In the world of growth investing, few strategies have kept their importance as well as the principles found in Louis Navellier’s “The Little Book That Makes You Rich.” The method focuses on finding companies showing strong, speeding growth through a mix of earnings revisions, surprises, sales and earnings growth, margin expansion, cash flow strength, and high returns on equity. This disciplined way aims to capture stocks before their growth paths become widely known by the market. One company now meeting these strict conditions is CORMEDIX INC (NASDAQ:CRMD).

Earnings Revisions and Surprises

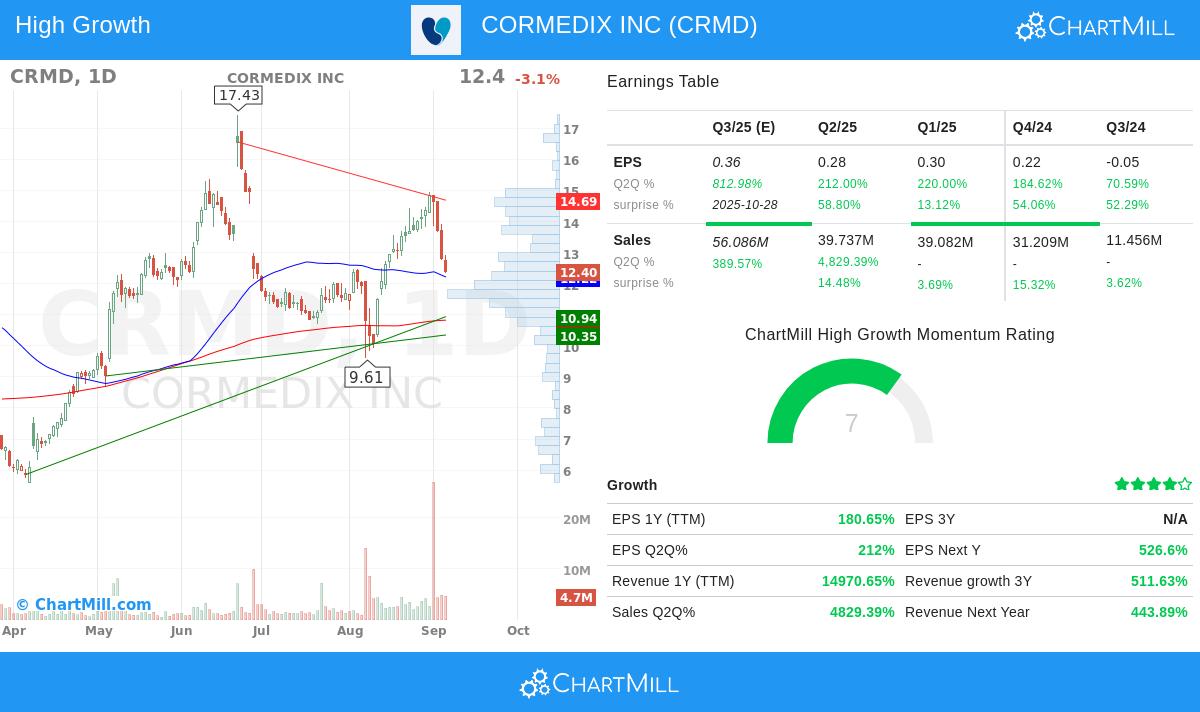

A key part of Navellier’s strategy is the focus on positive earnings revisions and surprises, as these often show underlying business speed that may not yet be fully priced in. CorMedix does very well here:

- The EPS estimate for the next quarter has been moved upward by 107.2% over the past three months.

- The company has reported four straight positive earnings surprises in its last four quarterly reports.

- The average earnings surprise over this period is 44.6%, much higher than the 10% level noted in the strategy.

These numbers imply that analysts are regularly trying to keep up with CorMedix’s results, a good sign that the company is beating expectations and possibly leading to future estimate increases.

Growth in Sales and Earnings

Speeding growth in both revenue and earnings is vital for finding companies with widening market chances and operational success. CorMedix shows outstanding speed:

- Year-over-year revenue growth has hit an amazing 14,970.6%.

- Quarterly sales growth is 4,829.4% compared to the same quarter last year.

- EPS has grown 180.6% year-over-year, with quarterly EPS growth reaching 212.0%.

Such huge growth rates are uncommon and show that the company is effectively scaling its operations, in this case pushed mainly by the commercialization of its main product, DefenCath.

Profitability and Cash Flow

Navellier’s system also favors companies that are not only growing, but growing with profit, with widening margins and good cash creation. CorMedix does strongly here too:

- Operating margin growth over the past year is 100.6%, showing better cost control and pricing ability.

- Free cash flow has risen by 197.0% year-over-year, giving the company money freedom to put into more growth or strategic chances.

These measures imply that CorMedix is turning its notable revenue growth into bottom-line results and shareholder value, instead of chasing growth at all costs.

Return on Equity and Overall Fundamental Health

A high return on equity (ROE) shows efficient use of shareholder money, another main idea of the “Little Book” strategy. CorMedix states an ROE of 23.2%, far above the lowest 10% needed by the screen, putting it in the top group of its industry peers. According to ChartMill’s fundamental analysis report, the company has an overall fundamental rating of 7 out of 10. It does very well in financial health and valuation, with no debt and liquidity ratios that point to steadiness. Although the company’s profitability has been uneven in the past, its recent results show a major change, with top-level margins and returns.

Conclusion

CorMedix seems to match closely with the growth stock selection standards supported by Louis Navellier. Its outstanding sales and earnings growth, upward revisions, positive surprises, getting better margins, and high return on equity together form a view of a company in a solid growth stage. For investors using a growth-focused strategy, these points may make CRMD an interesting candidate for more study.

It is important to say that the “Little Book” screen is made to find companies with good short-term fundamental speed. Investors are urged to do more due diligence and think about the lasting nature of growth rates, competitive place, and market situations.

For those wanting to look into other companies that currently pass this screen, you can view the full list of results here.

, Disclaimer: This article is for informational purposes only and does not constitute investment advice, financial guidance, or a recommendation to buy or sell any securities. Investors should conduct their own research and consult with a qualified financial advisor before making investment decisions.