For investors looking for opportunities where a company's market price seems separate from its actual financial condition, a methodical value investing method can serve as a useful guide. This method focuses on finding stocks that trade for less than their calculated true worth, frequently indicated by low valuation measures, while confirming the business is fundamentally good, profitable, financially stable, and able to expand. One stock that recently appeared from a structured filter for these "reasonable value" traits is CROCS INC (NASDAQ:CROX).

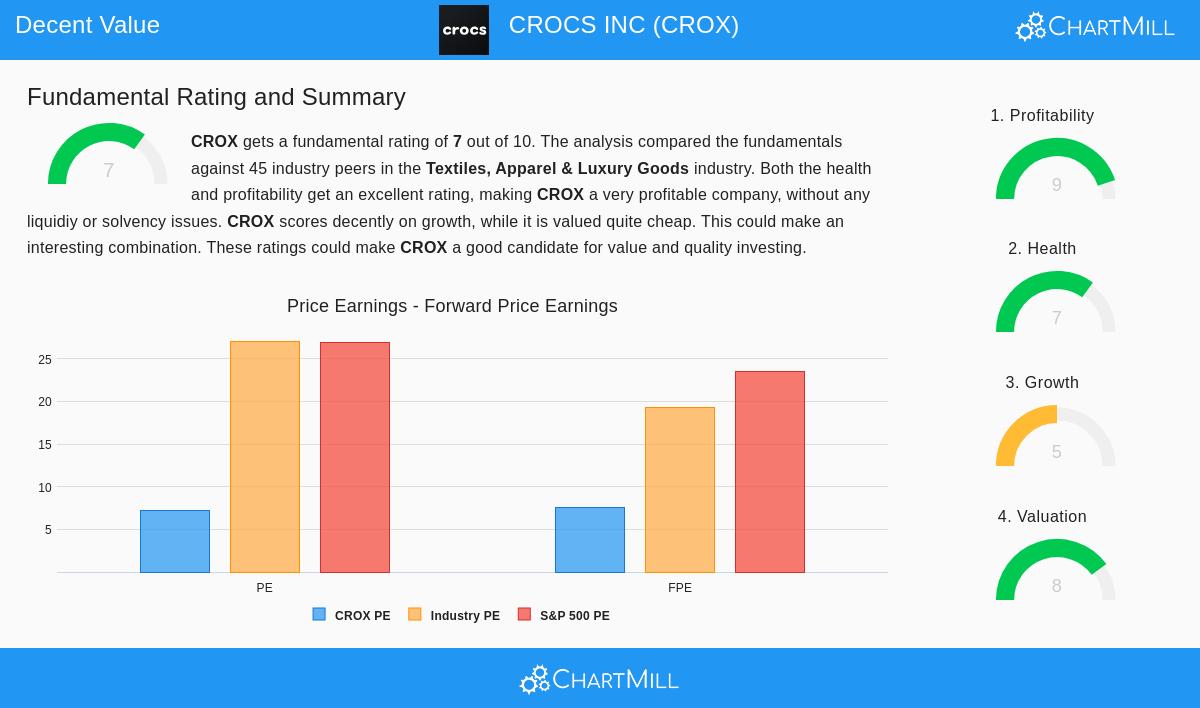

The filter used conditions based on ChartMill's Fundamental Analysis Ratings, looking for companies with a high Valuation Rating (above 7 out of 10) along with satisfactory scores in Profitability, Financial Health, and Growth. This pairing tries to locate stocks that may be priced low but are not value traps, firms that are inexpensive for a justified cause, but instead good businesses the market might be missing. A complete examination of CROCS's fundamentals is available in its full ChartMill Fundamental Analysis report.

Notable Valuation Measures

The central idea of value investing is buying assets for less than they are worth. CROCS's valuation measures imply such a discount could exist. The company's ChartMill Valuation Rating is a high 8/10, showing its low price compared to both its earnings and cash flow.

- Price-to-Earnings (P/E) Ratio: At 7.23, CROX's P/E ratio is much lower than the industry average of about 27.1 and the wider S&P 500 average of 26.9. This shows investors pay less for each dollar of CROCS's earnings than for most similar companies.

- Forward P/E Ratio: The situation is similar for future estimates, with a forward P/E of 7.51, which is lower than 95.6% of its industry rivals.

- Price-to-Free-Cash-Flow: This measure, which compares market price to the real cash the company produces, also indicates a low valuation compared to over 91% of the industry.

For a value investor, these low multiples offer a possible "margin of safety", a cushion if future earnings are somewhat below estimates. The valuation implies the market assumes almost no expansion, offering a chance if the company's fundamentals remain or get better.

Strong Profitability and Financial Condition

An inexpensive stock is only a worthwhile investment if the company is financially secure. This is an area where CROCS performs well, receiving a top Profitability Rating of 9/10 and a good Health Rating of 7/10. High profitability confirms the business model is effective, while sound financial condition lowers the chance of trouble, making the low valuation more interesting.

Profitability Advantages:

- High Margins: The company has an operating margin of 23.1%, better than 95.6% of its industry. Its gross margin of 59.1% is also high. These numbers show an ability to set prices and run operations efficiently.

- Good Returns: CROCS produces a Return on Invested Capital (ROIC) of 23.6%, exceeding 91% of similar firms. An ROIC that regularly beats the company's cost of capital is a main sign of creating value.

Financial Condition Review:

- Solvency is Safe: With an Altman-Z score of 3.82, the company displays no short-term bankruptcy risk. More significantly, its Debt-to-Free-Cash-Flow ratio is a very good 1.84, meaning it could pay off all its debt with under two years of cash flow.

- Controllable Debt: While the Debt-to-Equity ratio is average at 0.97, the report states that high free cash flow coverage lessens worries. The overall condition view is of a company with controllable debt that is easily supported by its profitable activities.

Growth Path and Points to Note

Value investing does not need fast growth, but steady growth helps reduce the difference between market price and true worth over time. CROCS's Growth Rating is an average 5/10, showing a varied but clear situation.

- Historical Results: The company has an excellent history, with Revenue increasing at an average yearly rate of 27.2% and Earnings Per Share (EPS) at 51.6% over recent years.

- Future Estimates: Analysts predict a marked slowdown, with low single-digit growth expected for both revenue and EPS in the next few years. This anticipated reduction is probably a main reason for the stock's low valuation.

For a value investor, this background is important. The filter found CROX not as a rapid-growth story, but as a "reasonable growth" option combined with significant value. The investment case depends on whether the market has been too harsh on the stock for a growth rate returning to normal after an exceptional period, particularly with the company's ongoing high profitability and cash production.

Summary

CROCS INC illustrates what value-focused filters aim to find: a company selling at a lower price than its industry and the market, yet supported by better profitability and a financially sound base. Its low P/E and cash flow multiples provide a margin of safety, while its high margins and returns on capital indicate business quality. The main question for investors is if the expected growth reduction is already completely, or even excessively, accounted for in the present share price.

This review of CROX came from a structured search for stocks matching particular value and fundamental conditions. Investors wanting to find other companies that match a similar outline of acceptable valuation, profitability, health, and growth can examine the Decent Value Stocks screen on ChartMill.

Disclaimer: This article is for informational purposes only and does not constitute financial advice, a recommendation to buy or sell any security, or an endorsement of any investment strategy. Investors should conduct their own research and consider their individual financial circumstances and risk tolerance before making any investment decisions.