CISCO SYSTEMS INC (NASDAQ:CSCO) has been identified as a possible option for technical traders using a methodical screening process that finds stocks showing both good technical condition and encouraging consolidation shapes. This method uses two specific indicators: the ChartMill Technical Rating, which assesses general technical condition, and the Setup Quality Rating, which judges the state of price consolidation formations. Stocks with high scores on both measures frequently offer good situations for breakout trading plans, where trades are started as prices exit set consolidation areas.

Technical Strength Review

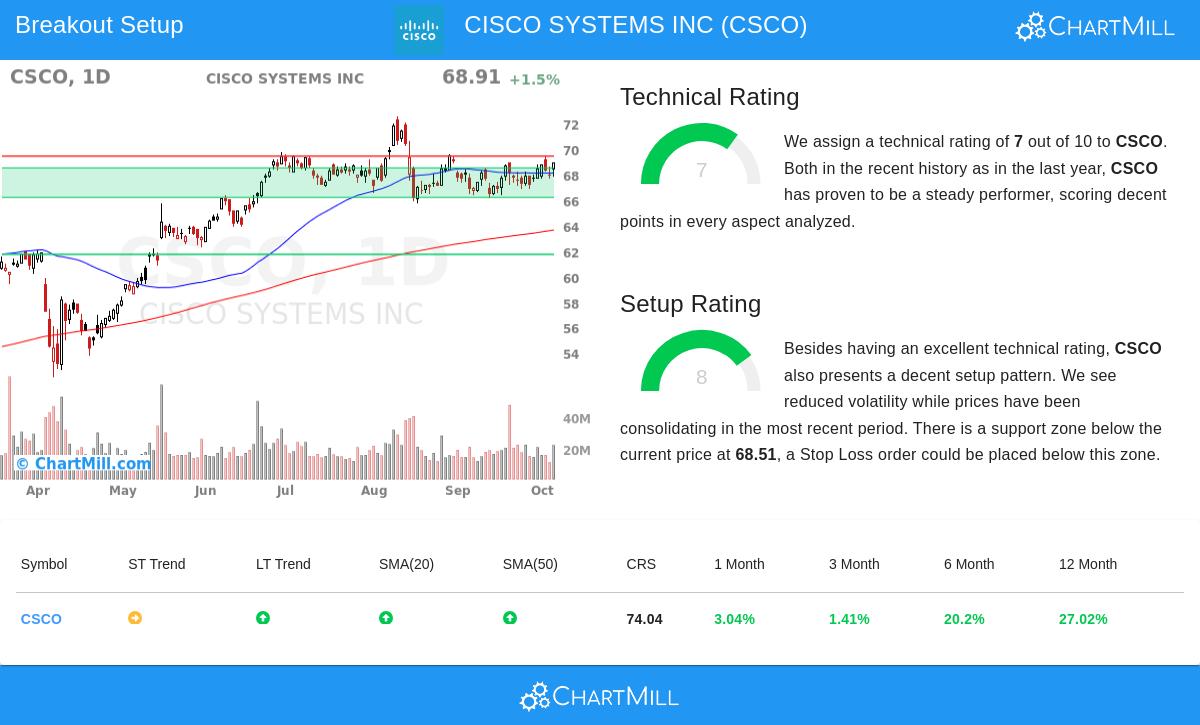

Cisco shows good technical bases with a Technical Rating of 7 out of 10, suggesting the stock keeps a sound technical state. This rating shows the stock's results across different time periods and technical measures, giving traders assurance in the basic trend condition. The detailed technical analysis report shows several good traits:

- Long-term trend stays positive while short-term trend is neutral

- Good relative strength beating 74% of all stocks in the last year

- Steady trading in the higher part of its 52-week range

- All main moving averages (20, 50, 100, and 200-day) moving upward

- Strong average daily volume of about 20 million shares gives sufficient liquidity

The technical rating's value is in its capacity to find stocks with confirmed upward momentum, which is important for breakout plans as they depend on the extension of current trends instead of trying to catch reversal actions.

Setup Quality Review

With a Setup Rating of 8 out of 10, Cisco shows a notable consolidation shape that technical traders often look for before possible breakout actions. The setup quality measure evaluates how closely a stock has been trading and if clear support and resistance points have developed. Recent trading shows Cisco has been consolidating inside a small area between $66.13 and $69.49 over the last month, with lower volatility hinting at possible energy accumulating for a directional move.

The setup review finds clear support and resistance areas that give specific reference points for trade management:

- Firm support area between $66.20 and $68.51 made by several trendlines and moving averages

- Close resistance at $69.43 from recent price action

- The close consolidation shape allows for exact stop-loss positioning and good risk-reward ratios

This consolidation period is especially important because it happens after a large upward move, letting the stock absorb gains while keeping its technical condition, often coming before the next step upward.

Trading Points

For traders watching Cisco for possible breakout chances, the technical review indicates specific price points to observe. A clear move above the $69.43 resistance point could indicate the start of a new upward phase, while the support area between $66.20 and $68.51 gives a sensible place for stop-loss positioning. The current setup presents a sensible risk outline with the distance to support being about 3.74% from current levels, which is inside acceptable limits for many breakout plans.

The mix of sound technical ratings and high-grade setup shapes makes Cisco worth watching for technical traders using breakout methods. While the wider market situation stays encouraging with both short and long-term S&P 500 trends positive, individual stock choice stays most important for successful technical trading.

Traders wanting to find more technical breakout chances can check the Technical Breakout Setups Screen for daily updated options meeting similar technical standards.

Disclaimer: This review is for information only and does not form investment guidance, suggestion, or request to buy or sell any securities. Trading carries significant risk and is not right for every investor. Always do your own research and think about talking with a qualified financial expert before making any investment choices.