negative free cash flow per share, while normal in growth-focused REITs due to expansion actions, needs watching.

The stock's current technical setup indicates a possible breakout above the $34.09-$34.61 resistance area could signal the next move higher. But, as with all technical shapes, confirmation through price action stays necessary before thinking about position start.

For investors wanting to look into similar chances that meet these strict growth and technical rules, more screening results can be seen through our High Growth Momentum Breakout Setups Screen. This screen often finds stocks showing the mix of fundamental growth momentum and technical breakout patterns that may interest growth-focused investors.

Disclaimer: This analysis is given for information only and does not make up investment advice, suggestion, or backing of any security. Investors should do their own research and talk with a qualified financial advisor before making investment choices. Past performance is not a sign of future results.