Investors looking for growth chances at acceptable prices frequently use filtering methods that mix expansion possibility with financial steadiness. The Affordable Growth method focuses on companies displaying solid growth paths while keeping good profitability and financial condition, all without high valuation premiums. This system helps find businesses that mix operational quality with expansion possibility, possibly providing good risk-adjusted returns. Catalyst Pharmaceuticals Inc (NASDAQ:CPRX) recently appeared using such filtering rules, justifying a more detailed look at its basic qualities.

Growth Path

Catalyst Pharmaceuticals shows notable expansion measures that are central to its affordable growth outline. The company's growth score of 9/10 shows significant operational speed in several areas:

- Earnings Per Share has jumped 45.76% over the last year, with a three-year average yearly growth rate of 34.29%

- Revenue rose 25.56% in the last year, keeping a solid three-year average growth of 36.89% each year

- Future estimates point to ongoing solid performance with anticipated EPS growth of 26.80% and revenue growth of 11.21% per year

This continued growth pattern is especially notable in the biotechnology field, where steady expansion is often difficult. The company's specific method on rare disease treatments seems to be producing clear outcomes, with both past results and future estimates supporting the growth story needed for affordable growth investing.

Valuation Review

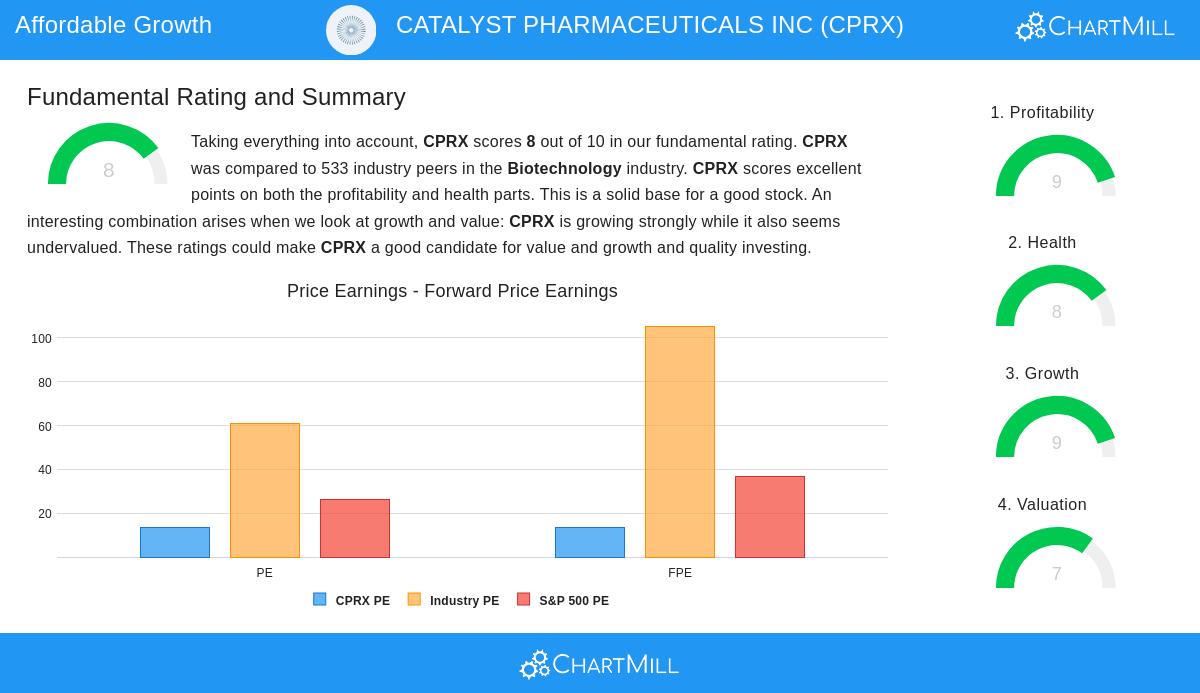

Trading at acceptable multiples compared to its growth outline, Catalyst Pharmaceuticals presents an interesting valuation case with a score of 7/10. The company's valuation measures indicate market pricing that may not completely show its growth possibility:

- P/E ratio of 13.61 looks good compared to industry average of 60.91 and S&P 500's 26.31

- Forward P/E of 13.60 stays much lower than industry peers averaging 105.37

- Enterprise Value to EBITDA and Price/Free Cash Flow ratios are lower priced than 98% and 97% of industry rivals respectively

These valuation features are important for the affordable growth plan, as they offer a safety buffer while taking part in the company's expansion story. The market seems to be valuing CPRX cautiously in spite of its solid operational performance, creating a possible chance for investors looking for growth at acceptable multiples.

Profitability and Financial Condition

Beyond growth and valuation, Catalyst Pharmaceuticals displays excellent operational effectiveness and balance sheet power. The company reaches a profitability score of 9/10, showing better returns on capital use:

- Return on Invested Capital of 21.23% is higher than 97% of industry peers

- Operating margin of 44.78% is in the top 1% of the biotechnology field

- Profit margin of 37.64% is better than 96% of industry rivals

Financial condition scores at 8/10, backed by strong liquidity and solvency measures. The company holds no outstanding debt, with current and quick ratios above 6.0, showing large short-term financial adaptability. This mix of high profitability and solid financial condition lowers operational risk while supporting continued growth projects, important factors for maintainable expansion at acceptable valuations.

The company's basic profile, described in the complete analysis report, shows how Catalyst Pharmaceuticals represents the affordable growth features wanted by investors mixing expansion possibility with financial care. The combination of solid growth measures, acceptable valuation multiples, and excellent operational effectiveness creates an interesting case for more study.

Investors curious about finding comparable affordable growth chances can review other filtering outcomes using our dedicated Affordable Growth stock screener.

Disclaimer: This analysis is an impartial review of basic factors and is not investment guidance. Investors should perform their own study and think about their personal financial situation before making investment choices. Past results do not ensure future outcomes, and all investments have built-in risks including possible loss of original capital.