The search for undervalued companies with strong basic financials is a key part of value investing. This strategy involves finding stocks trading below their inherent worth, often decided through careful study of a company's financial condition, earnings, and future possibilities. By concentrating on businesses that are financially stable and expanding but priced cautiously by the market, investors try to create a safety buffer for their capital. One way to simplify this search is by using tools that sort for stocks with good scores in price, stability, earnings, and expansion, highlighting possible candidates that need more detailed study.

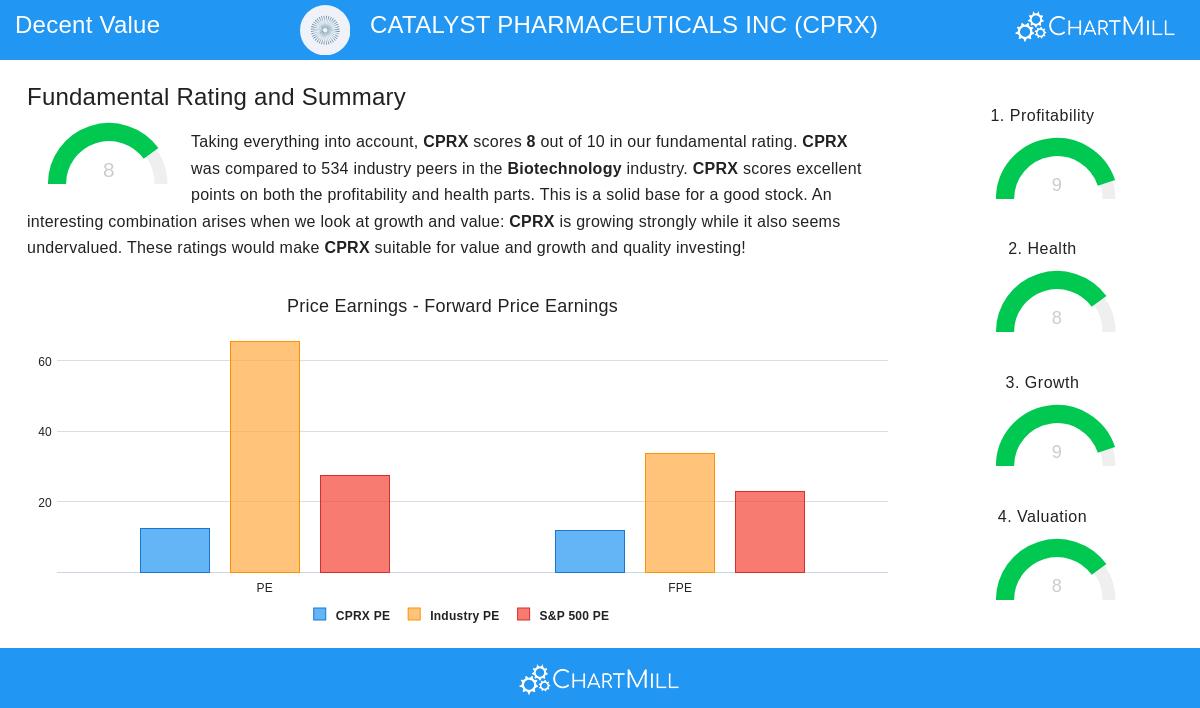

Catalyst Pharmaceuticals Inc (NASDAQ:CPRX) presents an interesting example for this method. The company, a commercial-stage biopharmaceutical business focused on rare diseases, has been found using a "Decent Value" filter that emphasizes good price measures while maintaining basic quality. A detailed fundamental analysis report shows a solid financial condition that matches the ideas of value investing.

Valuation Metrics

A main idea of value investing is buying assets for less than their true value. Catalyst's price measures indicate the market may be providing such a lower price. The stock's attraction from a price viewpoint has several parts:

- The company's Price-to-Earnings (P/E) ratio of 12.45 is much lower than the S&P 500 average of 27.42 and also puts it in a better situation than 97% of similar companies in the biotechnology field.

- Its Price-to-Free-Cash-Flow and Enterprise-Value-to-EBITDA ratios show a comparable situation, with CPRX being less costly than over 98% of its industry counterparts.

- These measures show that investors are paying a fairly small amount for each dollar of profit and cash the company creates, a typical indicator of possible undervaluation that value investors look for.

Financial Health

A solid financial base is essential for value investors, as it gives strength against market declines and business difficulties. Catalyst Pharmaceuticals does very well here, having a Financial Health score of 8 out of 10. The company's balance sheet is particularly strong, marked by no debt at all, which removes interest cost risk and offers great financial room to maneuver. Also, its high Altman-Z score of 15.79 points to a very small short-term chance of financial trouble, doing better than 88% of the industry. This financial steadiness provides the safety buffer that Benjamin Graham, the founder of value investing, saw as necessary.

Profitability Strength

While a low price is key, value investors also need a good business able to produce steady earnings. Catalyst's Profitability score of 9 out of 10 confirms it is this type of business. The company's profit levels are very high, with a Profit Margin of 37.36% and an Operating Margin of 43.58%, numbers that are better than 97% and 99% of industry peers, in that order. These high profit levels are backed by notable returns on capital, including a Return on Invested Capital (ROIC) of 21.45%, which is much higher than its capital cost and shows effective and profitable use of investor money.

Growth Trajectory

For a value investment to achieve its possibility, the company must also be expanding. Catalyst shows a strong Growth score of 9 out of 10, mixing good price with increase. In the past, the company has shown very fast expansion, with Earnings Per Share (EPS) rising by over 205% in the last year and Revenue growing at an average yearly rate of almost 37% over recent years. Looking ahead, analysts predict this solid trend to persist, with estimated yearly EPS growth of 26.50% and Revenue growth of 11.27%. This mix of a fair price and solid expansion possibilities is a strong force for future stock price gains.

The basic profile of Catalyst Pharmaceuticals Inc. shows why filtering for stocks with high scores in price, stability, earnings, and expansion can be a useful first step for value-focused investors. The company seems to be a financially stable, very profitable, and quickly expanding business that is currently valued at a level that may not completely show its inherent worth.

For investors curious about finding other companies that fit similar "Decent Value" standards, more study can be done using the pre-configured stock screener.

Disclaimer: This article is for informational purposes only and does not constitute financial advice, a recommendation, or an offer or solicitation to buy or sell any securities. The opinions expressed are based on current fundamental data, which is subject to change. All investments involve risk, including the possible loss of principal. You should conduct your own research and consult with a qualified financial advisor before making any investment decisions.