Investors looking for growth possibilities often deal with the task of weighing expansion possibilities against fair prices. The Affordable Growth method handles this by finding companies with solid growth paths alongside good financial condition and earnings, all at prices that do not demand high costs. This method focuses on what is commonly known as Growth At Reasonable Price (GARP) investing, trying to achieve gain possibilities without excessive cost for future prospects.

CBRE GROUP INC - A (NYSE:CBRE), a top worldwide firm in commercial real estate services, offers a relevant example in this investment structure. The company's detailed fundamental review shows traits that fit well with affordable growth standards, especially in its growth speed and price standing compared to others in the field.

Growth Path

The firm shows notable increases in important financial measures, receiving a Growth Rating of 7 out of 10. Recent results display significant speed:

- Earnings Per Share rose 43.41% in the last year

- Revenue grew 14.61% in the latest fiscal year

- Average yearly revenue increase of 8.40% over several years

- Estimated EPS increase of 17.98% per year going forward

- Forecasted revenue growth of 9.02% each year from analyst projections

This quickening in earnings increase, together with steady revenue growth, indicates the firm is effectively enlarging its activities while enhancing final results. For investors focused on growth, this pairing of past results and future estimates offers assurance in the company's capacity to keep growing.

Price Evaluation

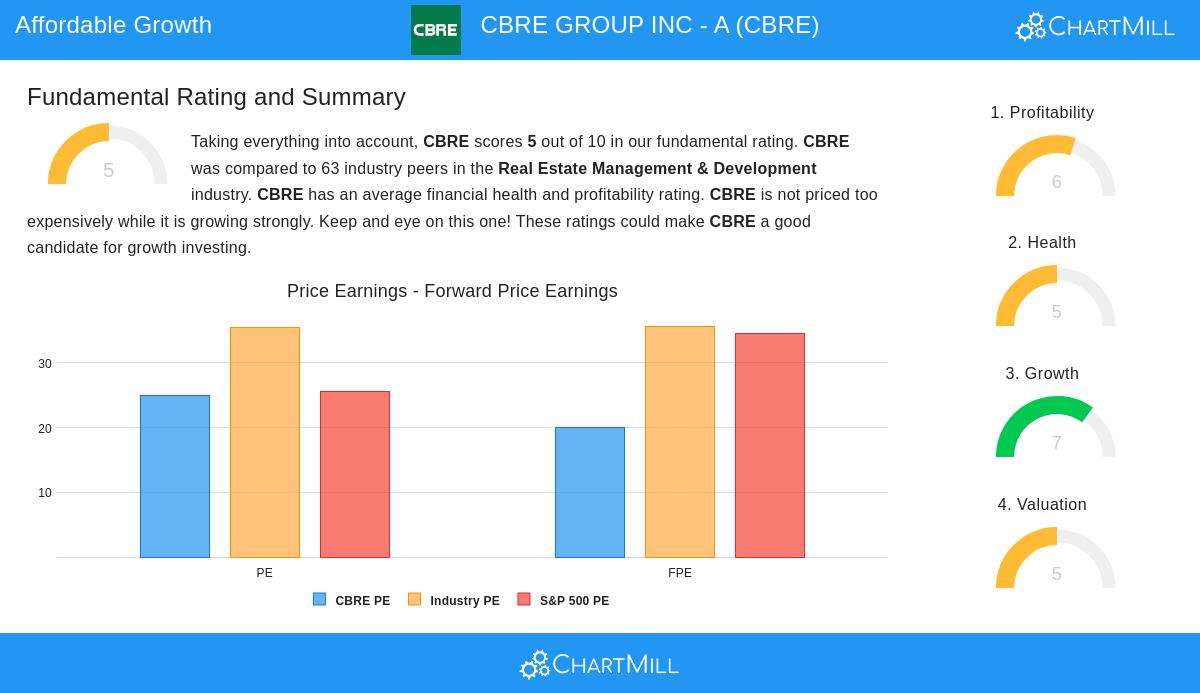

With a Valuation Rating of 5 out of 10, CBRE offers an appealing value case inside its industry. The company's price measures display a varied but mostly acceptable view:

- P/E ratio of 24.98 is near the S&P 500 average of 25.56

- Forward P/E of 20.02 is much lower than the S&P 500 average of 34.62

- Enterprise Value to EBITDA ratio is lower than 69.84% of similar companies

- Price/Free Cash Flow ratio is lower than 71.43% of others

- PEG ratio suggests good value when including growth

When compared to others in the Real Estate Management & Development field, where average P/E ratios are near 35.45, CBRE's price looks especially appealing. This relative lower price, combined with good growth outlooks, forms the basis for an affordable growth chance.

Financial Condition and Earnings

The company keeps acceptable financial bases with a Health Rating of 5 and Profitability Rating of 6. While these scores show space for betterment, they reflect enough steadiness to maintain continued growth:

Financial Condition points:

- Altman-Z score of 3.44 shows low failure risk

- Debt to Equity ratio of 0.84 matches industry standards

- Current and Quick ratios of 1.13 imply suitable cash availability

Earnings strong points:

- Return on Equity of 14.39% is higher than 93.65% of similar companies

- Return on Invested Capital of 6.76% is better than 85.71% of others

- Profit Margin of 3.12% is more than 69.84% of field companies

These measures show that while CBRE has some debt and encounters profit pressures typical in its field, the company maintains enough financial steadiness and produces acceptable returns on investor money.

Investment Points

The mix of better-than-average growth, acceptable price, and suitable financial condition makes CBRE a interesting option for investors using an affordable growth plan. The company's place in the commercial real estate field gives contact to worldwide economic patterns while its varied service lines in consulting, operations, project oversight, and investments form several income sources.

While the company does not provide dividends, this matches growth-focused firms that usually put earnings back into expansion chances. The reducing profits in recent times need watching, though present levels stay competitive inside the field.

For investors wanting to review similar affordable growth chances, more screening outcomes are available using our Affordable Growth Stock Screener.

Disclaimer: This review uses fundamental data and ratings from ChartMill.com and is not investment advice. Investors should perform their own review and think about their personal money situation before making investment choices. The noted stock and plan may not fit all investors. Past results do not ensure future outcomes.